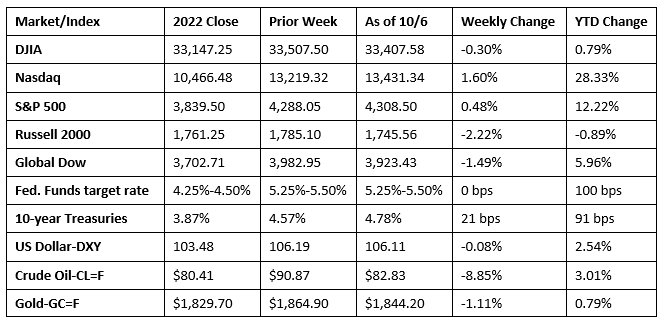

The market ended last week with mixed results. The tech-heavy Nasdaq made it two straight weeks of gains, while the S&P 500 also ended the week in the black. The remaining benchmark indexes listed here ended last week lower despite a late-week rally. Wall Street tried to predict what the Federal Reserve would do after the latest jobs report showed employment accelerated by a whopping 336,000 in September. Strength in the labor sector, coupled with other favorable economic data, certainly supports the Federal Reserve’s restrictive monetary policy, which traders fear could lead to another interest-rate hike when the Fed meets again in November. In addition, the robust September hiring data may push long-term bond yields higher with bond prices sagging. Earlier in the week, 10-year Treasury yields touched highs not seen since 2007. Crude oil prices had their biggest weekly decline since March, falling to just under $83.00 per barrel after hitting $94.00 per barrel at the end of September. Crude oil prices have fluctuated despite foreign production cuts, largely because the U.S. and other non-OPEC+ countries increased production, which happened to coincide with a lag in demand.

Ten-year Treasury yields jumped to a 16-year high last Monday, while stocks closed the session mixed. Stronger-than-expected manufacturing data (see below) and the weekend deal to avoid a government shutdown boosted sentiment that another interest-rate hike is forthcoming from the Federal Reserve. The Nasdaq gained 0.7% as tech and communication shares climbed higher, while the remaining market sectors slumped. The S&P 500 couldn’t maintain an early-day rally, ultimately ending the day flat. The Russell 2000 (-1.6%), the Global Dow (-1.1%), and the Dow (-0.2%) declined. Yields on 10-year Treasuries added 11.0 basis points to close at 4.68%. Crude oil prices dipped 2.2%, falling below $90.00 per barrel. The dollar rose 0.9%, while gold prices fell 1.2%.

The benchmark indexes listed here ended last Tuesday sharply lower as positive economic news seemed to favor the Fed keeping interest rates higher for longer. Job openings (see below) unexpectedly increased, which may lead to a tight labor market with the September employment figures out on Friday. Only utilities closed higher among the market sectors with consumer discretionary and information technology declining the most. Overall, the Nasdaq dropped 1.9%, the Russell 2000 lost 1.7%, the S&P 500 and the Global Dow declined 1.4%, and the Dow slipped 1.3%. Ten-year Treasury yields followed the previous day’s increase by adding nearly 12.0 basis points to end the day at 4.80%, reaching another 16-year high. The dollar inched higher, gold prices fell, and crude oil prices rose to $89.53 per barrel.

Stocks rallied last Wednesday as Treasury yields retreated. The Nasdaq jumped 1.4%, followed by the S&P 500 (0.8%), the Dow (0.4%), and the Russell 2000 (0.1%). The Global Dow slipped 0.3%. Ten-year Treasury yields dipped 6.7 basis points to 4.73%. Crude oil prices hit their lowest levels in over a month after falling 5.4% as weakening demand more than offset reduced oil production. The dollar and gold prices ended the session in the red.

The market closed marginally lower last Thursday. The Nasdaq and the S&P 500 dipped 0.1%, while the Dow fell less than 0.1%. The Global Dow rose 0.4%, while the Russell 2000 edged up 0.1%. Ten-year Treasury yields closed at 4.71%, a decline of 1.8 basis points. Crude oil prices continued to decline, falling 2.1% to $82.45 per barrel. The dollar fell for the second straight day, while gold prices decreased for the fourth straight session.

