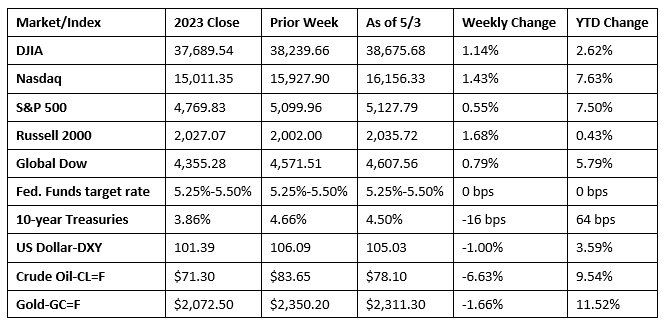

The markets enjoyed a solid week of gains on the heels of favorable corporate earnings data and a softer-than-expected employment report (see below). Investors could be viewing the dip in job hires and wage growth as the fuel the Federal Reserve needs to consider interest rate cuts. The Fed has consistently maintained that a softening labor market would help drive inflation lower. The Russell 2000 and the Nasdaq led the benchmark indexes listed here. Ten-year Treasury yields, gold prices, and the dollar declined. Crude oil prices slid more than 6.5% amid rising inventories and a push for a Gaza ceasefire.

Stocks edged higher to start the week as investors awaited a batch of key earnings and the results of the latest Federal Reserve meeting. The Russell 2000 added 0.7%, followed by the Global Dow (0.5%), the Nasdaq and the Dow (0.4%), and the S&P 500 (0.3%). Yields on 10-year Treasuries declined 5.5 basis points to 4.61%. Crude oil prices dipped $1.14 to $82.71 per barrel. The dollar fell 0.3%, while gold prices ticked up 0.1%.

U.S. stocks joined their global counterparts in turning sharply lower last Tuesday as investors awaited the release of important economic data and the latest policy statement from the Federal Reserve. Each of the benchmark indexes listed here declined, led by the Russell 2000 and the Nasdaq, which lost 2.1% and 2.0%, respectively. The S&P 500 fell 1.6%, the Dow decreased 1.5%, and the Global Dow dipped 0.9%. Ten-year Treasury yields rose 7.2 basis points to 4.68%. Crude oil prices fell a little over $1.00 to $81.58 per barrel. The dollar gained 0.7%, while gold prices lost 2.4%.

Only the Russell 2000 (0.3%) and the Dow (0.2%) closed higher last Wednesday after the Federal Reserve maintained interest rates as expected. The Nasdaq, the S&P 500, and the Global Dow each fell 0.3%. Ten-year Treasury yields closed at 4.59% after falling 9.1 basis points. Crude oil prices slid below $80.00 per barrel, settling at $79.20 per barrel. The dollar lost 0.5%, while gold prices advanced 1.1%.

Stocks closed higher last Thursday, snapping a two-day losing streak. While investors probably conceded that interest rates will not be coming down any time soon, they took solace in the Fed’s suggestion that rates won’t be increasing either. Each of the benchmark indexes listed here ended the session higher, led by the Russell 2000 (1.8%) and the Nasdaq (1.5%). The S&P 500 and the Dow advanced 0.9%, while the Global Dow gained 0.8%. Ten-year Treasury yields fell for the second straight day, dropping 2.4 basis points to 4.57%. Crude oil prices settled at $78.99 per barrel, little changed from the prior day. The dollar dipped 0.4%, while gold prices inched up 0.1%.

Wall Street continued to show resilience last Friday, as each of the benchmark indexes listed here posted solid gains. The Nasdaq rose 2.0%, followed by the S&P 500 (1.3%), the Dow (1.2%), the Russell 2000 (1.0%), and the Global Dow (0.8%). Bond prices rose, pulling yields lower, with 10-year Treasuries falling 7.1 basis points. Crude oil prices fell $0.82 per barrel. The dollar dipped 0.3%, while gold prices were flat.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The Federal Open Market Committee left interest rates unchanged following the conclusion of its meeting last Wednesday. The statement from the Committee noted the lack of further progress over the last several months toward driving inflation down to the Fed’s 2.0% target. The Committee also noted that, while achieving its dual goals of maximum employment and price stability are in better balance, the economic outlook continues to be uncertain, and the Committee remains attentive to inflation risks.

