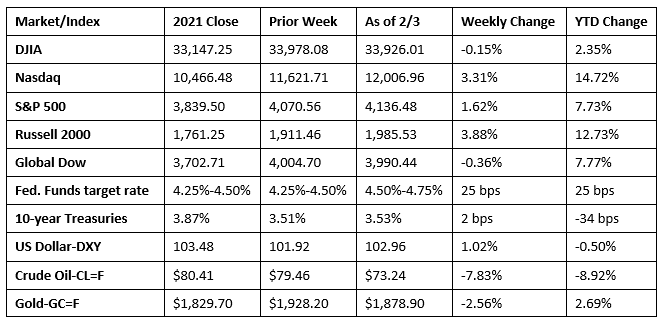

Just when investors saw a glimmer of hope that the Fed would soften its rate-hike policy, the January labor figures came out showing a massive job increase coupled with moderated wage growth. The latest employment data is evidence of a labor market that has withstood the Fed’s actions thus far and could encourage a more aggressive response by the central bank as it attempts to drive down inflation. Despite a late-week slide, stocks ended the week mixed, with the Nasdaq, the Russell 2000, and the S&P 500 posting gains, while the Dow, and the Global Dow lost ground. Ten-year Treasury yields inched higher and the dollar advanced. Gold prices, which had been on an upswing, fell to under $1,900.00 per ounce. Doubts about increased eand from China and concerns about rising interest rates sent crude oil prices lower last week.

Investors turned cautious last Monday ahead of the Federal Reserve’s meeting and a slew of big-tech earnings reports. The Nasdaq suffered its worst day since December 22, falling 2.0%, while the S&P 500 lost 1.3%, marking its worst daily performance since mid-January. Declines in a couple of mega-cap tech stocks dragged both indexes lower. The remaining benchmark indexes listed here didn’t fare much better. The Russell 2000 slid 1.4%, while the Global Dow and the Dow dipped 0.8%. Ten-year Treasury yields added 3.3 basis points to reach 3.55%. Crude oil declined nearly $2.00 to $77.78 per barrel. The dollar advanced against a basket of currencies. Gold prices fell 0.4% to $1,938.70 per ounce.

Stocks closed January on an uptick, with each of the benchmark indexes listed here posting solid gains. The Russell 2000 jumped 2.5% by the close of trading, followed by the Nasdaq (1.7%), the S&P 500 (1.5%), the Dow (1.1%), and the Global Dow (0.4%). Treasury yields on 10-year notes slipped 2.2 basis points to close at 3.52%. Crude oil prices rose 1.6%, reaching $79.12 per barrel. The dollar fell, while gold prices advanced.

Last Wednesday saw stocks climb higher after the Federal Reserve scaled back its interest-rate hikes (see below) and indicated that inflation may be slowing. The Nasdaq jumped 2.0%, well ahead of the other benchmark indexes listed here. The Russell 2000 gained 1.5%, the S&P 500 advanced 1.1%, the Global Dow added 0.9%, and the Dow ended the day flat. Bond prices climbed higher, with the yield on 10-year Treasuries falling 13.2 basis points to 3.39%. Crude oil prices slid 2.5%, landing at $76.94 per barrel. The dollar declined, while gold prices increased 1.2% to $1,967.70 per ounce.

Stocks continued to rally last Thursday, as investors clung to hopes that the Fed is on track to loosen its fiscal tightening policy. Both the Nasdaq and the S&P 500 have enjoyed the best three-session rally since November. The Nasdaq gained 3.3%, the Russell 2000 climbed 2.1%, the S&P 500 advanced 1.5%, and the Global Dow increased 0.3%. Only the Dow failed to advance, dipping 0.1%. Ten-year Treasury yields were flat by the end of Thursday’s session. Crude oil prices fell for the second straight day, declining to $76.00 per barrel. The dollar rose, while gold prices fell nearly 1.0%.

A robust jobs report sent stocks reeling last Friday, with each of the benchmark indexes listed here closing the session in the red. The Nasdaq lost 1.6%, followed by the S&P 500 and the Global Dow, which fell 1.0%. The Russell 2000 declined 0.9% and the Dow dipped 0.4%. Ten-year Treasury yields added 13.6 basis points to hit 3.53%. Crude oil prices continued to slip, falling to $73.24 per barrel. The dollar rose 1.2%, while gold prices slid 2.7%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Following its meeting last week, the Federal Open Market Committee voted to increase the target range for the federal funds rate 25 basis points to 4.50%-4.75%. In support of its decision, the Committee pointed to modest growth in spending and production, robust job gains, and a low unemployment rate, while noting that inflation had eased somewhat but remained elevated. The FOMC anticipates more interest-rate increases in the future until it feels that inflation has returned to the Committee’s goal of 2.0% over time. However, the FOMC indicated that it would continue to assess economic information in determining whether to adjust its current monetary policy. In addition, following its meeting, Federal Reserve Chair Jerome Powell said, “we can now say for the first time that the disinflationary process has started.”

