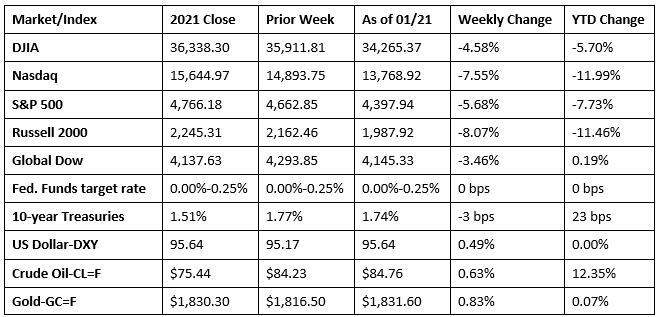

Volatility has engulfed the markets this month and is showing no signs of letting up, impacted by a more hawkish Federal Reserve stance, economic disruptions from Omicron, and risks to company profits due to rising costs. Fourth-quarter 2021 corporate earnings season has begun with uneven results so far. Inflation continues to hover over investors as they anticipate a bump in interest rates for the first time in three years, with the first increase likely coming in March. Demand for 10-year Treasuries has driven prices higher, sending yields lower for the first time in five weeks. With last week’s losses, both the Nasdaq and the Russell 2000 have declined nearly 12.0% in January. The Nasdaq is in correction territory, down over 10.0% from its November peak, hitting its lowest level since June 2021.

Wall Street continued its January swoon last Tuesday, falling lower to start the holiday-shortened trading week. The Nasdaq dropped 2.6%, recording its lowest close since October. The Russell 2000 fell 3.1%, the S&P 500 dipped 1.8%, the Dow declined 1.5%, and the Global Dow lost 1.1%. Investors continued to weigh the anticipated interest-rate hikes by the Federal Reserve, which meets this week. Ten-year Treasury yields jumped nine basis points to 1.86%. The dollar gained 0.5%. Crude oil prices rose to $85.89 per barrel. Among the market sectors, energy was the only gainer. Information technology (-2.5%), financials (-2.3%), and communication services (-2.0%) fell the most.

The slide continued for stocks last Wednesday. Each of the benchmark indexes listed here lost value. The Nasdaq extended losses, dropping more than 10.0% from a November high, falling into correction territory. The small caps of the Russell 2000 declined 1.5%, followed by the Nasdaq (-1.2%), the Dow and the S&P 500 (-1.0%), and the Global Dow (-0.8%). Ten-year Treasury yields dipped, despite projections that yields will cross the 2.0% threshold, possibly within the first six months of the year. The dollar also slipped lower. Crude oil prices continued to climb, reaching $86.50 per barrel. Consumer staples and utilities were the only market sectors to gain ground. Consumer discretionary and financials each fell 1.7%.

Higher-than-expected jobless claims didn’t help investor confidence, as equities dipped lower again last Thursday. Dip buyers sent stocks higher earlier in the day, but the rally did not last as each of the benchmark indexes listed here gave back any gains to close in the red. The Russell 2000 (-1.9%) led the declines, followed by the Nasdaq (-1.3%), the S&P 500 (-1.1%), the Dow (-0.9%), and the Global Dow (-0.3%). Crude oil prices moved slightly lower on Thursday, down 0.7% to around $86.29 per barrel. Ten-year Treasury yields and the dollar crept higher.

Stocks fell again last Friday, with tech shares leading the sell off following shaky corporate earnings data. The S&P 500, which slid 1.9%, closed below its 200-day moving average for the first time since 2020. The Nasdaq dropped 2.7% and the Russell 2000 lost 1.8%. The Dow (-1.3%) and the Global Dow (-1.6%) also ended the day in the red. Ten-year Treasury yields, the dollar, and crude oil prices also declined to end the week.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- According to the latest data from the Census Bureau, the number of building permits issued in December for privately owned housing units rose by 9.1% over the November estimate. Permits issued for single-family construction increased 2.0% in December. Overall, the number of building permits issued in 2021 was 17.2% above the 2020 figure. Housing starts also increased in December, climbing 1.4% higher than the November rate. Single-family housing starts in December were 2.3% below the November figure. Housing starts increased 15.6% in 2021 compared to the previous year. Housing completions dipped in December, falling 8.7% below the November total. However, single-family home completions increased 3.9% in December. For 2021, housing completions increased 4.0% compared to 2020.

