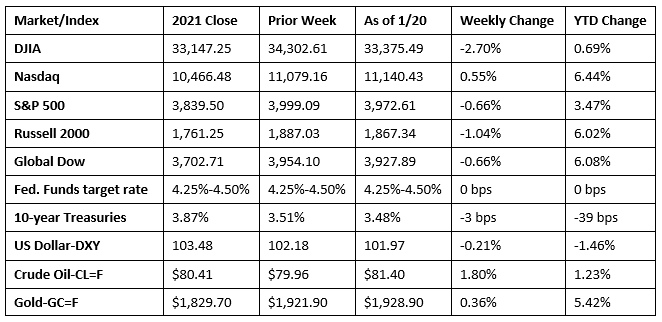

Last week saw stocks slide lower, despite a rally last Friday. Only the tech-heavy Nasdaq was able to post a gain among the benchmark indexes listed here. Throughout the week, investors had to balance data that showed inflation was waning with the impact rising interest rates may have on the economy. Several Federal Reserve officials indicated that now was not the time to stop interest-rate increases, but it may be appropriate to slow the pace of those hikes. While stock values slipped last week, Treasury yields declined, with 10-year Treasury yields falling for the third week in a row. Crude oil prices climbed higher for the second straight week on optimism over China’s anticipated increase in demand. The dollar held relatively steady, while gold prices increased $7.00 per ounce.

Stocks ended a four-day rally last Tuesday, with the Dow falling 1.1%. The S&P 500 dipped 0.1% and the Russell 2000 slid 0.2%. The Global Dow ended the day flat, while the Nasdaq eked out a 0.1% gain. Ten-year Treasury yields added 2.4 basis points to close at 3.53%. The dollar moved very little, while gold prices fell more than $10.00 per ounce. Crude oil prices rose $1.18 to hit $81.04 per barrel.

Last Wednesday saw stocks continue to decline as investors tried to balance favorable inflation data with weak economic information and hawkish Federal Reserve comments. The Dow fell 1.8%, ending its worst session of the new year. The Russell 2000 and the S&P 500 slipped 1.6%, the Nasdaq dropped 1.2%, while the Global Dow lost 0.8%. Bond prices jumped higher, pulling yields lower. Ten-year Treasury yields ended the day 16.0 basis points lower, falling to 3.37%. Crude oil prices fell for the first time in several sessions, closing at around $79.14 per barrel. The dollar was flat, while gold prices dipped less than 0.2%.

Stocks fell for the third straight day last Thursday as investors continued to fret about the economic impact of rising interest rates. The Global Dow led the declining benchmark indexes, falling 1.2%, followed by the Russell 2000 and the Nasdaq, which dipped 1.0%. The S&P 500 and the Dow fell 0.8%. Crude oil prices increased $0.42 to hit $80.75 per barrel. The dollar edged higher, while gold prices rose $8.00 to $1,931.90 per ounce. Ten-year Treasury yields inched up to 3.39%.

In what is likely the result of dip buying, stocks ended their three-day decline last Friday, closing higher to end the week. Tech shares led the rally, with the Nasdaq finishing the session up 2.7%, followed by the S&P 500 (1.9%), the Russell 2000 (1.6%), the Global Dow (1.2%), and the Dow (1.0%). Bond prices slid lower, driving yields higher, with 10-year Treasury yields adding 8.7 basis points to 3.48%. Crude oil prices rose to $81.40 per barrel. The dollar was flat, while gold prices continued to climb higher, reaching $1,928.90 per ounce.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Prices producers received for goods and services declined 0.5% in December, according to the latest information from the Bureau of Labor Statistics. This is the first monthly decline in producer prices since August. Prices for goods fell 1.6% in December, while prices for services rose 0.1%. Producer prices less foods, energy, and trade inched up 0.1% last month. Prices for foods decreased 1.2%, energy prices fell 7.9%, while margins received by wholesalers and retailers for trade services rose 0.3%. Overall, producer prices rose 6.2% in 2022 after rising 10.0% in 2021.

