The Tax Cuts and Jobs Act was signed into law in December 2017. The Act made extensive changes that affected both individuals and businesses. Most provisions were effective for 2018. Many individual tax provisions are scheduled to sunset and revert to pre-existing law after 2025 unless Congress acts. Some key provisions of the Act scheduled to sunset are discussed below. Comparisons below are generally for 2025 and 2026 as currently scheduled if Congress does not act.

Individual income tax rates

2025. There are seven regular income tax brackets: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

2026. There would be seven regular income tax brackets: 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%.

Personal exemptions, standard deduction, and itemized deductions

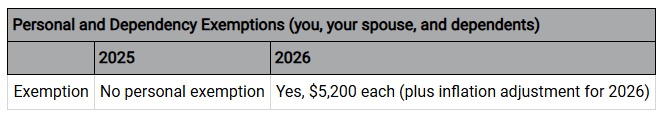

2025. Personal (and dependency) exemptions are not available.

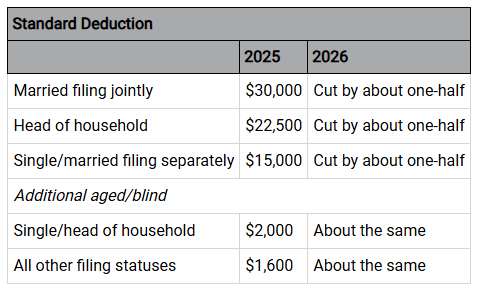

You can generally choose to take the standard deduction or to itemize deductions. Additional standard deduction amounts are available if you are blind or age 65 or older. Standard deduction amounts are fairly high.

Many itemized deductions are eliminated or restricted, but the overall limitation on itemized deductions based on the amount of your adjusted gross income does not apply.

- The deduction for state and local taxes is limited to $10,000 ($5,000 if married filing separately).

- The deduction for mortgage interest is available, but the maximum benefit is reduced for some individuals, and interest on home equity loans is deductible only if used for certain purposes.

- The deduction for personal casualty losses is eliminated unless the loss is incurred in a federally declared disaster.

2026. In general, personal (and dependency) exemptions would be available for you, your spouse, and your dependents. Personal exemptions would be phased out for those with higher adjusted gross incomes.

You would generally be able to choose to take the standard deduction or to itemize deductions. Additional standard deduction amounts would be available if you are blind or age 65 or older. Standard deduction amounts would be much lower.

Itemized deductions would include deductions for: medical expenses, state and local taxes, home mortgage interest, investment interest, charitable gifts, casualty and theft losses, job expenses and certain miscellaneous deductions, and other miscellaneous deductions.

Many itemized deductions that were eliminated or restricted would be restored, but the overall limitation on itemized deductions based on the amount of your adjusted gross income would return.

- The deduction for state and local taxes would no longer be limited to $10,000 ($5,000 if married filing separately).

- The deduction for mortgage interest would still be available, but the maximum benefit would be increased for some individuals, and home equity loans could once again be used for any purpose.

- The deduction for personal casualty losses would be available without regard to whether the loss is incurred in a federally declared disaster.

Personal exemptions, standard deduction, itemized deductions

In 2026, personal exemptions would generally be available in addition to either the standard deduction or itemized deductions.

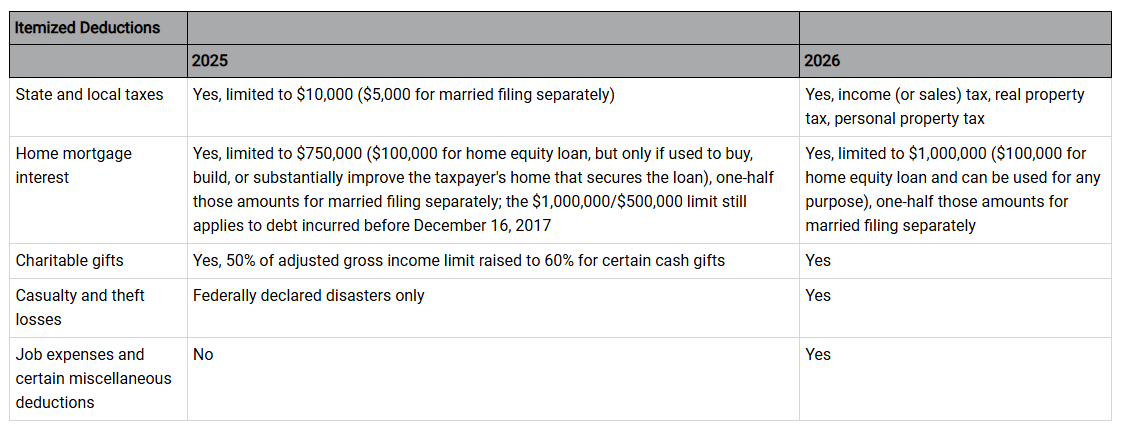

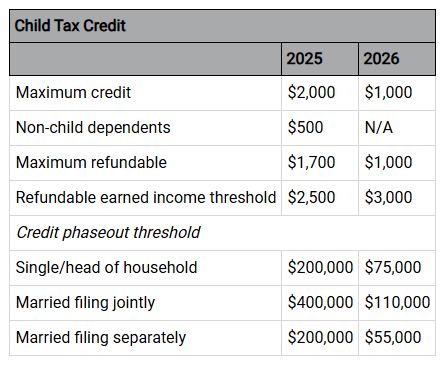

Child tax credit

2025. The maximum child tax credit is $2,000. A nonrefundable credit of $500 is available for qualifying dependents other than qualifying children. The maximum refundable amount of the credit is $1,700. The amount at which the credit begins to phase out is fairly high, and the earned income threshold is $2,500.

2026. The maximum child tax credit would be $1,000. The child tax credit would be phased out if modified adjusted gross income exceeds certain much lower amounts. If the credit exceeds the tax liability, the child tax credit would be refundable up to 15% of the amount of earned income in excess of $3,000 (the earned income threshold).

Alternative minimum tax (AMT)

2025. The alternative minimum tax exemptions and exemption phaseout thresholds are fairly high.

2026. The alternative minimum tax exemptions and exemption phaseout thresholds would be much lower. Many more taxpayers would be subject to the AMT.

Special provisions for business income of individuals

2025. An individual taxpayer can deduct 20% of domestic qualified business income (excludes compensation) from a partnership, S corporation, or sole proprietorship. The benefit of the deduction is phased out for specified service businesses with taxable income exceeding $197,300 ($394,000 for married filing jointly). The deduction is limited to the greater of (1) 50% of the W-2 wages of the taxpayer, or (2) the sum of (a) 25% of the W-2 wages of the taxpayer, plus (b) 2.5% of the unadjusted basis immediately after acquisition of all qualified property (certain depreciable property). This limit does not apply if taxable income does not exceed $197,300 ($394,000 for married filing jointly), and the limit is phased in for taxable income above those thresholds.

2026. There would be no deduction for qualified business income.

Estate, gift, and generation-skipping transfer tax

2025. The gift and estate tax basic exclusion amount and the generation-skipping transfer tax exemption are $13,990,000.

2026. These amounts would be reduced by about one-half.