Rule Number 1

A frequently repeated piece of advice from Warren Buffett is, “Rule Number 1: Never lose money. Rule Number 2: Never forget Rule Number 1.” As simple and useless as this piece of advice sounds, it points out an important money management and personal management starting point for every investor. It directs attention to the risk side of the risk/reward relationship. An honest Personal Investment Risk Tolerance Assessment must be the starting point for every investor. If you are interested in testing for your investment risk tolerance, please contact one of our trust officers: https://tckansas.com/staff-directory/.

By “never lose money”, Buffett is not referring to the experience of normal or temporary fluctuation but sometimes very large declines in market prices which can occur when invested in stocks. The loss he is speaking of is the permanent loss of investment capital. There is a big difference between seeing a decline in the value of my portfolio and permanently losing money. The paper losses experienced in a correction or even a bear market will not become permanent losses of capital unless a person sells out at those lower levels.

There are two reasons one might turn a market decline into a permanent loss. One would be if I had misjudged the amount of my net worth which is truly long-term money. If I invest short-term and intermediate-term money in stocks I can easily find myself in a position in which I am forced to turn a paper loss into a permanent loss. For example, if I buy stocks with funds I have set aside for my teenager’s college expenses I could find myself facing bills for tuition, room and board at a time when the market is in a period of decline and be forced to sell out at a time when stock prices are low. I would be forced to turn my paper loss into a permanent loss. The second case in which I could turn a market decline into a permanent loss is if I misjudge my ability, emotionally, to withstand a decline in the value of my portfolio. If I sell out in a panic during a market decline, I will again turn paper losses into permanent losses. Buffett also hinted at a way to judge your emotional approach to stock investing, “Unless you can watch your stock holdings decline by 50% without becoming panic-stricken, you should not be in the stock market”. To put this to work, make sure you invest only the portion of your net worth in the market with which you could emotionally shrug off such a decline. Always remember Rule Number 1.

What We Are Watching So You Don’t Have To

On The One Hand

- Retail sales rose 0.4% in January and December got a sizable upward revision to +1.0%. Year over year retail sales are up 5.6%

- Although Industrial production fell 0.3% in January, a look behind the headline is in order. Year over year, industrial production is unchanged and capacity utilization fell to 75.3% after a revised December rate of 75.6%. It is important to note the utilities sector was behind the decline. Manufacturing, which excludes mining and utilities, increased 0.3% in January and was up 0.4% year over year. Manufacturing capacity utilization increased to 75.1% in January from December’s 75.0% rate.

- Initial unemployment claims, for the 102nd consecutive week, were below 300,000. Initial claims for the week ending February 11 increased 5,000 to 239,000. Continuing claims for the week ending February 4 declined 3,000 to 2.076 million.

- The Philadelphia Fed Index for February increased from 23.6 to 43.3, indicating manufacturing is proceeding at a healthy pace in this Fed region.

- The Conference Board’s Leading Economic Index rose by 0.6% in January following an unrevised 0.5% increase in December. The Coincident Economic Index increased 0.1% in January. The Lagging Economic Index increased 0.3%.

On The Other Hand

- The Producer Price Index (PPI) rose 0.6% for the month of January, well above the expected 0.3%. While the annual PPI increase was just 1.7% through January, the most recent three months shows prices accelerating at the producer level. Core prices accelerated at an annual rate of 3.7% over the last three months.

- The Consumer Price Index (CPI) for January increased 0.6%, double the expected number. Year over year, prices increased 2.5% at the consumer level. Over the most recent three month period, the CPI is up at an annual rate of 4.1% with core CPI up at an annual rate of 2.9%. Included in the CPI report, real average hourly earnings declined 0.5% in January, are unchanged in the past year and are down 2.6% annualizing the last three months figures. Real weekly earnings are down 0.6% year over year.

- Housing starts declined 2.6% in January after a sizable upward revision for December. The headline was not the whole story. Rather than deterioration, the report may indicate starts are simply taking a breather. Year over year, total unit starts are up 10.5% with single-unit starts up 6.2% and multi-unit starts up 19.8%.

All Else Being Equal

The economy continues its trend of uneven growth. Recent price increases have erased the words, deflation and disinflation from economic commentary. The Fed will take off the gloves in coming months if the economy continues to strengthen and prices continue to increase.

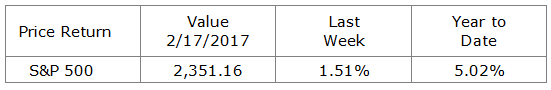

Last Week’s Market

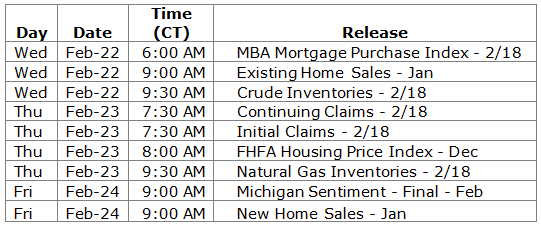

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.