Even though tax filing season is well under way, there’s still time to make a regular IRA contribution for 2020. You have until your tax return due date (not including extensions) to contribute up to $6,000 for 2020 ($7,000 if you were age 50 or older on or before December 31, 2020). For most taxpayers, the contribution deadline for 2020 is April 15, 2021.

You can contribute to a traditional IRA, a Roth IRA, or both, as long as your total contributions don’t exceed the annual limit (or, if less, 100% of your earned income). You may also be able to contribute to an IRA for your spouse for 2020, even if your spouse didn’t have any 2020 income.

Traditional IRA

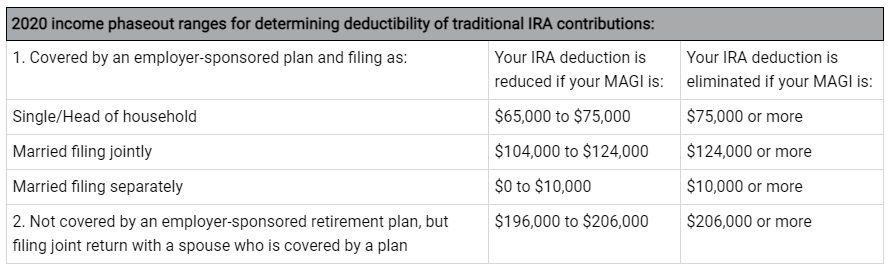

You can contribute to a traditional IRA for 2020 if you had taxable compensation. However, if you or your spouse was covered by an employer-sponsored retirement plan in 2020, then your ability to deduct your contributions may be limited or eliminated, depending on your filing status and modified adjusted gross income (MAGI). (See table below.) Even if you can’t make a deductible contribution to a traditional IRA, you can always make a nondeductible (after-tax) contribution, regardless of your income level. However, if you’re eligible to contribute to a Roth IRA, in most cases you’ll be better off making nondeductible contributions to a Roth, rather than making them to a traditional IRA.

Roth IRA

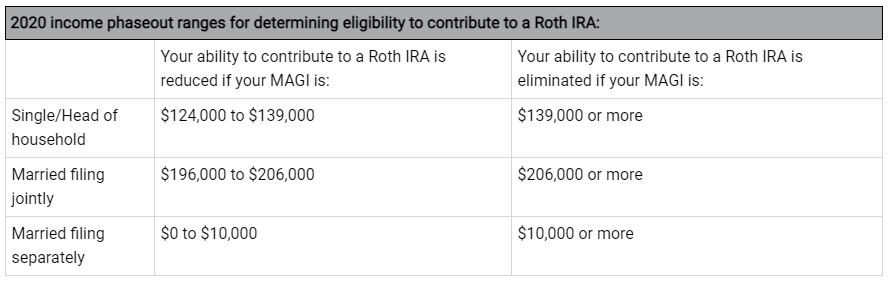

You can contribute to a Roth IRA if your MAGI is within certain limits. For 2020, if you file your federal tax return as single or head of household, you can make a full Roth contribution if your income is less than $124,000. Your maximum contribution is phased out if your income is between $124,000 and $139,000, and you can’t contribute at all if your income is $139,000 or more. Similarly, if you’re married and file a joint federal tax return, you can make a full Roth contribution if your income is less than $196,000. Your contribution is phased out if your income is between $196,000 and $206,000, and you can’t contribute at all if your income is $206,000 or more. If you’re married filing separately, your contribution phases out with any income over $0, and you can’t contribute at all if your income is $10,000 or more.

Even if you can’t make an annual contribution to a Roth IRA because of the income limits, there’s an easy workaround. You can make a nondeductible contribution to a traditional IRA and then immediately convert that traditional IRA to a Roth IRA. Keep in mind, however, that you’ll need to aggregate all traditional IRAs and SEP/SIMPLE IRAs you own — other than IRAs you’ve inherited — when you calculate the taxable portion of your conversion. (This is sometimes called a “back-door” Roth IRA.)

If you make a contribution — no matter how small — to a Roth IRA for 2020 by your tax return due date and it is your first Roth IRA contribution, your five-year holding period for taking qualified tax-free distributions from all your Roth IRAs (other than inherited accounts) will start on January 1, 2020.