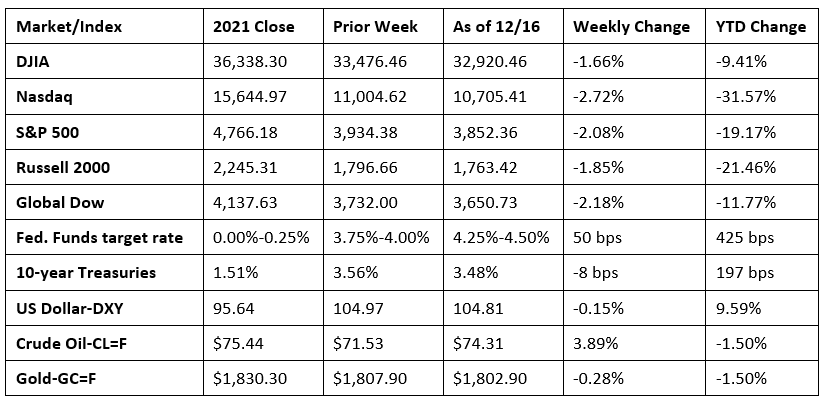

Wall Street saw stocks end last week lower as investors worried that the Federal Reserve’s push to slow rising inflation may lead the economy into a recession. Early in the week, investors were buoyed by softer-than-expected inflation data, which preceded the Fed’s expected 50-basis-point interest-rate hike. However, Federal Reserve officials were clear that interest rate increases will continue until it is evident that inflation has been controlled. After beginning last week on a high note, equities endured three straight days of losses. The Nasdaq, the Global Dow, and the S&P 500 each fell more than 2.0%. The Russell 2000 and the Dow also declined. Crude oil prices advanced, but remain subdued on recession fears. Ten-year Treasury yields slid lower by the end of the week. The dollar and gold prices dipped lower.

Stocks rallied to kick off the week last Monday as investors awaited upcoming inflation data and the results from the Federal Reserve meeting. Bargain hunters took advantage of depressed stock values from the previous week. Among the benchmark indexes listed here, the Dow jumped 1.6%, followed by the S&P 500 (1.4%), the Nasdaq (1.3%), the Russell 2000 (1.2%), and the Global Dow (0.3%). Crude oil prices ($73.45 per barrel), the dollar, and 10-year Treasuries (3.61%) climbed higher. Gold prices slid lower.

Last Tuesday, investors tried to gauge the impact a lower-than-expected consumer price index (see below) might have on the Federal Reserve’s aggressive policy to corral inflation. Stocks ended higher following a volatile session. The Global Dow (1.1%) and the Nasdaq (1.0%) led the benchmark indexes listed here, followed by the Russell 2000 (0.8%), the S&P 500 (0.7%), and the Dow (0.3%). Yields on 10-year Treasuries fell 11.0 basis points to close at 3.50%. Crude oil prices climbed to their highest levels in more than a week reaching $75.43 per barrel on cold weather forecasts. The dollar fell by more than 1.0%, while gold prices gained more than $30.00 to hit $1,822.40 per ounce.

Stocks ended a two-day rally last Wednesday after the Federal Reserve hiked interest rates by another 50 basis points, while indicating that its “restrictive policy” will continue for some time in order to ensure price stability. The Nasdaq slid 0.8%, followed by the S&P 500 and the Russell 2000, which declined 0.6%. The Dow dropped 0.4% and the Global Dow edged down 0.3%. Ten-year Treasury yields ended flat. Crude oil prices continued to advance, reaching $77.39 per barrel by late afternoon. The dollar and gold prices fell. While Fed Chair Jerome Powell indicated that the Fed intends to maintain its aggressive policy aimed at bringing inflation down, he did say that the cycle could be near an end.

Last Thursday saw stocks continue to fall, with each of the benchmark indexes listed here falling at least 1.5%. The Nasdaq slid 3.2%, the Russell 2000 lost 2.6%, the S&P 500 dipped 2.5%, the Global Dow declined 2.4%, and the Dow fell 2.3%. Ten-year Treasury yields fell to 3.45%. Crude oil prices ended a mini-rally, falling to $76.14 per barrel. The dollar advanced, while gold prices declined.

Stocks fell for the third consecutive session last Friday. Each of the benchmark indexes listed here ended the day in the red, with the S&P 500 dropping 1.1%, while the Global Dow and the Nasdaq slid 1.0%. The Dow fell 0.9% and the Russell 2000 declined 0.6%. Ten-year Treasury yields added 3.2 basis points to reach 3.48%. Crude oil prices retreated, ending the week at about $74.32 per barrel. The dollar and gold prices advanced.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The Federal Open Market Committee hiked the federal funds rate by 50 basis points to a target rate range of 4.25%-4.50%, ending a string of 75 basis-point rate increases. In support of its decision, the Committee noted that spending and production have experienced modest growth, job gains have been robust, the unemployment rate remains low, and inflation levels remain elevated due to supply and demand imbalances related to the pandemic, higher food and energy prices, broader price pressures, and the ongoing Russia/Ukraine war. Reiterating its stated goals of maximum employment and inflation at the rate of 2.0% over the longer run, the FOMC expects that the pace of ongoing rate increases will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. The Committee will adjust its stance if risks emerge that could impede the attainment of the aforementioned goals.

