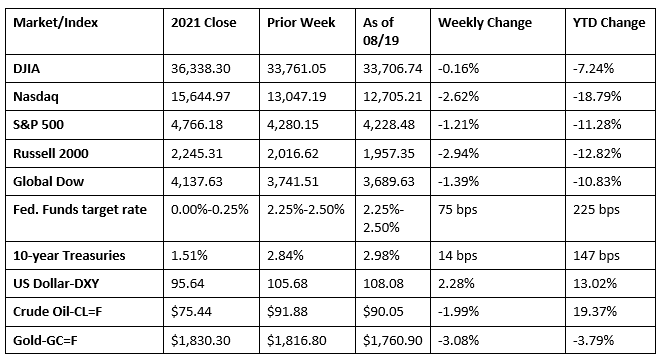

The four-week rally for stocks came to an end last week. Investors turned cautious after Fed officials continued to support more interest-rate hikes. Each of the benchmark indexes listed here lost ground, with the S&P 500 declining for the first time in five weeks. Yields on 10-year Treasuries climbed 14.0 basis points. The dollar had its best week since April 2020. Crude oil prices fell by nearly $2.00 per barrel. Gold plunged lower, falling nearly $60.00 per ounce. Traders saw the stock of a large retailer fall more than 40.0%, and cryptocurrency-linked stocks declined.

Wall Street opened last Monday on an uptick. Megacap shares led the rally, with the Nasdaq adding 0.6%. The Dow (0.5%), the S&P 500 (0.4%), and the Russell 2000 (0.2%) also advanced. The Global Dow dipped 0.2%, likely impacted after China’s economy slowed unexpectedly in July. Ten-year Treasury yields slid 5.8 basis points to close at 2.79%. Crude oil fell over $4.00, dipping to $87.85 per barrel. The dollar advanced, while gold prices declined.

Stocks closed generally higher last Tuesday, despite a late session pullback in tech shares. The Dow (0.7%), the Global Dow (0.7%), and the S&P 500 (0.2%) posted modest gains. The Nasdaq (-0.2%) slipped, while the Russell 2000 was flat. Crude oil prices slid to $86.90 per barrel, down by $2.46. Ten-year Treasury yields rose 3.3 basis points to 2.82%. The dollar and gold prices declined.

Last Wednesday saw stocks close lower following the release of the minutes of the Federal Reserve’s July meeting. The Dow slid 0.5%, ending a five-session winning streak. The minutes revealed that several members of the Federal Open Market Committee remained concerned that rising inflation could become entrenched in the economy, while expressing trepidation that too much tightening could send the economy reeling. Tech shares fell for the second consecutive session, dragging the Nasdaq down 1.3%. The Russell 2000 fell 1.7%, the S&P 500 dipped 0.7%, and the Global Dow lost 0.4%. The yield on 10-year Treasuries jumped 6.9 basis points to reach 2.89%. Crude oil prices advanced to $87.74 per barrel. The dollar rose, while gold prices continued to decline.

In a day marked by ups and downs, stocks closed marginally higher last Thursday among mixed economic and earnings data. The Russell 2000 led the benchmark indexes listed here, gaining 0.7%, followed by the Nasdaq and the S&P 500, which advanced 0.2%. The Dow inched up 0.1%, and the Global Dow was flat. Crude oil prices shot up $2.45 to hit $90.56 per barrel. The dollar gained, while gold prices fell for the fourth consecutive session. Stocks closed last Friday lower, with each of the benchmark indexes ending the day in the red. The Nasdaq (-2.0%) and the Russell 2000 (-2.2%) lost the most ground, followed by the S&P 500 (-1.3%), the Global Dow (-1.2%), and the Dow (-0.9%). Ten-year Treasury yields picked up nearly 11.0 basis points to end the week at 2.98%. Crude oil prices slipped less than $1.00, closing at $90.05 per barrel. The dollar advanced for the third consecutive day, while gold prices fell for the fifth day in a row.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Sales of existing homes declined 5.9% in July, the sixth straight monthly decline. Year over year, existing home sales are down 20.2%. According to a report from the National Association of Realtors®, rising mortgage rates, which peaked at 6.0% at the end of June, impacted existing home sales. Since then, mortgage rates have declined to near 5.0%, which should bring more buyers back to the market. Total existing housing inventory in July was 1,310,000, reflecting a supply of 3.3 months at the current sales pace. The median existing home price was $403,800, down from the June sales price of $413,800 but ahead of the July 2021 price of $364,600. Sales of existing single-family homes declined 5.5% in July and 19.0% from a year ago. The median existing single-family home price was $410,600 in July, down from the June price of $420,900 but up from the July 2021 price of $371,400.

