Wall Street endured another down week as tech shares, which had been the bellwether of the bull market, were hit hard by major selloffs as investors worried about rising tensions in the Middle East and stubborn inflationary pressures. The Dow managed to essentially break even by week’s end, and that was the good news. The remaining benchmark indexes listed here declined, with the Nasdaq losing more than 5.5%. Last week saw several Federal Reserve officials taking a more hawkish stance due to hotter-than-anticipated inflation data. Ten-year Treasury yields gained 12.0 basis points as bond values slid lower. Crude oil prices declined, while gold prices extended their streak of gains.

Last Monday saw Wall Street extend losses from the previous week as rising tensions in the Middle East weighed on the markets. The Nasdaq fell 1.8%, followed by the Russell 2000 (-1.4%), the S&P 500 (-1.2%), the Dow (-0.7%), and the Global Dow (-0.5%). Money flowed into long-term bonds sending prices lower and yields higher. Ten-year Treasury yields closed at 4.52% after adding 12.9 basis points. Crude oil prices were flat. The dollar inched up 0.2%, while gold prices rose 1.1%.

Stocks continued to trend lower last Tuesday as bond yields climbed higher following hawkish comments from Fed Chair Jerome Powell. Among the benchmark indexes listed here, only the Dow ticked higher, gaining 0.2%. The Global Dow fell 1.1%, the Russell 2000 dropped 0.4%, the S&P 500 dipped 0.2%, while the Nasdaq edged 0.1% lower. Ten-year Treasury yields settled at 4.65% after gaining 3.1 basis points. Crude oil prices were relatively unchanged, closing at about $85.34 per barrel. The dollar gained 0.2% and gold prices rose 0.8%.

Tech stocks led a stock slide last Wednesday, with the Nasdaq falling 1.2%. The Russell 2000 lost 0.9%, the S&P 500 declined 0.6%, the Dow dipped 0.1%, while the Global Dow was flat. Ten-year Treasury yields lost 7.4 basis points, settling at 4.58%. Crude oil prices declined for the second straight day, falling to $82.74 per barrel. The dollar and gold prices ended in the red.

Last Thursday saw the Nasdaq (-0.5%) and the S&P 500 (-0.2%) extend their losing streaks to five straight sessions. The Russell 2000 fell 0.3%, while the Dow (0.1%) and the Global Dow (0.4%) edged higher. Bonds lost value, driving yields higher with 10-year Treasury yields climbing 6.2 basis points to 4.64%. Crude oil prices changed little, settling at about $82.67 per barrel. The dollar and gold prices eked out gains.

The S&P 500 and the Nasdaq ended lower for the sixth consecutive session last Friday. Tech shares were hard hit following a major selloff of the world’s largest tech companies. The Nasdaq lost 2.1%, the S&P 500 fell 0.9%, and the Global Dow dipped 0.2%. The Dow (0.6%) and the Russell 2000 (0.2%) advanced. Ten-year Treasury yields fell 3.2 basis points. Crude oil prices gained 0.64%. The dollar was flat, while gold prices inched up 0.2%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Retail sales rose 0.7% in March from February and 4.0% from March 2023. Retail trade sales were up 0.8% from February 2024 and up 3.6% above last year. Nonstore retailers were up 2.7% in March and 11.3% from last year, while food services and drinking places rose 0.4% last month and 6.5% from March 2023.

- The number of issued residential building permits declined 4.3% in March from the previous month’s estimate, but were 1.5% above the March 2023 rate. Issued building permits for single-family homes decreased 5.7% in March. The number of housing starts fell 14.7% last month and 4.3% below the March 2023 estimate. Single-family housing starts were 12.4% under the February total. Housing completions also declined in March, down 13.5% for the month and 3.9% from a year earlier. Single-family housing completions were 10.5% under the February rate.

- Sales of existing homes fell 4.3% in March and 3.7% from a year earlier. Total housing inventory sat at a 3.2-month supply, up from 2.9 months in February. The median existing-home price in March was $393,500, up from $383,800 in February and well above the March 2023 price of $375,300. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.88% as of April 11. That’s up from 6.82% the previous week and 6.27% one year ago. Sales of existing single-family homes also declined in March, falling 4.9% from February and 11.4% from a year ago. The median existing single-family home price in March was $397,200, up from $388,000 in February and higher than the March 2023 estimate of $379,500.

- Industrial production rose 0.4% in March but declined at an annual rate of 1.8% in the first quarter. Manufacturing output increased 0.5% in March, boosted in part by a gain of 3.1% in motor vehicles and parts; factory output excluding motor vehicles and parts moved up 0.3%. Mining fell 1.4%, while utilities gained 2.0%. Total industrial production in March was unchanged compared with its year-earlier level.

- The national average retail price for regular gasoline was $3.628 per gallon on April 15, $0.037 per gallon more than the prior week’s price but $0.035 per gallon less than a year ago. Also, as of April 15, the East Coast price increased $0.060 to $3.451 per gallon; the Midwest price rose $0.005 to $3.465 per gallon; the Gulf Coast price decreased $0.038 to $3.177 per gallon; the Rocky Mountain price rose $0.048 to $3.428 per gallon; and the West Coast price increased $0.105 to $4.853 per gallon.

- For the week ended April 13, there were 212,000 new claims for unemployment insurance, unchanged from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended April 6 was 1.2%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended April 6 was 1,812,000, an increase of 2,000 from the previous week’s level, which was revised down by 7,000. States and territories with the highest insured unemployment rates for the week ended March 30 were New Jersey (2.6%), California (2.4%), Minnesota (2.4%), Rhode Island (2.3%), Massachusetts (2.1%), Illinois (1.9%), New York (1.9%), Pennsylvania (1.8%), Washington (1.8%), and Alaska (1.7%). The largest increases in initial claims for unemployment insurance for the week ended April 6 were in New Jersey (+4,339), New York (+2,499), Pennsylvania (+1,783), Texas (+1,523), and Florida (+977), while the largest decreases were in Iowa (-1,418), California (-631), Ohio (-530), Nevada (-362), and Maryland (-352).

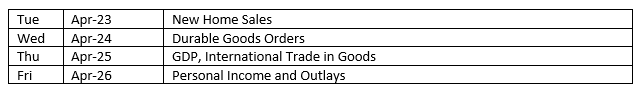

Eye on the Week Ahead

There’s plenty of market-moving economic data available this week. Two important pieces of information that will garner much attention include the advance report on first-quarter gross domestic product. GDP grew at a rate of 3.4% in the fourth quarter but is expected to slow to 2.3% in the first quarter of 2024. Also out this week is the March report on personal income and outlays. Consumer spending rose 0.8% in February, while consumer prices increased 0.3%.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.