Stocks opened last week higher on encouraging economic and vaccine news. The S&P 500 climbed for the fifth straight session, closing up 0.7%, and the Dow advanced for the seventh session, reaching another record high after gaining 0.5%. Tech stocks rebounded, driving the Nasdaq up 1.1%. The Russell 2000 and the Global Dow each rose 0.3%. Crude oil prices and Treasury yields fell, while the dollar inched up. Utilities led the advancing sectors, climbing 1.4%, consumer discretionary and real estate each rose 1.2%, and information technology jumped 1.1%. Energy (-1.3%) and financials (-0.6%) were the only sectors to lose ground.

Last Tuesday, stocks retreated for the first time in several sessions. The Russell 2000 plunged 1.7%, followed by the Dow (-0.4%), the Global Dow (-0.2%), and the S&P 500 (-0.2%). Technology shares climbed, pushing the Nasdaq up marginally. Long-term Treasury yields rose, moving closer to their one-year highs. Crude oil prices dipped, while the dollar advanced. Energy, financials, industrials, materials, and consumer discretionary lagged, while communication services and information technology advanced.

Investors got good news from the Federal Reserve last Wednesday. Following its meeting, the Federal Open Market Committee indicated that the economy was showing signs of gradual recovery, but not enough to temper the accommodative measures in place, including maintaining interest rates at near zero through 2023. By the close of trading, both the Dow and the S&P 500 reached record highs after increasing 0.6% and 0.3%, respectively. The Russell 2000 climbed 0.7%, the Nasdaq gained 0.4%, and the Global Dow jumped 0.4%. Yields on 10-year Treasuries rose, while crude oil prices and the dollar sank. Several market sectors advanced, with consumer discretionary (1.4%) and industrials (1.1%) climbing the highest. Health care, utilities, and consumer staples decreased.

Tech shares plunged last Thursday, pulling the Nasdaq down 3.0%. The Russell 2000 lost 2.9%, the S&P 500 fell 1.5%, and the Dow gave back 0.5%. The Global Dow inched up 0.3%. Crude oil prices declined 8.1%, falling below $60 per barrel. Renewed fears of rising inflation drove Treasury prices lower and yields higher. Ten-year Treasury yields increased 9 basis points, jumping to 1.7% — their highest mark in more than a year. The dollar gained against a basket of currencies. By the close of trading, only financials advanced. A major sell-off drove energy down 4.7%, while information technology fell 2.9%, and consumer discretionary lost 2.6%.

Stocks closed last Friday with mixed results. Tech shares rebounded somewhat to push the Nasdaq up 0.8%. The small caps of the Russell 2000 advanced 0.9% on the day. On the other hand, the Dow and the Global Dow each closed down 0.7%, while the S&P 500 slipped 0.1%. Both communication services and consumer discretionary gained 0.8% to lead the market sectors, while financials (-1.2%) and real estate (-1.3%) lagged. Treasury yields, crude oil prices, and the dollar all advanced.

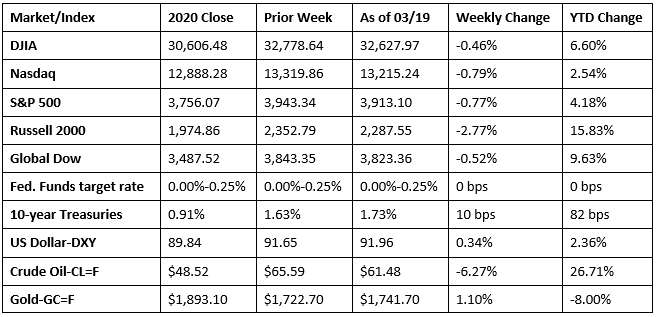

The risk of rising inflation continued to influence investors last week, as they weigh that risk against the prospects of an accelerating economy. Each of the benchmarks lost value, led by the Russell 2000, which plunged 2.8%. Among the sectors, only communication services (0.5%), health care (0.4%), and consumer staples (0.2%) advanced last week. Lagging last week were energy (-7.7%), financials (-1.6%), and information technology (-1.4%). Despite a Friday rally, crude oil prices closed the week down 1.1%, the dollar rose 0.3%, gold climbed 1.1%, and 10-year Treasury yields rose 10 basis points.

