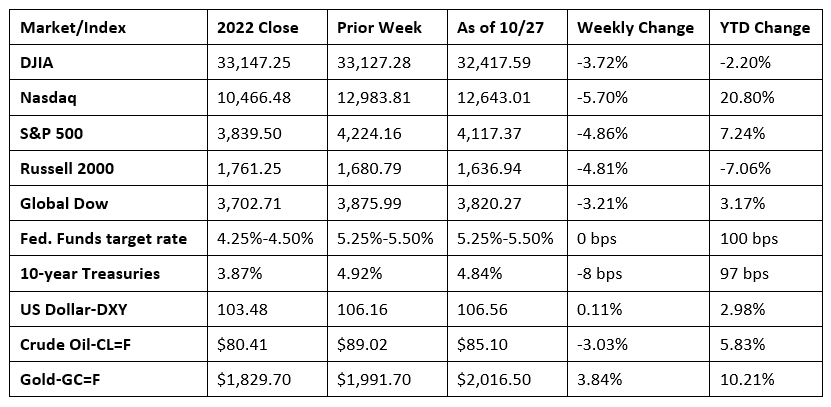

Last week saw Wall Street endure another lackluster performance. Investors continued to fret over hawkish comments from Federal Reserve officials as inflation remained above the Fed’s target rate of 2.0%. In addition, higher bond yields and unrest in the Middle East also weighed on the market. Each of the benchmark indexes listed here ended the week lower, adding to losses from the previous week. The S&P 500 and the Nasdaq Composite entered correction territory during the week. Each of the market sectors declined, with the exception of utilities, which inched up 0.3%. Communication services and energy declined more than 7.0%. Crude oil prices fell, although a sharp climb last Friday could be the result of a widening of the Israel-Hamas conflict.

Last Monday saw a pullback in bond yields help propel growth sector stocks. Tech shares climbed higher as corporate earnings season began to ramp up. While the Nasdaq (0.27%) gained ground, the remaining benchmark indexes listed here were not so fortunate. The small caps of the Russell 2000 dropped 0.9%, followed by the Dow (-0.6%), the Global Dow (-0.3%), and the S&P 500 (-0.2%). Ten-year Treasury yields dipped 8.6 basis points to 4.82%. Crude oil prices fell 2.3% to settle at $86.02 per barrel. The dollar and gold prices declined.

Stocks rebounded last Tuesday as investors awaited earnings reports from some big tech companies. The S&P 500 ended a five-day losing streak after gaining 0.7%. The Dow and the Global Dow advanced 0.6%, while the largest climbers were the Nasdaq (0.9%) and the Russell 2000 (0.8%). Ten-year Treasury yields ticked up minimally, closing at 4.84%. Crude oil prices continued to drop, settling at $83.57 per barrel after retreating 2.3%. The dollar reversed course from the prior day, gaining 0.7%. Gold prices lagged.

Wall Street couldn’t maintain the prior day’s momentum last Wednesday as stocks declined on some disappointing corporate earnings data and a jump in Treasury yields. The Nasdaq dropped 2.4%, with megacaps tumbling. The S&P 500 fell for the fifth session out of the last six after losing 1.4%. The small caps of the Russell 2000 fell 1.5%, the Global Dow declined 0.5%, and the Dow dipped 0.3%. Ten-year Treasury yields advanced 11.3 basis points to 4.95% as bond prices fell, reflecting fears that interest rates could stay higher for longer. Crude oil prices rose 1.8%, closing at $85.24 per barrel. The dollar and gold prices inched higher.

Stocks continued to tumble last Thursday. The tech-heavy Nasdaq fell 1.8% as mixed earnings data had investors wondering whether big tech companies were overvalued. The S&P 500 slid 1.2%, the Dow dropped 0.8%, and the Global Dow declined 0.7%. The Russell 2000 edged up 0.4%. Bond prices gained value, pulling yields lower, with 10-year Treasury yields falling 10.8 basis points to 4.84%. The dollar inched up 0.1%, while gold prices were flat. Crude oil prices hovered around $83.46 per barrel, a decrease of about 2.3%.

