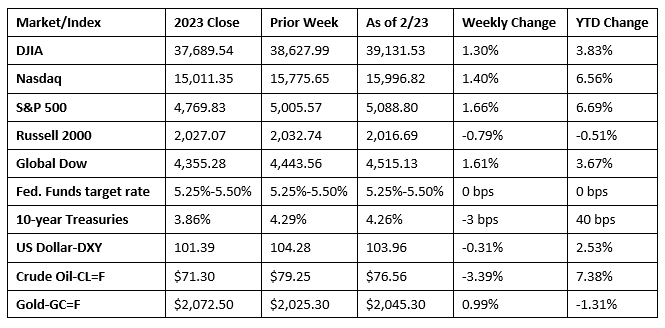

Stocks advanced last week, driven higher by tech shares that were bolstered by favorable corporate earnings reports. The Dow, the Nasdaq, and the S&P 500 posted weekly gains for the 16th time out of the last 18 trading weeks. Among the benchmark indexes listed here, only the small caps of the Russell 2000 closed the week in the red. Each of the 11 market sectors ended the week higher, led by consumer staples, materials, and health care. Bond prices ticked higher, pulling yields lower, with 10-year Treasuries slipping 3.0 basis points. The dollar slipped lower, while gold prices advanced. Crude oil prices fell over $3.00 per barrel.

Wall Street opened last Tuesday lower, dragged down by underperforming megacap technology stocks. The Russell 2000 fell 1.4%, followed by the Nasdaq (-0.9%), the S&P 500 (-0.6%), and the Dow (-0.2%), while the Global Dow was flat. Yields on 10-year Treasuries ticked lower to 4.27%. Crude oil prices edged down $0.92 to $78.27 per barrel. The dollar dipped to its lowest level in about two weeks. Gold prices advanced 0.6%.

Stocks got off to a slow start last Wednesday but were able to pare some of their early losses by the end of trading. The Dow, the Global Dow, and the S&P 500 ticked up 0.1%, while the Russell 2000 (-0.5%) and the Nasdaq (-0.3%) declined. Ten-year Treasury yields gained 5.0 basis points to reach 4.32%. Crude oil prices added $1.02 to close at about $78.06 per barrel. The dollar and gold prices declined.

Last Thursday saw an upbeat earnings report from a chip-making giant help drive stocks higher. The better-than-expected earnings results spurred investor optimism enough to drive both the S&P 500 (2.1%) and the Dow (1.2%) to new record highs, while the Nasdaq gained nearly 3.0%. The Global Dow advanced 1.1% and the Russell 2000 added 1.0% to round out the benchmark indexes listed here. The yield on 10-year Treasuries moved little, ending the session where it started at 4.32%. Crude oil prices gained nearly $0.50 to close at $78.38 per barrel. Gold prices and the dollar ended marginally lower.

Stocks were mixed last Friday, with the Global Dow (0.3%) gaining the most, while the Dow and the Russell 2000 inched up 0.2%. The S&P 500 ended the day flat. The tech-heavy Nasdaq couldn’t maintain the previous day’s momentum, sliding 0.3% by the close of trading. Ten-year Treasury yields fell 6.7 basis points to 4.26%. Crude oil prices dropped $2.00 per barrel. The dollar was flat, while gold prices rose 0.8%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Existing-home sales grew by 3.1% in January, with sales accelerating in the Midwest, South, and West, while remaining steady in the Northeast. Despite the recent increase, sales were 1.7% under the January 2023 pace. Total housing inventory in January represented a 3.0-month supply, down slightly from the 3.1-month supply in December. The median existing-home price was $379,100 in January, down from $381,400 in December, but up from the January 2023 price of $360,800. Sales of single-family existing homes rose 3.4% last month but were 1.4% under the total from a year earlier. The median existing single-family home price was $383,500 in January, down from December’s $385,800, but well above the January 2023 price of $365,400.

- The national average retail price for regular gasoline was $3.269 per gallon on February 19, $0.077 per gallon higher than the prior week’s price but $0.110 per gallon less than a year ago. Also, as of February 19, the East Coast price increased $0.079 to $3.230 per gallon; the Midwest price rose $0.078 to $3.122 per gallon; the Gulf Coast price decreased $0.094 to $2.901 per gallon; the Rocky Mountain price advanced $0.131 to $2.922 per gallon; and the West Coast price increased $0.046 to $4.057 per gallon.

- For the week ended February 17, there were 201,000 new claims for unemployment insurance, a decrease of 12,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended February 10 was 1.2%, a decrease of 0.1 percentage point from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended February 10 was 1,862,000, a decrease of 27,000 from the previous week’s level, which was revised down by 6,000. States and territories with the highest insured unemployment rates for the week ended February 3 were New Jersey (2.9%), Rhode Island (2.7%), California (2.5%), Minnesota (2.5%), Massachusetts (2.4%), Illinois (2.2%), Alaska (2.1%), Montana (2.1%), Connecticut (2.0%), New York (2.0%), Pennsylvania (2.0%), and Washington (2.0%). The largest increases in initial claims for unemployment insurance for the week ended February 10 were in Kentucky (+3,264), California (+2,053), Nevada (+364), Maryland (+290), and Washington (+91), while the largest decreases were in Missouri (-3,519), Pennsylvania (-1,477), Texas (-1,431), Illinois (-1,213), and Oregon (-941).

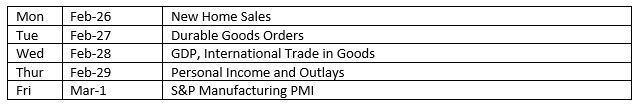

Eye on the Week Ahead

This week is loaded with important, market-moving economic information. The second estimate of the fourth-quarter gross domestic product is available. The initial release had the economy accelerating at an annualized rate of 3.3%. The January report on personal income and outlays is also out at the end of this week. Most investors will be focused on the personal consumption expenditures price index, a measure of inflation favored by the Federal Reserve. Prices advanced 0.2% in December. However, January has seen other inflation indicators accelerate at a rate higher than expected, so it is likely the same will hold true for the PCE price index.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.