Of the 420 S&P 500 companies which have reported Q2 earnings to date, 60% have reported revenues above analyst expectations and 73% have reported earnings above expectations. Earnings for the S&P 500 are on track to increase by 12.0% from the second quarter of 2016.

The first estimate of Q2 GDP was a better than expected 2.6%, confirming of Brian Wesbury’s description of the U.S. “plow horse” economy. The Atlanta Fed is again estimating a full trot in Q3 with its most recent guess for GDP growth of 3.7% in the current quarter.

Worries about low volatility are puzzling. It would be a concern if one was working on or around one of the many Wall Street trading desks. Investors have nothing to fear from low volatility. Enjoy it while you can. The hedge funds and high frequency traders will have another day. Do not let them spook you.

On The One Hand

- Personal spending was up 0.1%, in line with expectations. The PCE Price Index was unchanged in June while the core PCE Price Index increased 0.1%.

- Initial unemployment claims for the week declined 3,000 to 240,000. Continuing claims also declined 3,000 to 1.968 million.

- Factory orders rose 3.0% in June following an upwardly revised 0.3% decline, from the initially reported 0.8% decline, for May.

- July nonfarm payrolls increased by 209,000. The July unemployment rate declined to 4.3% from 4.4% in June. Average hourly earnings increased 0.3% for the month and 2.5% year-over-year. The average workweek held steady in July at 34.5 hours. The labor force participation rate increased to 62.9% in July from 62.8% in June.

On The Other Hand

- The MNI Chicago Business Barometer (aka Chicago PMI) dropped to 58.9 in July (Briefing.com consensus 60.0) from 65.7 in June, which was the highest reading since May 2014.

- Personal income was unchanged in June, below the expectation of +0.3%.

- Total construction spending declined 1.3% in June. May was revised up to 0.3% from 0.0%. Year-over-year, spending was up 1.6%, the second-slowest growth rate since 2011.

- The ISM Manufacturing Index slipped to 56.3 in July from 57.8 in June. While lower, the index has continued to signal expansion (a reading above 50.0%) since September 2016.

- U.S. light vehicle sales were at a seasonally adjusted annual rate of 16.73 million units in July, 6.1% below the rate of 17.81 million units for July 2016. Total domestic sales slipped to 13.22 million units from 13.23 in June.

- While remaining in expansion territory (above 50.0%), the ISM Non-Manufacturing PMI decelerated from 57.4 in June to 53.9 in July, the second lowest reading over the last 12 months.

All Else Being Equal

The second quarter real GDP growth rate of 2.6% was slightly higher than 2.1% average annual rate since the economic recovery began in mid-2009.

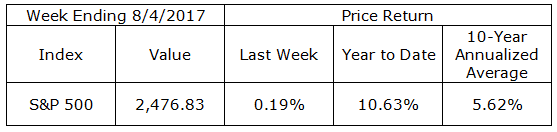

Last Week’s Market

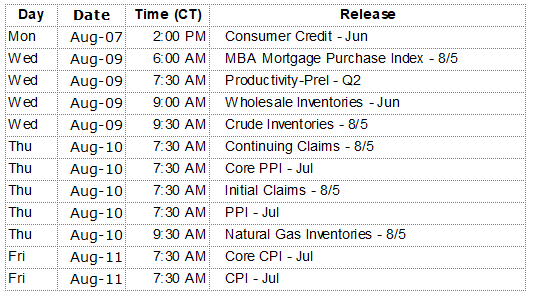

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.