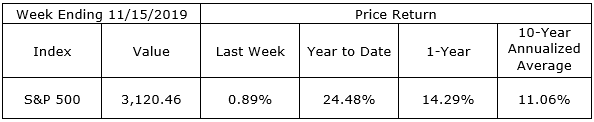

The S&P 500 Index moved higher for the sixth straight week closing at a new milestone high of 3,120.46. The NASDAQ Index and Dow Jones Industrial averages also moved to new all-time highs.

The mood has been positive as signals of a phase one, U.S.-China trade agreement is likely before December 15th when barring an agreement, the next round of tariffs is scheduled to take effect. Adding to the relaxed atmosphere is the postponement of recession worries and the belief corporate earnings will not deteriorate.

Market milestones grab the headlines but remember, the most important targets are those of which your personal financial plan is built. Investors should never use market milestones as a basis for adjusting their personal goals, plans, and processes.

On the One Hand

- The Consumer Price Index (CPI) was up 0.4% month-over-month in October. October prices put the year-over-year change in consumer prices at 1.8%, up slightly from September’s 1.7% but under the Fed target rate of 2.0%.

- The Producer Price Index (PPI) for October came in at 0.4% month-over-month. The annual rate was 1.1% versus 1.4% in September.

- For the 245th straight week, initial unemployment claims came in below 300,000. The most recent week’s initial unemployment claims were reported at 225,000, up 14,000. The four-week moving average for initial claims rose by 1,750 to 217,000. Continuing claims declined by 10,000 to 1.683 million.

- October retail sales rebounded from the 0.3% decline in September by increasing 0.3% month-over-month. Consumer spending, which accounts for more than two-thirds of the economy, increased at a 2.9% annualized rate in the third quarter.

- Import prices for October were down 0.5%. Export prices were down 0.1% in the same period.

- Total business inventories were unchanged month-over-month in September after a downwardly revised 0.1% decline in August. Total business sales for the same periods were down 0.2% following a downwardly revised 0.1% increase in the previous month. Prices should remain in check with year-over-year inventory growth of 3.7% and sales growth of just 0.5%.

On the Other Hand

- Industrial production declined by 0.8% in October following an upwardly revised decline of 0.3% in September.

- The capacity utilization rate declined to 76.7% in October from 77.5% in September.

All Else Being Equal

Consumer and producer prices came in below the Fed’s 2.0% target rate on an annual basis but there was some buzz about the 0.4% one-month rate for October. It is true that using this single monthly rate to project an annual rate results in a 4.91% increase in prices. It is not, however, true that projecting a single month’s economic data far into the future is useful. These and other inflation indicators must be monitored regularly but do not overweigh any single monthly report.

Last Week’s Market

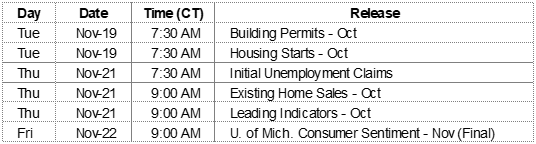

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.