- There were 175,000 new jobs added in April, lower than the monthly average of 242,000 over the past 12 months. In April, job gains occurred in health care, social assistance, and in transportation and warehousing. The change in employment for February was revised down by 34,000, from 270,000 to 236,000, and the change for March was revised up by 12,000, from 303,000 to 315,000. With these revisions, employment in February and March combined was 22,000 lower than previously reported. In April, the unemployment rate rose 0.1 percentage point to 3.9%. The number of unemployed was little changed at 6.5 million. The labor force participation rate was unchanged at 62.7%, while the employment-population ratio, at 60.2%, dipped 0.1 percentage point. In April, average hourly earnings increased by $0.07, or 0.2%, to $34.75. Over the past 12 months, average hourly earnings have increased by 3.9%. In April, the average workweek edged down by 0.1 hour to 34.3 hours.

- According to the latest Job Openings and Labor Turnover Summary, the number of job openings declined by less than 400,000 in March to 8.5 million. However, this figure is down by 1.1 million from a year ago. The number of hires, at 5.8 million, was little changed from the February total. There were 5.2 million total separations in March, 339,000 under the February total. Business activity in the services sector continued to increase in April but at a slower rate amid the first reduction in new orders since last October. Employment was also reduced as firms showed a reluctance to replace departed staff.

- According to the latest survey of purchasing managers conducted by S&P Global®, manufacturing suffered its first setback of the year in April. The S&P Global US Manufacturing Purchasing Managers’ Index™ fell to 50.0 in April, down from 51.9 in March. New orders decreased for the first time in four months as survey respondents noted clients reluctance to commit to new business amid subdued market conditions.

- According to S&P Global US Services PMI®, business in the services sector expanded in April, but at a slower pace, as new orders declined for the first time since October. Hires also slowed as firms were hesitant to replace departed staff.

- The goods and services trade deficit changed marginally in March from the previous month. According to the latest data from the Bureau of Economic Analysis, the goods and services deficit was $69.4 billion in March, down $0.1 billion, or 0.1%, from the previous month. Exports declined $5.3 billion, or 2.0%, while imports fell $5.4 billion, or 1.6%. Year to date, the goods and services deficit increased $6.5 billion, or 3.2%, from the same period in 2023. Exports increased $9.1 billion, or 1.2%. Imports increased $15.6 billion, or 1.6%.

- The national average retail price for regular gasoline was $3.653 per gallon on April 29, $0.015 per gallon below the prior week’s price but $0.053 per gallon more than a year ago. Also, as of April 29, the East Coast price was unchanged at $3.540 per gallon; the Midwest price dipped $0.010 to $3.453 per gallon; the Gulf Coast price decreased $0.040 to $3.192 per gallon; the Rocky Mountain price declined $0.030 to $3.426 per gallon; and the West Coast price decreased $0.036 to $4.796 per gallon.

- For the week ended April 27, there were 208,000 new claims for unemployment insurance, unchanged from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended April 20 was 1.2%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended April 20 was 1,774,000, unchanged from the previous week’s level, which was revised down by 7,000. States and territories with the highest insured unemployment rates for the week ended April 13 were New Jersey (2.5%), California (2.3%), Illinois (1.9%), Rhode Island (1.9%), Massachusetts (1.8%), Minnesota (1.8%), New York (1.7%), Washington (1.7%), Alaska (1.6%), and Nevada (1.6%). The largest increases in initial claims for unemployment insurance for the week ended April 20 were in Massachusetts (+3,575), Rhode Island (+1,737), Texas (+450), Colorado (+443), and California (+216), while the largest decreases were in New York (-4,253), Pennsylvania (-2,763), Oregon (-1,712), Georgia (-1,104), and Wisconsin (-994).

Eye on the Week Ahead

It is a very slow week for economic data, with only the Treasury budget statement for April available. Investors will be looking ahead to next week when the latest inflation data is released.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.