The national average retail price for regular gasoline was $2.853 per gallon on March 15, $0.082 per gallon more than the prior week’s price and $0.605 higher than a year ago. U.S. crude oil imports averaged 5.3 million barrels per day last week, down by 332,000 barrels per day from the previous week. U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 2.4 million barrels from the previous week. Total motor gasoline inventories increased by 0.5 million barrels last week and are about 4% below the five-year average for this time of year.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Following its meeting last week, the Federal Open Market Committee agreed to continue promoting measures to support the economy and the flow of credit to households and businesses. While noting that the economy is showing signs of recovery, the effects of the COVID-19 pandemic continue to weigh on economic activity, employment, and inflation. The FOMC has consistently sought to achieve inflation at a rate of 2.0%. However, now the Committee will aim for inflation to run moderately above 2.0% for some time so that it averages at least 2.0% over the short term. Not surprisingly, the Committee decided to keep the target range for the federal funds rate at its current 0.00%-0.25% and expects to maintain this range until maximum employment and inflation levels of at least 2.0% are reached.

- Sales at the retail level plunged 3.0% in February after stimulus payments helped drive sales up 7.6% the previous month. Nevertheless, retail sales are 6.3% above their February 2020 level. Most businesses experienced a drop in sales, with the largest decreases occurring in sporting goods, hobby, musical instrument, and book stores (-7.5%); department stores (-8.4%); nonstore (online) retailers (-5.4%); and motor vehicle and parts dealers (-4.2%). Sales at gasoline stations increased 3.6% last month — the only major retail business that posted a sizable monthly gain. March is likely to see a surge in retail sales following another round of stimulus checks. Despite the dip in February, for the 12-month period ended last month, the majority of retailers saw an increase in sales.

- U.S. import prices advanced 1.3% in February following a 1.4% increase in January. With the exception of a 0.1% downturn in October, import prices have increased each month since April 2020. Prices for imports rose 3.0% over the past year, the largest 12-month advance since a 3.4% jump in the period from October 2017 to October 2018. Prices for fuel imports increased 11.1% in February, the largest advance since a 15.2% increase in July 2020. Nonfuel import prices increased 0.4% in February. Prices for exports also rose in February, climbing 1.6% after rising 2.5% the previous month. Prices for exports increased 5.2% for the year ended in February and have not recorded a monthly decline since falling 3.5% in April 2020. Both agricultural export prices (2.9%) and nonagricultural export prices (1.5%) contributed to the overall increase in export prices last month.

- Industrial production fell 2.2% in February after increasing 1.1% in January. Manufacturing output and mining production fell 3.1% and 5.4%, respectively, while the output of utilities increased 7.4%. Overall, total industrial production in February was 4.2% lower than its February 2020 level.

- After surging over the past several months, both housing starts and issued building permits lagged in February, according to the latest information from the Census Bureau. Privately owned housing starts were 10.3% below the January estimate and 9.3% lower than the February 2020 rate. Building permits for housing units also fell, down 10.8% from the January rate but 17.0% over the February 2020 level. Last month, housing completions were 2.9% higher than the January figure and 5.0% above the February 2020 estimate.

- For the week ended March 13, there were 770,000 new claims for unemployment insurance, an increase of 45,000 from the previous week’s level, which was revised up by 13,000. According to the Department of Labor, the advance rate for insured unemployment claims was 3.0% for the week ended March 6, an increase of 0.1 percentage point from the previous week’s rate. For comparison, during the same period last year, there were 282,000 initial claims for unemployment insurance, and the insured unemployment claims rate was 1.2%. The advance number of those receiving unemployment insurance benefits during the week ended March 6 was 4,124,000, a decrease of 18,000 from the prior week’s level, which was revised down by 2,000. States and territories with the highest insured unemployment rates in the week ended February 27 were in Pennsylvania (6.1%), Alaska (5.6%), Nevada (5.4%), the Virgin Islands (5.1%), Connecticut (5.0%), New York (4.7%), Rhode Island (4.5%), Illinois (4.4%), Massachusetts (4.4%), and California (4.2%). The largest increases in initial claims for the week ended March 6 were in California (+17,793), Ohio (+7,686), Massachusetts (+2,200), Alabama (+1,968), and Virginia (+1,581), while the largest decreases were in New York (-11,906), Illinois (-10,628), Mississippi (-10,549), Texas (-6,932), and Kentucky (-4,580).

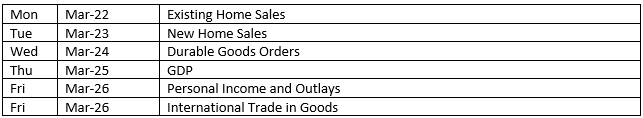

Eye on the Week Ahead

The final figures for the fourth-quarter gross domestic product are out this week. The second estimate for the fourth-quarter GDP showed that the economy expanded at an annual rate of 4.1%. It is anticipated that the annual rate of economic growth will not change much from the second estimate. The latest information on the housing sector is also available this week. January saw existing home sales increase by 0.6%, while sales of new, single-family homes rose by 4.3%. The February data on personal income, consumer spending, and price inflation is revealed this week. In January, personal income rose by 10.0%, consumer spending increased by 2.4%, and prices for consumer goods and services inched up 0.3%.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.