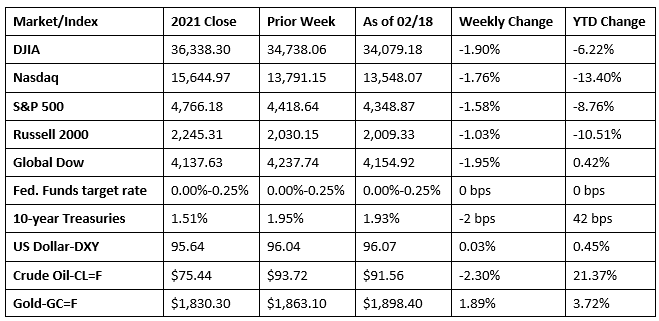

Last week, Wall Street reacted to the ongoing Russia-Ukraine conflict by moving from stocks to bonds, the dollar, and gold. Investors were faced with rising fears that a Russian invasion of the Ukraine will engulf Europe and the United States, worsen global supply bottlenecks, and further accelerate inflation. Stocks continued to track lower despite solid fourth-quarter earnings growth. Each of the market sectors ended the week lower, with the exception of consumer staples, which managed to eke out a 0.1% gain. Information technology dipped over 1.0%, helping to pull the Nasdaq down 1.8% for the week. The Global Dow and the Dow led the declines among the benchmark indexes listed here. Long-term Treasury yields slipped two basis points. Crude oil prices fell nearly $2.00 to $91.56 per barrel. Gold prices continued to show strength, advancing for the second consecutive week.

Stocks road a wave of highs and lows last Monday, ultimately closing with modest losses. Ukraine worries and rising bond yields drove several of the benchmark indexes listed here lower. The Global Dow fell 1.5%, followed by the Dow and the Russell 2000, each of which lost 0.5%. The S&P 500 dipped 0.4%, while the Nasdaq was unable to maintain a mid-day surge, eventually ending the day flat. Ten-year Treasury yields reached 1.99% by the end of trading. Crude oil prices continued to march toward $100.00 per barrel, ending the day at around $94.88 per barrel. The dollar advanced against a basket of currencies. Consumer discretionary and communication services were the only market sectors to advance, while energy fell 2.24%.

U.S. equities closed notably higher last Tuesday, reversing a three-day skid on signs of a possible easing of tensions between Russia and the Ukraine. The Russell 2000 advanced 2.8%, followed by the Nasdaq, which gained 2.5%. The S&P 500 (1.6%), the Dow (1.2%), and the Global Dow (1.0%) also climbed higher. Ten-year Treasury yields rose eight basis points to 2.04%. The dollar, crude oil prices, and gold prices fell.

Last Wednesday saw stocks end the day mixed, with the S&P 500 (0.1%), the Russell 2000 (0.1%), and the Global Dow (0.4%) edging higher, while the Dow (-0.2%) and the Nasdaq (-0.1%) dipped lower. Ten-year Treasury yields closed flat. Crude oil prices fell to $93.66 per barrel. The dollar also declined, while gold prices advanced.

Stocks tumbled lower last Thursday after President Joe Biden warned that a Russian invasion of the Ukraine could happen within the next several days. Among the market sectors, only consumer staples and utilities closed the day ahead. Several sectors fell more than 2.0%, including communication services, consumer discretionary, financials, and information technology. The benchmark indexes closed sharply lower, with the Nasdaq falling 2.9%, closely followed by the Russell 2000, which declined 2.5%. The S&P 500 (-2.1%), the Dow (-1.8%), and the Global Dow (-1.0%) also dipped lower. Investors apparently moved to bonds, driving prices higher and yields lower. Ten-year Treasury yields fell seven basis points to 1.97%. The dollar inched higher, while crude oil prices decreased to $91.61 per barrel.

Last Friday saw bond prices rise and stock values fall on fears of an imminent military conflict between Russia and the Ukraine. The Nasdaq again led the declines among the benchmark indexes listed here, dropping 1.2%, followed by the Russell 2000 (-1.0%), the Global Dow (-0.8%), the S&P 500 (-0.7%), and the Dow (-0.7%). Ten-year Treasury yields slid to 1.93%. Crude oil prices also dipped lower, while the dollar inched higher.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Producer prices jumped 1.0% in January, the largest increase since rising 1.0% a year earlier. For the 12 months ended in January 2022, producer prices have moved up 9.7%. Excluding food and energy, producer prices increased 0.8% in January and 8.3% since January 2021. Prices for both services and goods rose last month. Prices for services advanced 0.7% in January, the same as in December. A major factor in the January increase in the prices for services was hospital outpatient care prices, which rose 1.6%. Prices for goods climbed 1.3% in January after declining 0.1% in December. Within the goods category in January, prices for energy rose 2.5%, while prices for motor vehicles and equipment rose 0.7%. Prices for diesel fuel, gasoline, beef and veal, dairy products, and jet fuel also increased. With prices at the producer level surging in January, the extent to which this appreciation is passed on to consumers remains to be seen.

