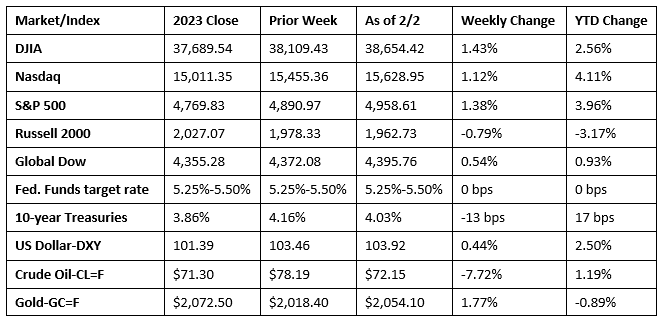

A strong labor report and solid earnings data from megatech companies helped drive stocks higher last week. Each of the benchmark indexes listed here posted solid gains with the exception of the Russell 2000. Nine of the 11 market sectors advanced last week, led by consumer discretionary, consumer staples, and health care, while real estate and energy declined. Ten-year Treasury yields trended lower for most of the week, only to vault higher on Friday. Crude oil prices, which had been surging, fell last week as continued unrest in the Middle East has irritated oil markets. The dollar inched higher, while gold prices advanced.

The S&P 500 (0.8%) and the Dow (0.6%) reached new record highs to kick off the week ahead of several key earnings reports. The tech-heavy Nasdaq gained 1.1% to reach a 52-week high. The Russell 2000 gained 1.6% and the Global Dow rose 0.5% as investors were bullish on stocks as they awaited fourth-quarter earnings data from more than 100 S&P 500 companies released later in the week. Ten-year Treasury yields fell 6.9 basis points to 4.09%. Crude oil prices stepped back following last week’s surge, falling nearly 1.3% to $77.00 per barrel. Gold prices advanced 0.7%, while the dollar was flat.

The Nasdaq lost 0.8% last Tuesday ahead of earnings reports from some major tech companies. The small caps of the Russell 2000 also slipped 0.8%, while the S&P 500 dipped 0.1%. The Dow rose 0.4% and the Global Dow ticked up 0.1%. Ten-year Treasury yields declined for the second straight day, losing 3.2 basis points to settle at 4.05%. Crude oil prices reversed course, closing at about $77.88 per barrel after gaining 1.4%. The dollar fell 0.2%, while gold prices continued their mini bull run after advancing 0.5%.

Last Wednesday saw Wall Street react negatively to the Federal Reserve’s indication that interest rates will not be coming down any time soon. Each of the benchmark indexes declined, with the Russell 2000 (-2.3%) and the Nasdaq (-2.2%) falling the furthest, followed by the S&P 500 (-1.6%), the Dow (-0.8%), and the Global Dow (-0.4%). Bond prices increased, pulling yields lower, with 10-year Treasury yields falling 9.2 basis points to 3.96%. Crude oil prices dropped 2.6%, settling at $75.78 per barrel. The dollar rose 0.2%, while gold prices ticked up 0.1%.

Stocks rebounded last Thursday, with each of the benchmark indexes listed here closing higher. Investors were not deterred by Federal Reserve Chair Jerome Powell’s indication that interest rates would not likely be lowered in March, when the Fed next meets. Several major corporations posted solid fourth-quarter earnings data, which also helped support equities. The Russell 2000 advanced 1.4% to lead the benchmark indexes listed here, followed by the Dow (1.0%), the Nasdaq and the S&P 500 (0.3%), and the Global Dow (0.2%). Ten-year Treasury yields fell to 3.86%, a decrease of 10.4 basis points. Crude oil prices dropped 2.5% to $73.92 per barrel as traders focused on attempts to broker a cease-fire between Israel and Hamas. The dollar slid 0.2%, while gold prices rose 0.2%.