- Building permits issued for new housing fell 1.3% in July but are 1.1% ahead of the July 2021 rate. Permits for single family housing also declined in July, dropping 4.3%. Last month saw housing starts slip 9.6% (-10.1% for single family housing starts). Housing completions rose 1.1% in July, although completions of single family homes dipped -0.8%.

- Industrial production rose 0.6% in July after making no advance the prior month. Manufacturing output increased 0.7% last month following 0.4% declines in both May and June. Contributing to the production increase in July was a 6.6% rise in the production of motor vehicles and parts, while factory output elsewhere moved up 0.3%. The index for mining increased 0.7%, while the index for utilities decreased 0.8%. Overall, total industrial production in July was 3.9% above its year-earlier level.

- Retail sales were unchanged in July from their June total. However, sales at the retail level were 10.3% above the July 2021 pace. Retail trade sales were also unchanged in July from the previous month, but are up 10.1% from a year ago. In July, sales at motor vehicle and parts dealers fell 1.6%, gasoline station sales dipped 1.8%, and sales at general merchandise stores decreased 0.7%. Retail sales advanced at food services and drinking places (0.1%), nonstore (online) retailers (2.7%), miscellaneous store retailers (1.5%), and building material and garden equipment and supplies stores (1.5%).

- The national average retail price for regular gasoline was $3.938 per gallon on August 15, $0.100 per gallon below the prior week’s price but $0.764 higher than a year ago. Also as of August 15, the East Coast price decreased $0.111 to $3.856 per gallon; the Gulf Coast price fell $0.107 to $3.428 per gallon; the Midwest price dropped $0.096 to $3.755 per gallon; the West Coast price slid $0.085 to $4.914 per gallon; and the Rocky Mountain price fell $0.140 to $4.213 per gallon. Residential heating oil prices averaged $3.518 per gallon on August 12, about $0.302 per gallon more than the prior week’s price.

- For the week ended August 13, there were 250,000 new claims for unemployment insurance, a decrease of 2,000 from the previous week’s level, which was revised down by 10,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended August 6 was 1.0%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended August 6 was 1,437,000, an increase of 7,000 from the previous week’s level, which was revised up by 2,000. States and territories with the highest insured unemployment rates for the week ended July 30 were Connecticut (2.4%), Puerto Rico (2.3%), New Jersey (2.1%), California (1.9%), Rhode Island (1.8%), Massachusetts (1.6%), New York (1.6%), Pennsylvania (1.5%), Alaska (1.2%), Illinois (1.2%), and Nevada (1.2%). The largest increases in initial claims for the week ended August 6 were in California (+2,759), New Jersey (+965), Texas (+723), South Carolina (+679), and Indiana (+582), while the largest decreases were in Connecticut (-7,341), Michigan (-1,075), Oklahoma (-921), Georgia (-522), and Maryland (-184).

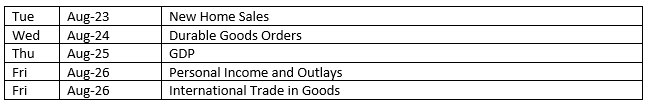

Eye on the Week Ahead

The second estimate of gross domestic product for the second quarter is available this week. The initial reading showed the economy retracted 0.9% in the second quarter. The report on personal income and outlays for July is also out this week. Two items that will garner particular attention are personal consumption expenditures and the personal consumption expenditures price index. Consumer spending rose 1.1% in June, while consumer prices advanced 1.0%. It will be interesting to see if the PCE price index decreases in July in line with the other inflation indicators, such as the CPI, import and export prices, and the PPI.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.