- Inflationary pressures finally may be easing. The consumer price index for November advanced 0.1% after increasing 0.4% in the previous month. Prices less food and energy rose 0.2% in November, the smallest increase since August 2021. Over the 12 months ended in November, the CPI has increased 7.1%, the slowest 12-month pace since December 2021. Among the items contributing to the November increase were prices for food (0.5%), fuel oil (1.7%), apparel (0.2%), and shelter (0.6%). In November, prices decreased in medical care services (-0.7%), used cars and trucks (-2.9%), energy (-1.6%), and gasoline (-2.0%).

- Retail sales fell 0.6% in November after advancing 1.3% in October. Year to date, retail sales are up 6.5%. Retail trade sales slid 0.8% last month but are 5.4% above the November 2021 rate. In November, the decline in retail sales was broad based, with sales notably declining at motor vehicle and parts dealers (-2.3%); furniture and home furnishings stores (-2.6%); electronics and appliance stores (-1.5%); building material, garden equipment, and supplies dealers (-2.5%); gasoline stations (-0.1%); clothing and clothing accessories stores (-0.2%); department stores (-2.9%); and nonstore, or online, retailers (-0.9%). Retail sales increased at food and beverage stores (0.8%), food and drinking places (0.9%), and health and personal care stores (0.7%).

- In another sign that inflationary pressures may have peaked, both import and export prices declined in November. Import prices dipped 0.6% following a 0.4% decrease in October. Despite the recent decreases, prices for U.S. imports rose 2.7% over the past year, the smallest 12-month advance since January 2021. Export prices dropped 0.3% after decreasing 0.4% the previous month. Export prices haven’t recorded an increase since June 2022. Prices for U.S. exports advanced 6.3% from November 2021 to November 2022, the smallest 12-month increase since February 2021.

- Total industrial production fell for the second consecutive month in November after declining 0.2% in October. Decreases of 0.6% for manufacturing and 0.7% for mining were partly offset by a rebound of 3.6% for utilities following three months of declines. Since November 2021, total industrial production is up 2.5%.

- The Treasury budget deficit for November was $248.5 billion, well above the October monthly deficit of $87.9 billion and the November 2021 deficit of $191.3 billion. In November 2022, total government receipts were $252.1 billion ($318.5 billion in October), while government expenditures totaled $500.6 billion ($406.4 billion in October). For the first two months of fiscal year 2023, the deficit sits at $336.4 billion compared to the $356.4 billion deficit over the same period in fiscal year 2022.

- Prices at the pump finally dipped below their 2021 levels last week. According to the U.S. Energy Administration, the national average retail price for regular gasoline was $3.239 per gallon on December 12, $0.151 per gallon below the prior week’s price and $0.076 lower than a year ago. Also as of December 12, the East Coast price decreased $0.129 to $3.225 per gallon; the Gulf Coast price fell $0.081 to $2.727 per gallon; the Midwest price declined $0.178 to $3.034 per gallon; the West Coast price dropped $0.222 to $4.147 per gallon; and the Rocky Mountain price decreased $0.177 to $3.227 per gallon. Residential heating oil prices averaged $4.558 per gallon on December 12, $0.297 below the previous week’s price but $1.208 per gallon more than a year ago.

- Claims for unemployment insurance declined during the last reporting period. For the week ended December 10, there were 211,000 new claims for unemployment insurance, a decrease of 20,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended December 3 was 1.2%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended December 3 was 1,671,000, an increase of 1,000 from the previous week’s level, which was revised down by 1,000. States and territories with the highest insured unemployment rates for the week ended November 26 were Alaska (2.2%), California (2.1%), New Jersey (2.1%), Puerto Rico (2.0%), Montana (1.7%), Minnesota (1.7%), New York (1.6%), Massachusetts (1.5%), Rhode Island (1.5%), and Washington (1.5%). The largest increases in initial claims for unemployment insurance for the week ended December 3 were in California (+15,306), New York (+8,777), Texas (+8,639), Georgia (+7,806), and Illinois (+5,083), while the only decrease was in Connecticut (-139).

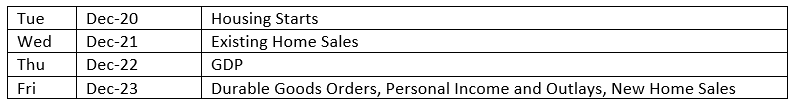

Eye on the Week Ahead

As December and 2022 wind down, the latest economic data likely will influence the market and economy heading into 2023. This week, the final estimate of third-quarter gross domestic product is scheduled for release. The previous estimate showed the economy expanded at an annual rate of 2.9%. The latest data on the housing sector is also available this week with the release of the November reports on new and existing home sales. The November report in personal income and outlays will be released at the end of the week. The Federal Reserve often takes note of personal consumption expenditures (consumer spending) and the personal consumption expenditures price index, an indicator of inflation.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.