Stocks opened last week mixed to lower. Only the Dow (0.1%) and the Global Dow (0.2%) were able to eke out minimal gains. The Nasdaq plunged 2.5% amid a tech sell-off. The S&P 500 fell for the fifth straight session, dropping 0.8%, and the Russell 2000 lost 0.7%. Energy surged, climbing 3.5%; financials, industrials, materials, and real estate also gained. Information technology (-2.7%) and consumer discretionary (-2.2%) sank. Treasury yields jumped higher. Crude oil prices increased $2.45 to $61.69 per barrel.

Large caps improved last Tuesday, lifting both the Dow and the S&P 500 to marginal 0.1% gains. The Global Dow climbed 0.3%. Tech stocks fell, pulling the Nasdaq down 0.5%, while the Russell 2000 gave back 0.9%. Crude oil advanced again, while Treasury yields and the dollar fell. Investors took some solace from Chairman Jerome Powell, who offered assurance that the Federal Reserve would move patiently and offer ample notice before it begins to firm monetary policy. Among the market sectors, energy led the way, adding nearly 1.6%. Only consumer discretionary, health care, and information technology lost value.

Stocks rebounded robustly last Wednesday following Federal Reserve Chair Jerome Powell’s reaffirmation that the economy in general, and inflation in particular, have a long way to go before reaching levels sufficient to scale back the accommodative measures currently in place. Encouraging news of an expected rollout of a new COVID vaccine from another manufacturer added to positive vibes for investors. Energy, financials, industrials, and information technology helped drive the benchmark indexes higher. The Russell 2000 climbed 2.4%, followed by the Dow (1.4%), the S&P 500 (1.1%), the Nasdaq (1.0%), and the Global Dow (0.8%). Ten-year Treasury yields advanced, as did crude oil prices, which soared to $63.30 per barrel. The dollar was generally mixed.

Last Thursday, equities could not follow up on the prior day’s gains. Tech shares plunged, and Treasury yields soared to a one-year high as rising interest rates attracted bond buyers, driving prices lower. The Nasdaq fell 3.5%, second only to the Russell 2000, which plummeted 3.7%. The S&P 500 dropped 2.5%, the Dow sank 1.8%, and the Global Dow dipped 0.6%. The yield on 10-year Treasuries surged past 1.5%; both crude oil prices and the dollar gained. All of the market sectors dropped by at least 1.0%, with consumer discretionary (-3.6%) and information technology (-3.5%) tumbling the furthest.

Stocks closed mixed last Friday, with only the Nasdaq and the Russell 2000 posting gains. Long-term Treasury yields and crude oil prices fell, while the dollar gained against a bucket of currencies. Consumer discretionary and information technology were the only sectors to gain. Energy, financials, utilities, real estate and consumer staples each fell more than 1.5%.

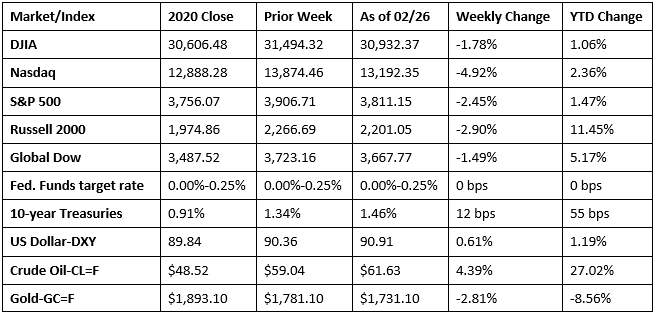

Stocks closed the week and the month of February lower. Each of the benchmark indexes listed here lost value last week, headed by the tech stocks of the Nasdaq, followed by the Russell 2000, the S&P 500, the Dow and the Global Dow. Treasury yields, the dollar, and crude oil prices advanced, while gold fell. Among the sectors, only energy (4.5%) climbed. Utilities and consumer discretionary fell 5.0% and 4.9%, respectively. Year to date, each of the indexes remained ahead of their respective 2020 closing values, led by the small caps of the Russell 2000, followed by the Global Dow, the Nasdaq, the S&P 500, and the Dow.

