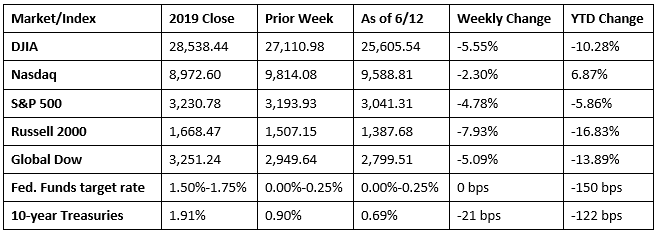

Last week began with a bang for stocks as each of the indexes gained well over 1.0% for the day. The S&P 500, after climbing 1.2%, has picked up nearly 45.0% since its 2020 low, pushing it into the black for the year. The Nasdaq rose to a record high while the Dow and Russell 2000 surged by close to 2.0% each. Oil prices fell marginally, and the dollar sank, as did the yield on 10-year Treasuries. Investors were encouraged by the prospects of more reopenings, the Federal Reserve’s expansion of its Main Street Lending Program, and the growing sentiment that the economy is reversing course toward expansion. Market sectors leading the way included energy, real estate, airlines, financials, travel and leisure, and retail.

Investors pulled some profits out of stocks last Tuesday, sending each of the benchmark indexes (except the Nasdaq) lower. The Dow fell 1.1%, and the S&P 500 dipped 0.8%. The tech-heavy Nasdaq edged up 0.3% and reached 10,000 for the first time in its history, only to fall back slightly by the end of trading. Oil prices rose, the yield on 10-year Treasuries dropped, and the dollar declined for the ninth straight day.

Equities fell again last Wednesday despite the Fed’s announcement that it would maintain the current target rate range at 0.00%-0.25% and continue to make asset purchases at the current pace. The Dow dropped 1.0%, the S&P 500 lost 0.5%, but the Nasdaq continued to climb, gaining 0.7%. For the first time in several sessions, FAANGs (Facebook, Apple, Amazon, Netflix, and Alphabet Google) posted gains, along with health care and tech stocks.

Stocks plunged dramatically last Thursday as investors sold stocks on news of rising COVID-19 cases coupled with the Federal Reserve’s assessment that the economy will be slow to recover. Each of the indexes listed here fell by at least 5.27%, with the Russell 2000 dropping 7.58% and the Dow plummeting 6.90%. Yields on 10-year Treasuries sank, as did crude oil prices.

Equities rallied from Thursday’s rout, but not enough to prevent an overall week of losses. Stocks posted solid returns last Friday with each of the benchmark indexes listed here posting solid daily gains, led by the Russell 2000, which climbed more than 2.25% on the day. Crude oil prices inched up, as did the yields on 10-year Treasuries.

However, the week was marked by fears of a second virus wave, which sent equities into a tailspin. While stocks rallied Friday, the major indexes lost ground for the week. The small caps of the Russell 2000 were hit the hardest, followed by the Dow, Global Dow, the S&P 500, and the Nasdaq. Year to date, only the Nasdaq remained solidly in the black, while the Russell 2000, the Global Dow, and the Dow continue to lag by more than 10.0%, respectively. Investors exercised caution in light of rising COVID-19 infection rates and an uncertain economic outlook.

For the first time in several weeks, crude oil prices fell, closing the week at $36.41 per barrel by late Friday afternoon, down from the prior week’s price of $39.16. The price of gold (COMEX) soared last week, closing at $1,738.40 by late Friday afternoon, up from the prior week’s price of $1,688.30. For the sixth week in a row, gas prices rose. The national average retail regular gasoline price was $2.036 per gallon on June 8, 2020, $0.062 higher than the prior week’s price but $0.696 less than a year ago.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Following its meeting last week, the Federal Open Market Committee left no doubt that it would use its full range of tools to support the U.S. economy. According to the Committee, the ongoing public health crisis caused by the COVID-19 pandemic will weigh heavily on economic activity, employment, and inflation in the near term, while posing considerable risks to the economic outlook over the medium term. In light of these developments, the Committee decided to maintain the target range for the federal funds rate at 0.00%-0.25%. The Committee expects to maintain this rate until it is confident the economy has weathered the recent events, which according to its projections, will run through the year 2022. The Committee also indicated that it would be increasing holdings of Treasuries (currently at $80 billion per month) and residential and commercial mortgage-backed securities (presently at $40 billion per month).

- The federal deficit was $399 billion in May and sits at $1,880 billion through the first eight months of the fiscal year. Through the same period last fiscal year, the budget deficit was $739 billion. According to the Federal Reserve, the Department of Labor spent $94 billion in May, driven by expanded unemployment benefit payments. Prior to this past April, the high was $17 billion in March 2010. Also, May has been a deficit month 65 times out of 66 fiscal years, since there are no major corporate or individual tax due dates in this month.

- The Consumer Price Index fell 0.1% in May after declining 0.8% in April. Over the last 12 months, the CPI has increased 0.1%. Price reductions in energy, motor vehicle insurance, airline fares, used cars and trucks, and apparel more than offset price increases in food, recreation, medical care, household furnishings, operations, new vehicles, and shelter. The index less food and energy fell 0.1% in May, its third consecutive monthly decline. This is the first time this index has ever declined in three consecutive months.

- Prices at the producer level increased in May. According to the latest report from the Bureau of Labor Statistics, the Producer Price Index rose 0.4% last month and is up 0.8% for the 12 months ended in May. This is the first monthly increase in producer prices in the last 3 months. The increase in producer prices in May is attributable to a 1.6% hike in goods prices, which saw food prices spike 6.0% and energy prices climb 4.5%. On the other hand, prices for services fell 0.2% in May, the same decline as in April.

- Prices for U.S. imports increased 1.0% in May after declining 2.6% in April and 2.4% in March. The May advance was led by higher fuel prices, which increased by 20.5%. The May jump in fuel prices was the largest monthly advance in the history of the index. The price index for U.S. exports rose 0.5% in May following a 3.3% drop the previous month.

- According to the latest Job Openings and Labor Turnover report, April saw total separations fall by 4.8 million from March. Despite the decline, April’s level of total separations is the second highest in series history. Job openings decreased to 5.0 million, and hires declined to 3.5 million, a series low. The changes in these measures reflect the effects of the COVID-19 pandemic and efforts to contain it.

- For the week ended June 6, there were 1,542,000 claims for unemployment insurance, a decrease of 355,000 from the previous week’s level, which was revised up by 20,000. According to the Department of Labor, the advance rate for insured unemployment claims decreased 0.2 percentage point to 14.4% for the week ended May 30. The advance number of those receiving unemployment insurance benefits during the week ended May 30 was 20,929,000, a decrease of 339,000 from the prior week’s level, which was revised down by 219,000.

Eye on the Week Ahead

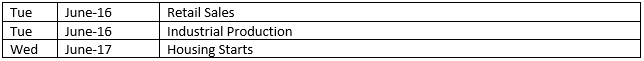

This week is relatively slow with respect to market-moving economic reports. However, one entry that bears watching is the Federal Reserve’s report on industrial production for May. April saw overall production regress by 11.2%, and manufacturing fall by 13.7%. With partial easing of COVID-related restrictions, May’s production numbers should be better.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.