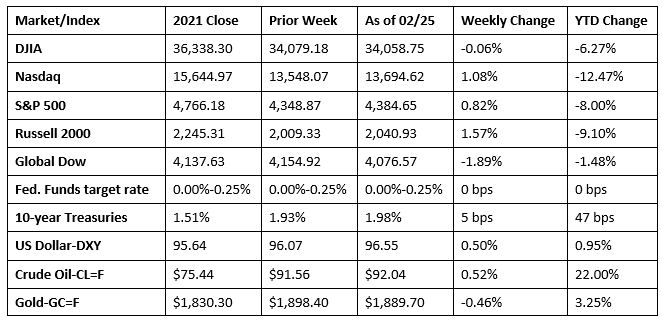

Stocks closed mostly higher last week, despite a tumultuous week with the Russian invasion of Ukraine. Of the benchmark indexes listed here, only the Dow and the Global Dow closed the week in the red. The Russell 2000, the Nasdaq, and the S&P 500 each posted solid gains. While the world reacted to the conflict in Eastern Europe, traders sought domestic stocks, driving values higher. Apparently, some investors may be viewing the Russia-Ukraine conflict as a reason to believe the Federal Reserve may not be quite so quick to jack up interest rates. However, with prices continuing to rise even before the turmoil in Europe, inflationary pressures are likely to accelerate due to disruptions caused by the war, which would seem to increase the likelihood of a more aggressive stance by the Fed. Much is still to be determined in the weeks ahead.

Growing tensions between Russia and Ukraine pulled stocks lower last Tuesday to start the holiday-shortened week. Both the Russell 2000 and the Dow closed down 1.4%, while the Nasdaq lost 1.2%. The S&P 500 and the Global Dow each fell 1.0%. Ten-year Treasury yields rose, while the dollar was flat. Crude oil prices increased to $92.27 per barrel. Earlier on Tuesday, NATO Secretary-General Jens Stoltenberg said that Russia’s recognition of two separatist regions in Ukraine could be viewed as a prelude to a large-scale assault. In response, several Western leaders unveiled a series of sanctions targeting Russian banks and financial firms.

As Russia moved closer to a full-scale invasion of Ukraine last Wednesday, tensions mounted globally. Sanctions were either threatened or imposed by the United States and other Western countries, prompting retaliatory rhetoric from Russia. Then, late Wednesday, as anticipated, Russia launched a military attack on Ukraine. Unsurprisingly, stocks extended losses. The Nasdaq shed 2.6% as technology stocks sold off amid fears of Russian cyberattacks. The S&P 500 fell 1.8%, falling deeper into correction territory. The Russell 2000 lost 1.8%, the Dow dropped 1.4%, and the Global Dow slid 0.9%. Yields on 10-year Treasuries rose nearly 3 basis points to 1.97%. The dollar was little changed. Crude oil prices surged, nearing $100.00 per barrel. Gold prices reached $1,910.80 per troy ounce, the highest value in more than a year.

Equities rebounded last Thursday following President Biden’s announcement of new sanctions against Russia after its full-scale invasion of Ukraine. Tech stocks, which had been hard-hit, led the surge, pulling the Nasdaq up 3.3%. The S&P 500 advanced 1.5%, while the Dow gained 0.3%. The small caps of the Russell 2000 advanced 2.7%. The Global Dow fell 2.3%. Along with technology, communication services and consumer discretionary moved higher. Ten-year Treasury yields declined, closing the day at 1.96%. Crude oil prices and the dollar rose. Not unexpectedly, the Cboe Volatility Index reached its highest level in 15 months.