Stocks closed out last Friday higher with the Nasdaq climbing 1.6% to top the benchmark indexes listed here. The S&P 500 rose 1.2%, the Dow advanced 0.9%, while the Global Dow and the Russell 2000 gained 0.8%. Long-term bond prices declined, driving yields higher, with 10-year Treasury yields adding 6.7 basis points to reach 4.78%. Crude oil prices rose 0.6%, the dollar dipped lower, while gold prices advanced for the first time last week.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Employment rose by a higher-than-expected 336,000 in September, above the average monthly gain of 267,000 over the prior 12 months. In September, job gains occurred in leisure and hospitality; government; health care; professional, scientific, and technical services; and social assistance. The change in job gains for July was revised up by 79,000, from 157,000 to 236,000, and the change for August was revised up by 40,000, from 187,000 to 227,000. With these revisions, employment in July and August combined was 119,000 higher than previously reported. The total number of unemployed in September, at 6.4 million, rose by 50,000 from the previous month’s total. The unemployment rate was unchanged at 3.8%. Both the labor force participation rate, at 62.8%, and the employment-population ratio, at 60.4%, were unchanged over the month. In September, average hourly earnings rose by $0.07, or 0.2%, to $33.88. Over the past 12 months, average hourly earnings have increased by 4.2%. The average workweek was unchanged at 34.4 hours in September.

- Manufacturing contracted for the third consecutive month in September but at a slower pace. The S&P Global US Manufacturing Purchasing Managers’ Index™ posted 49.8 last month, up from 47.9 in August. A reading of less than 50.0 indicates contraction. According to survey respondents, the slower pace of contraction stemmed from a renewed rise in output following increased hiring and a slight drop in new orders. Although buyer demand remained subdued, conditions declined at a much slower pace. In addition, purchasing managers’ expectations for future output increased, reaching their highest levels since April 2022.

- The services sector barely expanded in September, according to the S&P Global US Services PMI. The business activity index registered 50.1 in September, down from the August reading of 50.5. Overall, business activity in the services sector stagnated as demand conditions weakened with new orders dropping, while company costs rose at a marked pace. According to the S&P Global survey, respondents noted elevated inflation, high interest rates, and economic uncertainty, which led to stymied customer demand.

- According to the latest Job Openings and Labor Turnover report, the number of job openings increased by 690,000 to 9.6 million in August. Over the month, job openings increased in professional and business services, finance and insurance, state and local government education, nondurable goods manufacturing, and federal government. The number of hires was little changed at 5.9 million (+35,000). Total separations, which include quits, layoffs and discharges, and other separations, changed little in August, inching up 38,000 to 5.6 million. In August, the number of quits, which generally are voluntary separations, was 3.6 million, up 19,000 from July. The number of layoffs and discharges in August, at 1.7 million, was essentially unchanged from the previous month.

- The goods and services deficit declined $6.4 billion, or 9.9%, in August, according to the latest data from the Bureau of Economic Analysis. August exports were $256.0 billion, $4.1 billion, or 1.6%, more than July exports. August imports were $314.3 billion, $2.3 billion, or 0.7%, less than July imports. Year to date, the goods and services deficit decreased $137.6 billion, or 20.7%, from the same period in 2022. Exports increased $22.0 billion, or 1.1%. Imports decreased $115.6 billion, or 4.3%.

- The national average retail price for regular gasoline was $3.798 per gallon on October 2, $0.039 per gallon lower than the prior week’s price but $0.016 more than a year ago. Also, as of October 2, the East Coast price decreased $0.060 to $3.538 per gallon; the Midwest price fell $0.100 to $3.539 per gallon; the Gulf Coast price dropped $0.030 to $3.321 per gallon; the Rocky Mountain price declined $0.076 to $3.920 per gallon; and the West Coast price advanced $0.133 to $5.391 per gallon.

- For the week ended September 30, there were 207,000 new claims for unemployment insurance, an increase of 2,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended September 23 was 1.1%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended September 23 was 1,664,000, a decrease of 1,000 from the previous week’s level, which was revised down by 5,000. States and territories with the highest insured unemployment rates for the week ended September 16 were Hawaii (2.4%), New Jersey (2.2%), California (2.1%), Puerto Rico (1.8%), Massachusetts (1.6%), New York (1.6%), Oregon (1.5%), Rhode Island (1.5%), Washington (1.5%), Illinois (1.4%), Nevada (1.4%), and Pennsylvania (1.4%). The largest increases in initial claims for unemployment insurance for the week ended September 23 were in California (+2,712), Ohio (+1,422), Michigan (+1,282), Alabama (+870), and Missouri (+532), while the largest decreases were in Georgia (-1,853), South Carolina (-1,199), New York (-1,149), Indiana (-705), and Florida (-485).

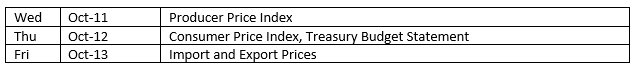

Eye on the Week Ahead

Inflation data for September is out this week with the releases of the Consumer Price Index and the Producer Price Index. The CPI rose 0.6% in August and 3.7% for the year. Producer prices increased 0.7% in August and 1.6% for the last 12 months.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.