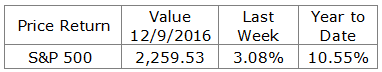

The S&P 500 price return as of December 9 was up 5.6% since the election and 10.55% for the year to date. The yield on the 10-Year Treasury also rose again last week finishing at 2.46%. The week ahead will be busy and includes the Fed’s FOMC meeting on Tuesday and Wednesday. We remain focused on the impact current data and decisions will have on long-term risk and returns.

What We Are Watching So You Don’t Have To

On The One Hand

- The ISM Non-Manufacturing Index was reported at 57.2 for November, up from 54.8 in October.

- The Q3 productivity revision was unchanged at 3.1%, unit labor costs were revised upward to 0.7% from 0.3%.

- New orders for manufactured goods increased 2.7% in October on top of an upward revision of September orders to an increase of 0.6%.

- Consumer credit increased by $16.0 billion in October after an upwardly revised $21.8 billion in September.

- Initial unemployment claims for the week ending December 3 decreased by 10,000 to 258,000. Continuing claims for the week ending November 26 declined 79,000 to 2.005 million.

- The University of Michigan Consumer Sentiment Index for December was reported at 98.0, up from the final November reading of 93.8.

On The Other Hand

The trade deficit widened to $42.6 billion in October from an upwardly revised $36.2 billion deficit in September. October exports were $3.4 billion less than September exports and October imports were $3.0 billion higher than September imports.

All Else Being Equal

The upward revision to unit labor costs, the result of an increase in hourly compensation, can provide a boost to consumer spending but it also cuts into corporate profits. We view this as a plus at this point in the economic cycle. Consumers are optimistic. Economic expansion continues.

Last Week’s Market

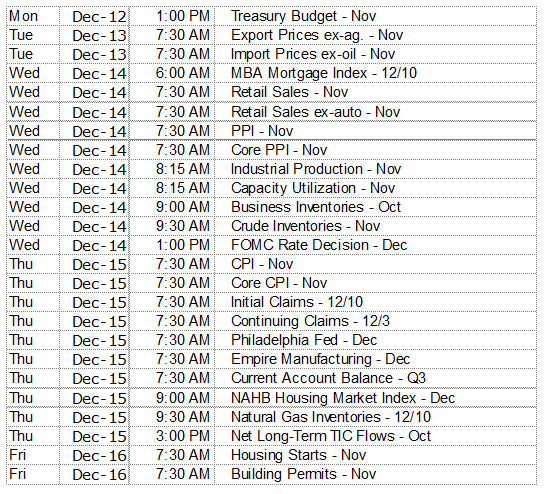

The Week Ahead