BTN Research recently pointed out the worst day for the S&P 500 last year generated a loss of 3.6% which was a greater loss than the worst year for the bond market at any time over the last 40 years (1977 -2016). That statistic points out the usefulness of an allocation to fixed income categories in reducing portfolio volatility.

It is worth noting, however, interest rates have been in steady decline over the past 40 years. Given today’s relatively low interest rate level, the next forty years may not produce a similar result. Rising rates and the resulting bond price declines will likely generate somewhat greater fixed income portfolio volatility. Fixed income does not imply a fixed strategy. Portfolios should be monitored and allocations adjusted as the economic environment and markets change.

What We Are Watching So You Don’t Have To

On The One Hand

- The December Consumer Price Index (CPI) was reported at 0.3% for the month, putting the government’s figure for annual CPI inflation at 2.1%.

- Initial jobless claims declined 15,000 to 234,000. Continuing claims declined 47,000 to 2.05 million. Historically, initial claims numbers below 300,000 are a positive sign for the labor market and economy.

- December housing starts increased 11.3% to a seasonally adjusted annual rate of 1.23 million.

Building permits declined 0.2% to a seasonally adjusted annual rate of 1.21 million. Multi-unit rather than single-family starts drove the increase.

- The Philadelphia Fed Index rose to 23.6 for January, putting the index at a two year high. The report indicates manufacturing in the Philadelphia Fed region expanded at an encouraging pace to start the year.

On The Other Hand

- Industrial production increased 0.8% in December while November was revised downward to -0.7% from the previously reported -0.4%. Barring major revisions to the data, 2016 industrial production was up a meager one-half of one percent.

- Total capacity utilization increased to 75.5% from 74.9% in November, leaving the rate below its 80% average rate (1972 to 2015).

All Else Being Equal

Industrial production remains soft. Weak overseas economies continue to be a drag but a few bright spots in recent months have been encouraging. In the U.S., more jobs, faster wage growth, and increasing consumer optimism are encouraging home buyers and builders.

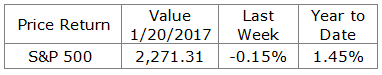

Last Week’s Market

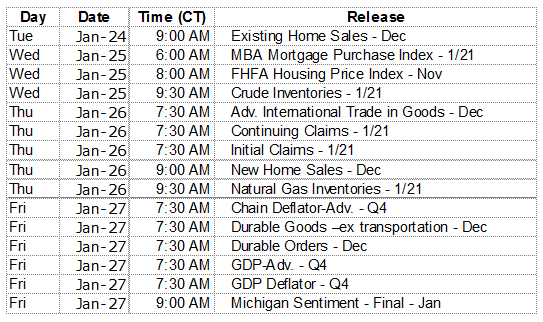

The Week Ahead