- Retail sales decreased 1.1% in December after falling 1.0% in November. Retail prices rose 9.2% in 2022. In December, retail trade sales were down 1.2% from November, but up 5.2% from December 2021. Nonstore (online) retailer sales were up 13.7% from December 2021, while sales at food services and drinking places were up 12.1% from last year. A decrease in consumer spending will negatively impact the gross domestic product.

- Industrial production decreased 0.7% in December and 1.7% at an annual rate in the fourth quarter. In December, manufacturing output fell 1.3% amid widespread declines across the sector. The index for utilities jumped 3.8%, as cold temperatures boosted the demand for heating, while the index for mining moved down 0.9%. Total industrial production in December was 1.6% above its level from a year ago.

- The number of residential building permits issued in December was 1.6% below the November figure, and 29.9% under the December 2021 rate. Issued building permits for single-family homes declined 6.5% in December from a month earlier. In December, privately-owned housing starts were 1.4% below the November estimate and 21.8% behind the December 2021 pace. Single-family housing starts in December were 11.3% above the November figure. Housing completions were 8.4% below the November estimate, but 6.4% above the December 2021 rate. Single-family housing completions in December were 8.0% under the November rate.

- Re-sales of existing homes fell for the 11th straight month in December, down 1.5% from the November figure. Since December 2021, sales of existing homes dropped 34.0%. Unsold inventory sits at a 2.9-month supply at the current sales pace, down from 3.3 months in November but up from 1.7 months in December 2021. The median existing-home price for all housing types in December was $366,900, down from $372,000 in November but up 2.3% from December 2021 ($358,800), marking the 130th consecutive month of year-over-year price increases. Sales of single-family homes declined 1.1% in December from the previous month and 33.5% from December 2021. The median existing single-family home price was $372,700 in December, down 1.6% from the November price of $378,700 but up 2.0% from December 2021 ($365,300).

- Prices at the pump moved higher across the country last week, according to the U.S. Energy Administration. The national average retail price for regular gasoline was $3.310 per gallon on January 16, $0.051 per gallon above the prior week’s price but $0.004 lower than a year ago. Also, as of January 16, the East Coast price increased $0.043 to $3.259 per gallon; the Gulf Coast price dipped $0.082 to $2.972 per gallon; the Midwest price climbed $0.060 to $3.205 per gallon; the West Coast price increased $0.006 to $3.967 per gallon; and the Rocky Mountain price advanced $0.170 to $3.292 per gallon. Residential heating oil prices averaged $4.606 per gallon on January 16, $0.060 above the previous week’s price and $1.006 per gallon more than a year ago.

- For the week ended January 14, there were 190,000 new claims for unemployment insurance, a decrease of 15,000 from the previous week’s level. Initial claim filings haven’t been this low since September 24, 2022. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended January 7 was 1.1%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended January 7 was 1,647,000, an increase of 17,000 from the previous week’s level, which was revised down by 4,000. States and territories with the highest insured unemployment rates for the week ended December 31 were New Jersey (2.6%), Rhode Island (2.6%), Alaska (2.4%), Minnesota (2.3%), Massachusetts (2.1%), Montana (2.1%), New York (2.1%), California (2.0%), and Puerto Rico (2.0%). The largest increases in initial claims for unemployment insurance for the week ended January 7 were in California (+17,447), New York (+17,285), Texas (+10,178), Georgia (+8,494), and Florida (+3,209), while the largest decreases were in New Jersey (-4,064), Connecticut (-2,202), Iowa (-1,891), Massachusetts (-1,585), and Oregon (-1,525).

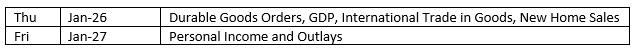

Eye on the Week Ahead

There’s plenty of important economic data available this week. The first estimate of the fourth-quarter 2022 gross domestic product is available. The third-quarter GDP showed the economy advanced at a rate of 3.2% after regressing in each of the first two quarters. Also out this week is the December release of the personal income and outlays report. Included in this information is the personal consumption expenditures price index, an inflation indicator favored by the Federal Reserve. The PCE price index inched up 0.1% in November.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.