One of the financial writers I follow began his Wednesday afternoon post with the headline, “The Fed didn’t tighten today”. Scott Grannis, retired economist and financial professional, summarized current interest rates and the Fed’s long awaited rate decision better than I can:

The Fed increased its target short-term interest rate today to 0.75%, but that doesn’t represent a tightening of monetary policy. It would be more correct to say that today monetary policy became slightly less accommodative. Neither the market nor the economy has anything to fear from today’s Fed action. Financial markets today enjoy plentiful liquidity conditions, and confidence in general is rising. Interest rates have adjusted upwards slightly to reflect this. Remember: higher interest rates don’t threaten growth; interest rates are higher because growth expectations are somewhat stronger.

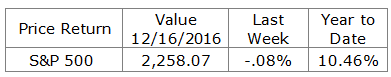

U.S. stocks, as with stocks around the globe, were flat last week. Yields rose again leaving the 10-Year Treasury note yielding 2.60% up from 2.46% the previous Friday.

What We Are Watching So You Don’t Have To

On The One Hand

- In November, import prices decreased 0.3% and were down 0.1% excluding fuel. Export prices decreased 0.1% in November and were also down 0.1% excluding agriculture.

- Business inventories declined 0.2% in October. Sales increased 0.8% in October and September was upwardly revised to an increase of 0.8% (from +0.7%).

- The Consumer Price Index (CPI) and core-CPI increased 0.2% in November. The CPI is up 1.7% from a year ago.

- Initial unemployment claims for the week ending December 10 decreased by 4,000 to 254,000. Continuing claims for increased by 11,000 to 2.018 million.

- Manufacturers in the Philadelphia Federal Reserve region are much more optimistic about growth prospects over the next six months than they were in November. The Philly Fed Index was reported at 21.5, up sharply from the 7.6 reading in November.

On The Other Hand

- Retail sales increased by a less than expected 0.1% in November and October sales were revised downward to an increase of 0.6%. Excluding autos, retail sales were up 0.2%, aided by modest sales increases in most retail categories. Retail sales were up despite aggregate earnings being unchanged in November, which implies the growth in sales was driven in part by spending from savings and/or on credit.

- The Producer Price Index (PPI) and core-PPI were up 0.4% in November. Producer prices are up 1.3% versus a year ago. Stripping out the volatile food and energy categories, “core” producer prices are up 1.6% in the past year. Prices for goods are accelerating, up at a 2.4% annual rate in the past six months and a 4.9% rate in the past three months. While not yet inflationary, producer prices have been accelerating.

- Industrial production declined 0.4% in November. Taking that and a 0.1% October revision into account, November registered a year over year decline of 0.6%. This is the 15th straight year over year decline in this index and an indication that industrial production remains soft.

- Housing Starts declined 18.7% in November to a seasonally adjusted annual rate of 1.090 million units. Building permits declined 4.7% to a seasonally adjusted annual rate of 1.201 million (permits for single-family homes increased 0.5% to 778,000).

All Else Being Equal

This is a weekly note so short-term market action and recurring weekly and monthly economic releases are presented. We cannot stress enough, however, the relative insignificance of the movement in these weekly and monthly data points compared to your personal goals and planning. A week’s worth of economic data and market action can help to clarify the current environment, but it will not and should not change your life’s goals. Focus on your personal success. That is our mission.

Merry Christmas!

Last Week’s Market

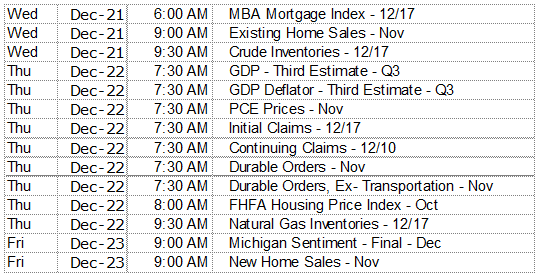

The Week Ahead