Megacap stocks moved higher on solid earnings reports, helping the tech-heavy Nasdaq to post a 0.4% gain last Friday. The remaining benchmark indexes didn’t fare as well. The small-cap Russell 2000 fell 1.3%, with the Dow dropping 1.1%. The Global Dow and the S&P 500 declined 0.5%, with the latter entering correction territory. Ten-year Treasury yields were flat. Crude oil prices gained 2.4%. The dollar slipped lower, while gold prices gained 1.0%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

The initial, or advance, estimate of gross domestic product showed the economy accelerated at an annualized rate of 4.9% in the third quarter, well above the 2.1% advance in the second quarter. While the initial estimate is based on incomplete source data, it certainly shows economic strength despite rising interest rates. The largest contributor to the increase in third-quarter GDP was a 4.0% increase in personal consumption expenditures (consumer spending), which ticked up 0.8% in the second quarter. Consumer spending rose on goods and services, with spending on durable goods jumping 7.6%, while spending on services rose 3.6%. Fixed investment advanced 0.8%, driven higher by a 3.9% increase in residential fixed investment. Nonresidential fixed investment moved down 0.1%. Exports increased 6.2%, while imports, which are a negative in the calculation of GDP, advanced 5.7%. The personal consumption expenditures price index increased 2.9%. Excluding food and energy, consumer prices rose 2.4%.

- Consumer prices rose 0.4% in September, the same increase as in August. Core prices, excluding food and energy, increased 0.3% last month, exceeding the 0.1% increase in August. However, over the last 12 months, overall consumer prices dipped 0.1 percentage point to 3.4%, while core prices decreased from 3.9% to 3.7%. Consumer spending advanced 0.7% in September, while personal income and disposable (after-tax) personal income increased 0.3%.

- Sales of new single-family homes rose 12.3% in September and 33.9% from a year ago. The median sales price of new houses sold in

September 2023 was $418,800. The average sales price was $503,900. The estimate for new homes for sale at the end of September represented a supply of 6.9 months at the current sales pace. - The advance report on international trade in goods showed the goods deficit rose $1.1 billion, or 1.3% in September. Exports of goods increased 2.9%, while imports rose 2.4%. Excluding transportation, new orders increased 0.5%. Excluding defense, new orders increased 5.8%. Transportation equipment advanced 12.7% following two consecutive monthly decreases.

- New orders for manufactured durable goods increased 4.7% in September following two consecutive monthly decreases.

- The government budget for September, the last month of fiscal year 2023, had a deficit of $171.0 billion. Receipts totaled $467.0 billion, while government outlays equaled $638.0 billion. For fiscal year 2023, the total government deficit increased to $1.695 billion, up from $1.375 billion for the previous fiscal year. Government outlays totaled $6.134 billion for this fiscal year while receipts were $4.439 billion.

- The national average retail price for regular gasoline was $3.533 per gallon on October 23, $0.043 per gallon lower than the prior week’s price and $0.236 less than a year ago. Also, as of October 23, the East Coast price decreased $0.048 to $3.348 per gallon; the Midwest price fell $0.011 to $3.315 per gallon; the Gulf Coast price inched up $0.001 to $3.041 per gallon; the Rocky Mountain price declined $0.014 to $3.691 per gallon; and the West Coast price decreased $0.139 to $4.858 per gallon.

- For the week ended October 21, there were 210,000 new claims for unemployment insurance, an increase of 10,000 from the previous week’s level, which was revised up by 2,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended October 14 was 1.2%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended October 14 was 1,790,000, an increase of 63,000 from the previous week’s level, which was revised down by 7,000. States and territories with the highest insured unemployment rates for the week ended October 7 were Hawaii (2.2%), California (2.0%), New Jersey (2.0%), Puerto Rico (1.8%), Massachusetts (1.5%), New York (1.5%), Rhode Island (1.5%), Washington (1.5%), Nevada (1.4%), and Oregon (1.4%). The largest increases in initial claims for unemployment insurance for the week ended October 14 were in Tennessee (+1,111), Kentucky (+374), Virginia (+277), Wisconsin (+90), and North Carolina (+22), while the largest decreases were in Texas (-3,108), California (-2,050), New York (-1,990), New Jersey (-1,460), and Georgia (-1,023).

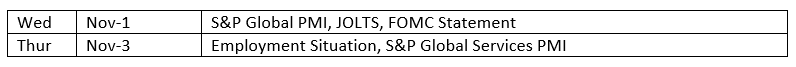

Eye on the Week Ahead

November kicks off with a meeting of the Federal Open Market Committee. The FOMC projected one more 25-basis point increase by the end of the year. The Committee did not raise interest rates at its last meeting in September, so it is likely that another interest rate hike is in the offing following the November meeting or the last meeting of the year in December. Also out this week are the employment figures for October. Job hirings have been steady throughout the year, with September’s revised figure coming in at 336,000, well above the monthly average of 267,000.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.