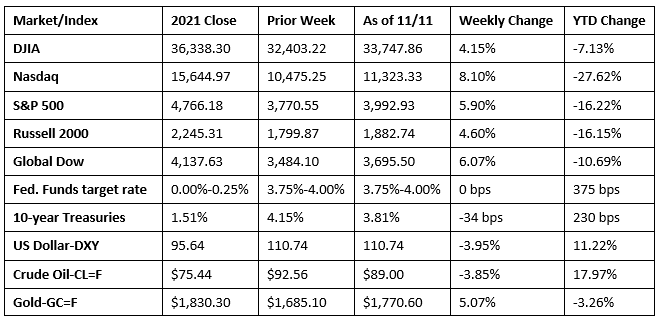

Stocks rebounded from a sluggish start to close last week higher. Investors continued to rally behind equities on the hope that last week’s soft inflation data will prompt the Federal Reserve to curtail its interest-rate hikes. The S&P 500 rose to its best week since June, while the tech-heavy Nasdaq notched its best week in two years. Bond prices advanced, pulling Treasury yields lower. Crude oil prices slid lower, although they could jump in December when the European ban on Russian oil shipments by sea takes effect on December 5, potentially limiting supply. Gold prices advanced for the second consecutive week. The dollar endured the largest two-day fall in 13 years after plunging last Thursday and Friday.

Wall Street continued its rally, closing up last Monday for the second consecutive session. Both small caps and blue-chip stocks enjoyed a lift to begin last week, sending the Nasdaq (0.90%) and the Russell 2000 (0.60%) higher. The Dow (1.3%) led the benchmark indexes listed here, while the S&P 500 (1.0%) and the Global Dow (1.2%) also gained ground. Yields on 10-year Treasuries added 5.8 basis points to close at 4.21%. Crude oil prices and the dollar dipped lower, while gold prices inched higher.

Stocks extended their rally for a third session in a row last Tuesday as investors awaited midterm election results. Of the benchmark indexes listed here, the Global Dow led the gains, up 1.1%, followed by the Dow (1.0%), the S&P 500 (0.6%), and the Nasdaq (0.5%). The small caps of the Russell 2000 ended flat. Ten-year Treasury yields, the dollar, and crude oil prices declined. Gold prices rose for a second day in a row.

The three-session rally ended last Wednesday as investors mulled midterm election results and the consumer price index, scheduled for release the next day. The Russell 2000 (-2.7%) and the Nasdaq (-2.5%) led the declines, followed by the S&P 500 (-2.1%), the Dow (-2.0%), and the Global Dow (-1.4%). Bond prices dipped, sending the yield on 10-year Treasuries up 2.5 basis points to 4.15%. Crude oil prices slid $3.34, dragging the price per barrel down to $85.57 after data revealed an unexpected increase in domestic crude oil supplies. The dollar rose, while gold prices fell for the first time in the last four trading sessions.

Stocks surged higher last Thursday as slower-than-expected consumer price growth brought hope that the Federal Reserve might respond by curtailing its aggressive rate-hike policy. U.S. markets enjoyed their biggest single-day gain since 2020. The Nasdaq increased 7.4%, the Russell 2000 jumped 6.1%, the S&P 500 rose 5.5%, and the Dow and the Global Dow advanced 3.7% and 3.8%, respectively. The yield on 10-year Treasuries fell 32.2 basis points, closing at 3.82% — a five-week low. Crude oil prices rose marginally, reaching $86.18 per barrel. The dollar tumbled, while gold prices advanced.

Equities continued their rally last Friday, with the Global Dow (1.9%), the Nasdaq (1.9%), and the S&P 500 (0.9%) ending sharply higher. The Russell 2000 advanced 0.8% while the Dow inched up 0.1%. Treasuries did not trade last Friday in observance of Veterans’ Day. Crude oil prices increased $2.48 to $88.95 per barrel. The dollar fell for the second consecutive day, while gold prices rose for the second day in a row.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The release of the much-anticipated consumer price index last Thursday revealed consumer prices rose 0.4% in October, the same increase as in September. Prices excluding food and energy rose 0.3% after rising 0.6% in September. Over the last 12 months, consumer prices have risen 7.7%, down from 8.2% for the 12 months ended in September. Prices for food increased 0.6% in October following a 0.6% increase in the previous month. Energy prices, which had decreased each month since July, jumped 1.8% in October as gasoline prices increased 4.0% and fuel oil prices vaulted up 19.8%. Prices for shelter climbed 0.8% last month after increasing 0.7% in September. The October CPI held steady for the second consecutive month and is below forecasters’ expectations. The latest data may support a pivot by the Federal Reserve to a less aggressive stance.

- The U.S. Treasury budget deficit decreased to $87.8 billion in October, the first month of fiscal year 2023. The October deficit was $341.9 billion lower than the September shortfall. Total government expenditures in October were $406.4 billion, roughly $41.0 billion below expenditures in September. Government receipts in October totaled $318.6 billion, $34.7 billion more than September receipts.

- According to the U.S. Energy Administration, the national average retail price for regular gasoline was $3.796 per gallon on November 7, $0.054 per gallon above the prior week’s price and $0.386 higher than a year ago. Also as of November 7, the East Coast price increased $0.068 to $3.590 per gallon; the Gulf Coast price advanced $0.009 to $3.186 per gallon; the Midwest price rose $0.135 to $3.776 per gallon; the West Coast price dropped $0.083 to $4.945 per gallon; and the Rocky Mountain price decreased $0.029 to $3.760 per gallon. Residential heating oil prices averaged $5.905 per gallon on November 7, $0.069 above the previous week’s price and $2.500 per gallon more than a year ago. In fact, despite a warm start to the winter heating season, which run from October through March, heating oil prices have increased, while propane prices have remained relatively flat from last year.

- For the week ended November 5, there were 225,000 new claims for unemployment insurance, an increase of 7,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended October 29 remained 1.0%. The advance number of those receiving unemployment insurance benefits during the week ended October 29 was 1,493,000, an increase of 6,000 from the previous week’s level, which was revised up by 2,000. States and territories with the highest insured unemployment rates for the week ended October 22 were Puerto Rico (1.9%), New Jersey (1.8%), California (1.8%), Alaska (1.6%), New York (1.3%), Rhode Island (1.2%), Massachusetts (1.2%), Nevada (1.1%), and Oregon (1.1%). The largest increases in initial claims for unemployment insurance for the week ended October 29 were in California (+1,989), Oregon (+1,541), Washington (+693), Illinois (+457), and Minnesota (+456), while the largest decreases were in Florida (-1,534), Kentucky (-1,007), North Carolina (-659), Arkansas (-517), and South Carolina (-471).

Eye on the Week Ahead

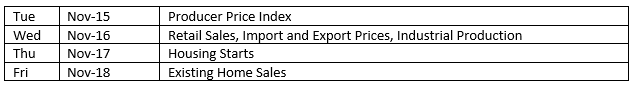

There’s plenty of economic data to consider this week. A couple of reports that measure consumer price inflation are available with the release of the producer price index and the import and export prices report for October. Prices producers received for goods and services increased 0.4% in September, while prices rose 8.5% year to date. The release of import and export prices is out this week. While most inflation indicators for September increased, import and export prices did not follow suit, as both import prices and export prices decreased. Also out this week is the release of the retail sales report for October. Retail sales were flat in September.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.