The national average retail price for regular gasoline was $2.633 per gallon on February 22, $0.132 per gallon over the prior week’s price and $0.167 higher than a year ago. During the week ended February 19, crude oil refinery inputs averaged 12.2 million barrels per day, which was 2.6 million barrels per day less than the previous week’s average. Refineries operated at 68.6% of their operable capacity last week, down from the prior week’s rate of 83.1%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The second estimate for the fourth-quarter gross domestic product revealed the economy expanded at an annualized rate of 4.1%. GDP increased 33.4% in the third quarter. Personal consumption expenditures, the main component of the report, increased 2.4%. Spending on services (+4.0%) drove the PCE index, as spending on goods fell 0.9%. The personal consumption price index, an indicator of inflationary trends, increased 1.6%, while the index less food and energy advanced 1.4%. Another highlight from the report is the continued growth in both nonresidential and residential fixed investment, which expanded 14.0% and 35.8%, respectively.

- Personal income increased 10.0% in January, while consumer spending increased 2.4% as provisions of the Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act of 2021 began to take effect. Disposable (after-tax) personal income increased 11.4% in January, while consumer prices inched up 0.3%. Excluding food and energy, consumer prices also rose 0.3%. Over the past 12 months, consumer prices have risen 1.5%.

- The international trade deficit was $83.7 billion in January, up $0.5 billion, or 0.7%, from December. Exports of goods for January were $135.2 billion, $1.9 billion, or 1.4%, more than December exports. Imports of goods for January were $218.9 billion, $2.5 billion, or 1.1%, greater than December imports.

- Continuing a positive trend, sales of new single-family houses rose by 4.3% in January and are up 19.3% over January 2020. The median sales price of new houses sold in January 2021 was $346,400. The average sales price was $408,800. Available inventory represents a four-month supply at the current sales pace.

- New orders for durable goods increased for the ninth consecutive month in January, rising 3.4% after advancing 1.2% in December. January’s increase in new orders was the largest monthly gain since July 2020. New orders for transportation equipment advanced 7.8%, driving the overall increase in January. Excluding transportation, new orders for durable goods gained a respectable 1.4%. New orders for nondefense capital goods increased 6.5%. Shipments increased 2.0% in January after climbing 2.1% in December. Unfilled orders for durable goods increased 0.1% following seven consecutive monthly decreases. Inventories deceased 0.3% in January.

- For the week ended February 20, there were 730,000 new claims for unemployment insurance, a decrease of 111,000 from the previous week’s level, which was revised down by 20,000. According to the Department of Labor, the advance rate for insured unemployment claims was 3.1% for the week ended February 13. For comparison, during the same period last year, there were 220,000 initial claims for unemployment insurance, and the insured unemployment claims rate was 1.2%. The advance number of those receiving unemployment insurance benefits during the week ended February 13 was 4,419,000, a decrease of 101,000 from the prior week’s level, which was revised up by 26,000. States and territories with the highest insured unemployment rates in the week ended February 6 were in Illinois (+28,110), Ohio (+6,563), Idaho (+4,764), Kansas (+1,744), and California (+1,664), while the largest decreases were in Maryland (-9,835), Rhode Island (-6,129), Georgia (-5,854), New Jersey (-4,630), and Texas (-4,234).

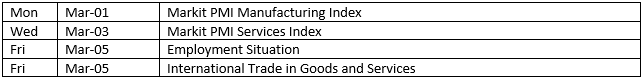

Eye on the Week Ahead

The employment figures for February are out this week. January saw only 49,000 new jobs added, while the unemployment rate remained high at 6.3%. On the plus side, average hourly earnings advanced 5.4% for the 12 months ended January 2021.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.