Despite global economic turmoil caused by the ongoing Russian onslaught of Ukraine, domestic markets seemed to be impervious to that tumult. Each of the benchmark indexes posted solid gains last Friday, led by the Dow (2.5%), the Russell 2000 (2.3%), the S&P 500 (2.2%), and the Nasdaq (1.6%). Even the Global Dow advanced nearly 3.0% by the close of trading. And while Brent crude oil prices surged, New York Mercantile (CL=F) crude oil prices dropped nearly 1.0% to close the day a little over $92.00 per barrel. The dollar and gold prices also fell, while 10-year Treasury yields advanced.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The economy accelerated at an annualized rate of 7.0% in the fourth quarter of 2021, according to the second estimate of gross domestic product. Major contributors to the fourth-quarter growth were private domestic investment (+33.5%), exports (+23.6%), and personal consumption expenditures (+3.1%). The personal consumption expenditures price index, a measure of the prices paid for consumer goods and services, increased 6.3%.

- Personal income and disposable (after-tax) personal income increased minimally in January, according to the latest data from the Bureau of Economic Analysis. While compensation increased 0.5%, it was partially offset by a decrease in government social benefits. On the other hand, consumer spending, as measured by personal consumption expenditures, rose 2.1% in January. Inflationary pressures continued to mount as consumer prices for goods and services advanced 0.6%. Over the past 12 months, prices have risen 6.1%; energy prices increased 25.9% while food prices rose 6.7%.

- January saw new orders for durable goods increase 1.6%, which followed a 1.2% increase in December 2021. Orders for transportation equipment led the increase, advancing 3.4% in January. Shipments of durable goods rose 1.2%, while unfilled orders climbed 0.9%. Nondefense capital goods used in the production of consumer goods increased 4.2%, while defense capital goods advanced 15.7%.

- Sales of new single-family homes fell 4.5% in January following a robust December 2021. While sales may have dipped, new home prices did not. The median sales price of new houses sold in January was $423,300, a 7.0% increase over December’s median sales price. The average sales price in January rose 3.1% to $496,900. The estimate of new houses for sale at the end of January represented a supply of 6.1 months, up from December’s estimate of 5.6 months.

- The national average retail price for regular gasoline was $3.530 per gallon on February 21, $0.043 per gallon more than the prior week’s price and $0.897 higher than a year ago. The Gulf Coast and East Coast prices each increased more than $0.05 to $3.24 per gallon and $3.50 per gallon, respectively; the Midwest price increased more than $0.03 to $3.35 per gallon; the West Coast price increased more than $0.04 to $4.23 per gallon; and the Rocky Mountain price increased nearly $0.02 to $3.34 per gallon. As of February 21, residential heating oil prices averaged more than $3.94 per gallon, more than $0.01 per gallon below the prior week’s price but almost $1.14 per gallon higher than last year’s price at this time. Residential propane prices averaged nearly $2.85 per gallon, more than $0.01 per gallon above last week’s price and more than $0.35 per gallon above last year’s price.

- For the week ended February 19, there were 232,000 new claims for unemployment insurance, a decrease of 17,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended February 12 was 1.1%, unchanged from the previous week’s revised rate. The advance number of those receiving unemployment insurance benefits during the week ended February 12 was 1,476,000, a decrease of 112,000 from the previous week’s level, which was revised down by 5,000. This is the lowest level for insured unemployment since March 14, 1970, when it was 1,456,000. States and territories with the highest insured unemployment rates for the week ended February 5 were California (2.7%), Alaska (2.6%), Illinois (2.5%), Minnesota (2.5%), New Jersey (2.5%), Rhode Island (2.4%), the Virgin Islands (2.4%), Massachusetts (2.3%), New York (2.3%), and Montana (2.0%). The largest increases in initial claims for the week ended February 12 were in Missouri (+7,253), Ohio (+5,392), Kentucky (+4,555), Tennessee (+1,737), and Illinois (+1,488), while the largest decreases were in Pennsylvania (-1,688), California (-1,618), Wisconsin (-1,034), New Jersey (-941), and Connecticut (-747).

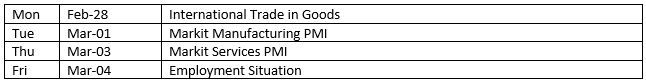

Eye on the Week Ahead

Employment data for February is out this week. Job growth has been solid so far this year, with 467,000 new jobs added in January. Wages rose 0.7% in January and have risen 5.7% since January 2021.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.