Equities closed higher last Friday with the exception of small caps which lagged. By the close of trading, the Dow (0.4%) and the S&P 500 (1.1%) reached new record highs. The Nasdaq jumped 1.7%, bolstered by strong earnings results from megatech companies. The Global Dow inched up 0.2%, while the Russell 2000 declined 0.6%. As investors moved to stocks, demand for bonds fell, sending yields higher. Ten-year Treasury yields climbed 17.0 basis points to 4.03%. Crude oil prices continued to slide, falling 2.3%. The dollar gained 0.8%, while gold prices lost 0.8%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- As expected, the Federal Open Market Committee maintained the federal funds target rate range at its current 5.25%-5.50%. While economic activity and employment were solid, inflation remained elevated. The Committee appeared to discourage any expectations of an impending interest rate reduction by indicating, “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%.”

- January saw employment increase by 353,000, well above expectations. January’s total, coupled with December’s upwardly revised total of 333,000, clearly shows strength in the labor sector. Last month, job gains occurred in professional and business services, health care, retail trade, and social assistance. Employment declined in the mining, quarrying, and oil and gas extraction industry. In January, the unemployment rate was 3.7% for the third month in a row, and the number of unemployed people declined by 144,000 to 6.1 million. The labor participation rate, at 62.5% was unchanged from the December estimate. The employment-population ratio edged up 0.1 percentage point to 60.2%. In January, average hourly earnings rose by $0.19, or 0.6%, to $34.55. Over the past 12 months, average hourly earnings have increased by 4.5%. The average workweek decreased by 0.2 hour to 34.1 hours in January and was down by 0.5 hour over the year.

- Manufacturing improved in January for the first time since April 2023. The S&P Global US Manufacturing Purchasing Managers’ Index™ was 50.7 in January, up from 47.9 in December. The latest advance in the purchasing managers’ index ended two months of declines and marked the strongest improvement in operating conditions since September 2022.

- The number of job openings, at 9.0 million, ticked up 101,000 in December from November, according to the latest Job Openings and Labor Turnover Summary. Nevertheless, this measure is down from a series high of 12.0 million in March 2022. Job openings increased in professional and business services (+239,000) but decreased in wholesale trade (-83,000). In December, the number of hires, at 5.6 million, increased marginally from the November total. The number of hires decreased in health care and social assistance (-119,000) but increased in state and local government, excluding education (+35,000). In December, the number of total separations, which includes quits, layoffs, discharges, and other separations, changed little at 5.4 million. Over the month, the number of total separations decreased in health care and social assistance (-91,000) but increased in wholesale trade (+39,000).

- The national average retail price for regular gasoline was $3.095 per gallon on January 29, $0.033 per gallon higher than the prior week’s price but $0.394 less than a year ago. Also, as of January 29, the East Coast price increased $0.062 to $3.083 per gallon; the Midwest price declined $0.017 to $2.872 per gallon; the Gulf Coast price increased $0.068 to $2.753 per gallon; the Rocky Mountain price rose $0.061 to $2.732 per gallon; and the West Coast price increased $0.011 to $3.937 per gallon.

- For the week ended January 27, there were 224,000 new claims for unemployment insurance, an increase of 9,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended January 20 was 1.3%, an increase of 0.1 percentage point from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended January 20 was 1,898,000, an increase of 70,000 from the previous week’s level, which was revised down by 5,000. States and territories with the highest insured unemployment rates for the week ended January 13 were New Jersey (2.6%), Rhode Island (2.6%), Minnesota (2.4%), Massachusetts (2.3%), Alaska (2.2%), California (2.2%), Illinois (2.2%), Montana (2.1%), Puerto Rico (2.1%), Pennsylvania (2.0%), and Washington (2.0%). The largest increases in initial claims for unemployment insurance for the week ended January 20 were in Wisconsin (+1,048) and Washington (+428), while the largest decreases were in Texas (-5,636), California (-4,632), New York (-4,208), Georgia (-3,477), and Oregon (-2,388).

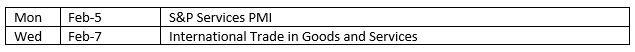

Eye on the Week Ahead

This week is light on economic data. Most of the attention will remain on the escalating conflict in the Middle East and the presidential primaries. The January survey of purchasing managers in the services sector is out this week. December saw the Purchasing Managers’ Index expand modestly.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.