- Employment rose by a whopping 517,000 new jobs in January, according to the latest report from the Bureau of Labor Statistics. January’s job gains exceeded the 2022 average monthly gain of 401,000. Job growth was widespread in January, led by gains in leisure and hospitality, professional and business services, and health care. Employment also increased in government, partially reflecting the return of workers from a strike. Both the unemployment rate, at 3.4%, and the number of unemployed persons, at 5.7 million, changed little in January. The unemployment rate has shown little net movement since early 2022. In January, both the labor force participation rate, at 62.4%, and the employment-population ratio, at 60.2%, were unchanged. In January, average hourly earnings rose by $0.10, or 0.3%, to $33.03. Over the past 12 months, average hourly earnings have increased by 4.4%, down from 4.9% for the 12 months ended in December. The average workweek rose by 0.3 hour to 34.7 hours.

- The Job Openings and Labor Turnover Summary for December, released February 1, 2023, revealed that the number of job openings rose to 11.0 million, up from the November total of 10.4 million. The number of job openings in December is the highest monthly total since July. In December, the largest increases in job openings were in accommodation and food services (+409,000), retail trade (+134,000), and construction (+82,000). The number of job openings decreased in information (-107,000). December saw hires increase by 131,000 to 6.2 million, while total separations increased 59,000 to 5.9 million.

- Manufacturing continued to decline in January, according to the latest release of the S&P Global US Manufacturing PMI™. Purchasing manager survey respondents noted a sharp contraction in new orders, while input and output costs increased as price pressures strengthened. Job growth slowed as new orders waned and backlogs declined. Overall, the purchasing managers’ index posted 46.9 in January, marginally higher than the December reading of 46.2.

- The services sector followed manufacturing, falling sharply in January, according to the S&P Global US Services PMI™. Like manufacturing, weak domestic and foreign demand led to declines in new business and new export orders. At the same time, cost inflation picked up for the first time in eight months.

- Regular retail gas prices continued to rise across the country last week, according to the U.S. Energy Information Administration. The national average retail price for regular gasoline was $3.489 per gallon on January 30, $0.074 per gallon above the prior week’s price and $0.121 higher than a year ago. Also, as of January 30, the East Coast price increased $0.082 to $3.466 per gallon; the Gulf Coast price dipped $0.041 to $3.133 per gallon; the Midwest price climbed $0.078 to $3.382 per gallon; the West Coast price increased $0.077 to $4.085 per gallon; and the Rocky Mountain price advanced $0.110 to $3.544 per gallon. Residential heating oil prices averaged $4.657 per gallon on January 30, $0.044 below the previous week’s price but $0.881 per gallon more than a year ago.

- For the week ended January 28, there were 183,000 new claims for unemployment insurance, a decrease of 3,000 from the previous week’s level. This is the lowest number of initial claims since April 2022 and the fifth straight week of declines. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended January 21 was 1.1%, unchanged from the previous week’s rate, which was revised down by 0.1 percentage point. The advance number of those receiving unemployment insurance benefits during the week ended January 21 was 1,655,000, a decrease of 11,000 from the previous week’s level, which was revised down by 9,000. States and territories with the highest insured unemployment rates for the week ended January 14 were New Jersey (2.5%), Rhode Island (2.4%), Alaska (2.3%), Minnesota (2.2%), California (2.1%), Massachusetts (2.1%), Puerto Rico (2.1%), Montana (2.0%), Illinois (2.0%), and New York (1.9%). The largest increases in initial claims for unemployment insurance for the week ended January 21 were in Arkansas (+419) and the Virgin Islands (+5), while the largest decreases were in California (-175,582), New York (-4,957), Ohio (-4,396), Georgia (-3,921), and Pennsylvania (-2,700).

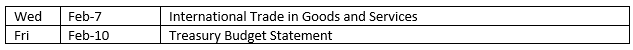

Eye on the Week Ahead

There isn’t much in terms of economic reports issued this week. The goods and services trade deficit report for December is out this week. The trade deficit narrowed sharply in November, falling $6.3 billion from the previous month. A notable drop in imports led to the lowest monthly trade deficit since July 2020. The Treasury budget rose more than $63.0 billion in December from a year ago. For the first three months of the fiscal year, the deficit sat at $421.4 billion, up from $377.7 billion over the same period in the previous fiscal year.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.