- Sales of existing homes broke a three-month series of gains, falling 4.6% in December. Year over year, existing home sales dipped 7.1%. According to the National Association of Realtors®, the December pullback was more attributable to supply constraints than weakened demand for housing. However, existing home sales may continue to slow in the coming months due to anticipated higher mortgage rates. Unsold inventory sits at a 1.8-month supply at the current sales pace, down from November’s 2.1-month supply. The median existing home price for all housing types was $358,000 in December, up 1.2% from the November price of $353,900 and 15.8% above the December 2020 figure ($309,200). Sales of existing single-family homes also fell in December, down 4.3% from November’s total and off 6.8% from a year ago. The median existing single-family home price in December was $364,300, 0.5% above the November price ($362,600) and 16.1% higher than the December 2020 price.

- The national average retail price for regular gasoline was $3.306 per gallon on January 17, $0.011 per gallon more than the prior week’s price and $0.927 higher than a year ago. The Gulf Coast price increased nearly $0.04 to $2.96 per gallon, the East Coast price increased more than $0.01 to $3.24 per gallon, and the West Coast price increased less than $0.01, remaining virtually unchanged at $4.16 per gallon. The Rocky Mountain price decreased nearly $0.02 to $3.33 per gallon, and the Midwest price decreased less than $0.01, remaining virtually unchanged at $3.11 per gallon. As of January 17, residential heating oil prices averaged almost $3.61 per gallon, nearly $0.15 per gallon above last week’s price and $1.05 per gallon higher than last year’s price at this time. Residential propane prices averaged nearly $2.73 per gallon, more than $0.02 per gallon above last week’s price and more than $0.54 per gallon above last year’s price.

- For the week ended January 15, there were 286,000 new claims for unemployment insurance, an increase of 55,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended January 8 was 1.2%, an increase of 0.1 percentage point from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended January 8 was 1,635,000, an increase of 84,000 from the prior week’s level, which was revised down by 8,000. States and territories with the highest insured unemployment rates for the week ended January 1, were Alaska (3.1%), Minnesota (2.8%), Kentucky (2.7%), New Jersey (2.6%), New York (2.6%), Rhode Island (2.5%), California (2.4%), Connecticut (2.4%), Massachusetts (2.3%), and Oregon (2.3%). The largest increases in initial claims for the week ended January 8 were in California (+11,295), New York (+10,639), Texas (+10,437), Kentucky (+8,476), and Missouri (+7,768), while the largest decreases were in Massachusetts (-2,079), Connecticut (-1,437), Michigan (-1,158), New Hampshire (-424), and Rhode Island (-424).

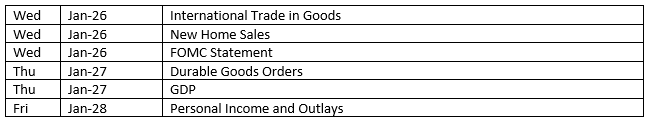

Eye on the Week Ahead

There’s plenty of economic news to watch for this week. The first estimate of the fourth-quarter 2021 gross domestic product is out. The economy advanced at an annualized rate of 2.3% in the third quarter, well off the 6.7% growth rate in the second quarter. The December figures on personal income and spending are available this week. Personal income rose 0.4% in November, consumer spending advanced 0.6%, while prices for consumer goods and services climbed 0.6% for the month and 5.7% since November 2020. Aside from these important economic reports, all eyes will be focused on the Federal Reserve, which meets this week. It is expected that the Fed will continue to address rising inflation by further reducing stimulus and projecting interest-rate increases beginning this March.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.