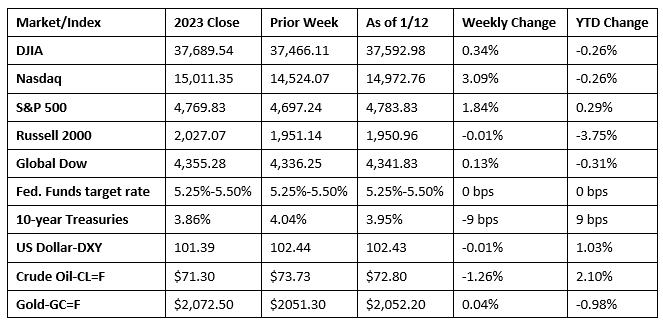

Wall Street saw stocks close higher last week, despite dampening hopes of an interest rate reduction. Each of the benchmark indexes listed here rebounded from a slow start to the year by adding value last week. Some major financial companies posted lower-than-expected fourth-quarter earnings. Information technology and communication services led the sectors, while energy and utilities underperformed. Ten-year Treasury yields slipped lower. Crude oil prices retreated marginally. The dollar was flat, while gold prices ticked higher.

Stocks closed sharply higher last Monday, led by a rally in tech shares. The Nasdaq jumped 2.2% as chip makers saw their stocks surge while megacaps outperformed. The Russell 2000 added 1.9%, followed by the S&P 500 (1.4%), the Dow (0.6%), and the Global Dow (0.3%). Ten-year Treasury yields dipped to 4.00%. Crude oil prices settled at $71.01 per barrel, down 3.80%. The dollar and gold prices also declined.

Tech shares extended their rally to begin last Tuesday but lost momentum by the end of the day. The Nasdaq inched up 0.1%, the only benchmark index to close above water, while the remaining indexes tumbled lower. The small caps of the Russell 2000 lost 1.1%, the Global Dow fell 0.5%, while the large caps of the Dow (-0.4%) and the S&P 500 (-0.2%) dipped lower. Long-term bond values, which have fluctuated marginally during the first few weeks of the new year, slipped lower last Tuesday, sending yields on 10-year Treasuries up to 4.01%. Crude oil prices rose 2.0% to $72.17 per barrel. The dollar gained 0.3%, while gold prices were flat.

Wednesday saw stocks advance, led by surging tech shares. The Nasdaq gained 0.8%, followed by the S&P 500 (0.6%) and the Dow (0.5%), while the Russell 2000 and the Global Dow inched up 0.1%. Ten-year Treasury yields ended the session marginally higher at 4.03%. Crude oil prices declined 1.3% to $71.28 per barrel. The dollar and gold prices slid 0.2%.

Equities took a marginal step back last Thursday following news that consumer prices rose a bit more than expected (see below), dampening the prospects of an interest rate cut any time soon. The Russell 2000 dropped 0.8%, the S&P 500 and the Global Dow dipped 0.1%, while the Dow and the Nasdaq ended the day flat. Ten-year Treasury yields closed at 3.97%, down 5.3 basis points. Crude oil prices rose 2.1% to $72.85 per barrel. The dollar was unchanged, while gold prices advanced 0.3%.

Stocks closed mixed on Friday with the Global Dow (0.3%) and the S&P 500 (0.1%) closing marginally higher, the Nasdaq was flat, while the Dow (-0.3%) and the Russell 2000 (-0.2%) declined. Ten-year Treasury yields ticked lower to close at 3.95%. Crude oil prices rose 1.1% to $72.78 per barrel. The dollar gained 0.2%, while gold prices rose 1.6%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- In what may dampen hopes for an interest rate cut by the Federal Reserve, the Consumer Price Index rose 0.3% in December, up from 0.1% in November. The 12-month rate also increased 0.3 percentage point to 3.4%. In December, prices excluding food and energy rose 0.3%, unchanged from the November figure. For the year ended in December, the CPI excluding food and energy rose 3.9%, 0.1 percentage point under the 12-months ended in November. Prices for shelter (0.5%) continued to rise in December, contributing over half of the monthly increase. In December, energy prices rose 0.4% after declining 2.3% in November, while prices for food increased 0.2%, unchanged from November. In 2023, food prices rose 2.7%, energy prices fell 2.0% (gasoline prices declined 1.9%), and prices for shelter rose 6.2%.

- Producer prices were lower than expected in December after declining 0.1% in December. Over the last 12 months ended in December, producer prices rose 1.0%. Prices excluding food and energy were unchanged in December but up 1.8% for the year. Producer prices excluding food, energy, and trade services rose 0.2% last month and 2.5% over the last 12 months. Prices for goods fell 0.4% in December, the third consecutive monthly decline. In December, nearly 60.0% of the decrease in prices for goods could be traced to a 1.2% drop in prices for energy. Prices for services remained unchanged in December for the third straight month.

- The Treasury monthly budget deficit for December 2023 was $129.0 billion, $185.0 billion less than the November deficit but $44.0 billion above the December 2022 deficit. For the year 2023, the total deficit was $1,784.0 trillion.

- The goods and services trade deficit was $63.2 billion in November, down $1.3 billion, or 2.0%, from the October deficit. November exports were $253.7 billion, $4.8 billion, or 1.9%, less than October exports. November imports were $316.9 billion, $6.1 billion, or 1.9%, less than October imports. Year to date, the goods and services deficit decreased $161.8 billion, or 18.4%, from the same period in 2022. Exports increased $28.8 billion, or 1.0%. Imports decreased $133.0 billion, or 3.6%.

- The national average retail price for regular gasoline was $3.073 per gallon on January 8, $0.015 per gallon lower than the prior week’s price and $0.186 less than a year ago. Also, as of January 8, the East Coast price decreased $0.012 to $3.075 per gallon; the Midwest price fell $0.027 to $2.768 per gallon; the Gulf Coast price increased $0.023 to $2.676 per gallon; the Rocky Mountain price fell $0.021 to $2.765 per gallon; and the West Coast price decreased $0.043 to $4.072 per gallon.

- For the week ended January 6, there were 202,000 new claims for unemployment insurance, a decrease of 1,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended December 30 was 1.2%, a decrease of 0.1 percentage point from the previous week’s rate, which was revised up by 0.1 percentage point. The advance number of those receiving unemployment insurance benefits during the week ended December 30 was 1,834,000, a decrease of 34,000 from the previous week’s level, which was revised up by 13,000. States and territories with the highest insured unemployment rates for the week ended December 23 were Montana (2.4%), New Jersey (2.4%), Alaska (2.3%), Minnesota (2.2%), California (2.1%), Massachusetts (2.1%), Rhode Island (2.1%), Illinois (1.9%), and Washington (1.9%). The largest increases in initial claims for unemployment insurance for the week ended December 30 were in Pennsylvania (+4,545), New Jersey (+3,187), Michigan (+2,769), Massachusetts (+2,751), and Connecticut (+2,020), while the largest decreases were in California (-8,062), Texas (-5,821), Missouri (-2,308), Florida (-1,408), and Oregon (-1,236).

Eye on the Week Ahead

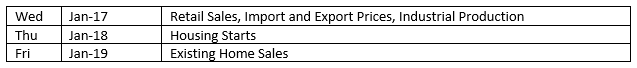

There’s a fairly substantial amount of important economic data released this week. Wednesday includes the December reports on retail sales, import and export prices, and industrial production. The end of the week focuses on the real estate sector with the release of the latest data on housing starts and the December report on existing-home sales.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.