- Sales by retail and food services stores advanced 3.8% in January and 13.0% since January 2021. Retail trade sales were up 4.4% in January from December and have risen 11.4% over the past 12 months. Sales at several businesses increased in January, including motor vehicle and parts dealers (5.7%), building material and garden equipment and supplies dealers (4.1%), food and beverage stores (1.1%), furniture stores (7.2%), general merchandise stores (3.6%), and nonstore (online) retailers (14.5%). Sales for food services and drinking places dipped 0.9% in January but rose 27.0% since January 2021. Gasoline station sales fell 1.3% in January but jumped 33.4% over the last 12 months.

- January saw both import and export prices increase following declines in December. Import prices advanced 2.0% last month, the largest increase since April 2011. Import prices are up 10.8% over the past year. Leading the January rise in import prices was a 9.3% increase in import fuel prices, which have climbed 60.3% over the past 12 months. Prices for nonfuel imports increased 1.4% in January and have not recorded a monthly decline since November 2020. The January advance was the largest one-month rise since January 2002. Higher prices for nonfuel industrial supplies and materials; foods, feeds, and beverages; capital goods; consumer goods; and automotive vehicles all contributed to the January increase in nonfuel import prices. Export prices increased 2.9% in January, which was the largest one-month rise since January 1989. Export prices have advanced 15.1% since January 2021. Agricultural exports rose 3.0% last month, while nonagricultural export prices increased 2.9%.

- The number of issued residential building permits rose 0.7% in January, largely driven by a 6.8% jump in single-family authorizations. Total building permits issued were 0.8% above the January 2021 rate. Housing starts fell 4.1% last month but are 0.8% higher than the rate a year earlier. Single-family housing starts also dipped, down 5.6% in January. Total housing completions in January fell 5.2% from the previous month’s figures and are 6.2% below the January 2021 pace. In January, single-family housing completions were 7.3% under the December estimate.

- Existing home sales advanced 6.7% in January following a December decline. Year over year, existing home sales are down 2.3%. Total housing inventory of existing homes slid 2.3% last month, sitting at a scant 1.6-month supply at the current sales pace. The median existing home price for homes in January was $350,300, down from $358,000 in December but up 15.4% from January 2021 ($303,600). Single-family home sales jumped 6.5% in January yet are down 2.4% from January 2021. The median existing single-family home price was $357,100 in January, down from December’s median price of $364,300 but up 15.9% from January 2021.

- In January, total industrial production increased 1.4%. Manufacturing output and mining production rose 0.2% and 1.0%, respectively. Manufacturing output is up 2.5% over the past 12 months. A surge in demand for heating in January sent utilities up 9.9%, the largest jump in the history of the index. The index for mining rose 1.0% in January. Total industrial production in January was 4.1% higher than its year-earlier level and 2.1% above its pre-pandemic (February 2020) reading.

- The national average retail price for regular gasoline was $3.487 per gallon on February 14, $0.043 per gallon more than the prior week’s price and $0.986 higher than a year ago. The Gulf Coast and East Coast prices each increased more than $0.06 to $3.19 per gallon and $3.45 per gallon, respectively; the Midwest price increased more than $0.03 to $3.32 per gallon; and the West Coast price increased more than $0.01 to $4.19 per gallon. The Rocky Mountain price decreased less than $0.01, remaining virtually unchanged at $3.33 per gallon. As of February 14, 2022, residential heating oil prices averaged nearly $3.96 per gallon, $0.07 per gallon above the prior week’s price and nearly $1.22 per gallon higher than last year’s price at this time. Residential propane prices averaged nearly $2.84 per gallon, more than $0.01 per gallon above last week’s price and more than $0.54 per gallon above last year’s price.

- For the week ended February 12, there were 248,000 new claims for unemployment insurance, an increase of 23,000 from the previous week’s level, which was revised up by 2,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended February 5 was 1.2%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended February 5 was 1,593,000, a decrease of 26,000 from the previous week’s level, which was revised down by 2,000. States and territories with the highest insured unemployment rates for the week ended January 29 were Alaska (2.7%), California (2.7%), New Jersey (2.6%), Minnesota (2.5%), Rhode Island (2.4%), Massachusetts (2.3%), New York (2.3%), and Illinois (2.2%). The largest increases in initial claims for the week ended February 5 were in Michigan (+2,884), New Jersey (+406), Kansas (+309), Delaware (+235), and Maryland (+148), while the largest decreases were in California (-4,247), Kentucky (-3,962), Tennessee (-2,916), Illinois (-2,303), and Indiana (-1,760).

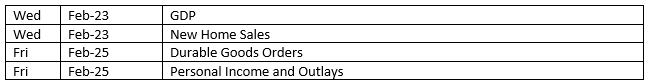

Eye on the Week Ahead

The second estimate for the fourth-quarter gross domestic product is available this week. The first estimate showed that the economy expanded at an annualized rate of 6.9%. Another important source of economic information is out this week with the release of the personal income and outlays report for January. The personal consumption price index, a measure of inflation relied upon by the Federal Reserve, rose 5.8% over the 12 months ended in December 2021.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.