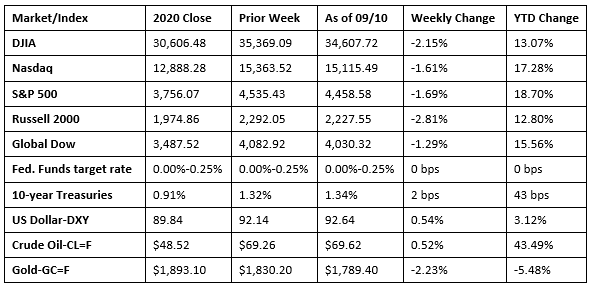

Stocks retreated last week, with each of the benchmark indexes listed here falling at least 1.3%. The Russell 2000 and the Dow dropped the furthest, declining 2.8% and 2.2%, respectively. Investors contended with mixed signals. A better-than-expected jobless claims report, while encouraging, could prompt the Federal Reserve to start reducing its asset purchases sooner. Also, the spread of the Delta variant may impede economic recovery. Each of the market sectors fell for the week, with real estate dropping nearly 4.0%. Crude oil prices and the dollar inched ahead last week, while gold prices, which had been climbing, fell 2.2%. Ten-year Treasury yields climbed marginally higher.

Stocks opened the Labor Day week mostly down. Last Tuesday saw only the Nasdaq eke out a 0.1% gain, while the remaining benchmark indexes listed here lost value. The Dow and the Russell 2000 fell by nearly 8.0%, with the S&P 500 and the Global Dow dropping nearly 0.4%. The yield on 10-year Treasuries rose, crude oil prices dipped, and the dollar advanced. Several of the market sectors lost ground, with only communication services, consumer discretionary, and information technology advancing.

Wall Street ended lower last Wednesday, reflecting fears that the Delta variant could stymie the economy’s recovery and uncertainty over when the Federal Reserve might begin to pull back its accommodative bond purchasing. Each of the benchmark indexes listed here lost ground, with the Russell 2000 dipping 1.2%, followed by the Global Dow and the Nasdaq, which fell 0.6%. Crude oil prices and the dollar rose, while 10-year Treasury yields declined. Consumer staples, real estate, utilities, and industrials were the only market sectors to advance. Energy and materials decreased more than 1.0%.

Stocks trended lower last Thursday, despite jobless claims hitting an 18-month low. The S&P 500 fell for the fourth consecutive session after dipping 0.5%. The Dow and the Global Dow dropped 0.4%, the Nasdaq declined 0.3%, and the Russell 2000 slipped less than 0.1%. Ten-year Treasury yields fell 2.6%, crude oil prices declined 2.0%, and the dollar was mixed. Energy, financials, and materials were the only market sectors to advance, while real estate (-2.1%) and health care (-1.2%) fell the furthest.

Last week ended with stocks closing lower. The Russell 2000 dropped 1.0%, followed by the Nasdaq (-0.9%), the Dow and the S&P 500 (-0.8%), and the Global Dow (-0.3%). Treasury yields, crude oil prices, and the dollar increased. Each of the market sectors lost ground, with real estate, utilities, and information technology falling at least 1.0%.

The national average retail price for regular gasoline was $3.176 per gallon on September 6, $0.037 per gallon more than the prior week’s price and $0.965 higher than a year ago. Gasoline production increased during the week ended September 3, averaging 10.1 million barrels per day. U.S. crude oil refinery inputs averaged 14.3 million barrels per day during the week ended September 3 — 1.6 million barrels per day less than the previous week’s average. Refineries operated at 81.9% of their operable capacity, down from the prior week’s level of 91.3%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The job market is wide open, based on the latest data from the Job Openings and Labor Turnover summary. The number of job openings increased to an all-time high of 10.9 million (+749,000) on the last business day of July. The rate of job openings increased to 6.9%. Job openings increased in several industries, with the largest increases in health care and social assistance (+294,000), finance and insurance (+116,000), and accommodation and food services (+115,000). There were 4.0 million workers who voluntarily quit, while the numbers of layoffs and discharges were 1.5 million and 1.0 million, respectively. Over the 12 months ended in July, hires totaled 72.6 million and separations (includes quits, layoffs, and discharges) totaled 65.6 million, yielding a net employment gain of 7.0 million.

- Producer prices have risen 8.3% over the last 12 months after climbing 0.7% in August. Following a 0.3% increase last month, producer prices less foods, energy, and trade services are up 6.3% since August 2020, the largest 12-month advance since data was first calculated in 2014. Producer prices for services advanced 0.7% in August, while goods prices rose 1.0%. Half of the August increase in goods prices is attributable to a 2.9% jump in prices for foods.

- For the week ended September 4, there were 310,000 new claims for unemployment insurance, a decrease of 35,000 from the previous week’s level, which was revised up by 5,000. This is the lowest level for initial claims since March 14, 2020, when it was 256,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended August 28 was 2.0%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended August 28 was 2,783,000, a decrease of 22,000 from the prior week’s level, which was revised up by 57,000. This is the lowest level for insured unemployment since March 14, 2020, when it was 1,770,000. For comparison, during the same period last year, there were 881,000 initial claims for unemployment insurance, and the insured unemployment claims rate was 9.3%. During the last week of February 2020 (pre-pandemic), there were 219,000 initial claims for unemployment insurance, and the number of those receiving unemployment insurance benefits was 1,724,000. States and territories with the highest insured unemployment rates for the week ended August 21 were Puerto Rico (4.8%), the District of Columbia (4.0%), New Jersey (3.6%), California (3.4%), Illinois (3.3%), New York (3.0%), Rhode Island (3.0%), Connecticut (2.9%), Hawaii (2.6%), and the Virgin Islands (2.6%). States and territories with the largest increases in initial claims for the week ended August 28 were Missouri (+7,182), Ohio (+5,563), New York (+3,776), Tennessee (+1,854), and Florida (+1,723), while states/territories with the largest decreases were California (-7,009), Illinois (-6,712), Virginia (-4,146), New Jersey (-2,496), and Oregon (-1,686).

Eye on the Week Ahead

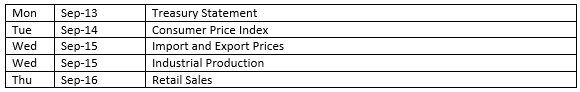

Inflation indicators are front and center this week, with the latest release of the Consumer Price Index, the retail sales report, and import and export data. The CPI has risen 5.4% since July 2020, while retail sales have risen 15.8% over the same period. Import prices have risen 10.2% for the 12 months ended in July, while export prices are up 17.2%.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.