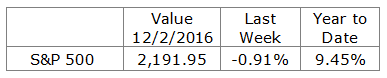

Stocks ended modestly lower last week, ending their three week winning streak. The 10-Year Treasury extended its streak of higher yields to four weeks, closing at a yield of 2.39%. Higher rates are beginning to affect the prices of interest rate sensitive stocks.

Traders bid the price of oil back over $52 after news of the latest announcement from OPEC. Member producers have again agreed to cut production. The rally could be short lived due to the ability of U.S. shale production costs declining to below $40 per barrel with some fields near or below $30 per barrel.

What We Are Watching So You Don’t Have To

On The One Hand

- Third quarter GDP growth was revised (first revision) up to an annual rate of 3.2% from 2.9%. The GDP Deflator was revised down to 1.4% from 1.5%.

- The Conference Board’s Consumer Confidence Index rose sharply to 107.1 in November from an upwardly revised 100.8 (from 98.6) in October.

- Personal income increased 0.6% in October. Personal spending was up 0.3% and September was revised up to 0.7% from 0.5%. The PCE Price Index, the Fed’s favorite inflation measure, increased 0.2% for the month and up 1.4% year-over-year, versus 1.2% in September.

- Construction spending increased 0.5% in October.

- The ISM Manufacturing Index rose for the third straight month to 53.2 in November from 51.9 in October.

- Nonfarm payrolls increased by 178,000 and have averaged 180,000 per month so far this year.

On The Other Hand

- Initial claims for the week ending November 26 increased 17,000 to 268,000. Continuing claims for the week ending November 19 increased 38,000 to 2.081 million.

- Average hourly earnings for November were down 0.1% from the 0.4% increase in October. The average workweek was unchanged at 34.4 hours. The manufacturing workweek declined 0.2 hours to 40.6 hours. Factory overtime was unchanged at 3.3 hours. The labor force participation rate was 62.7% versus 62.8% in October.

All Else Being Equal

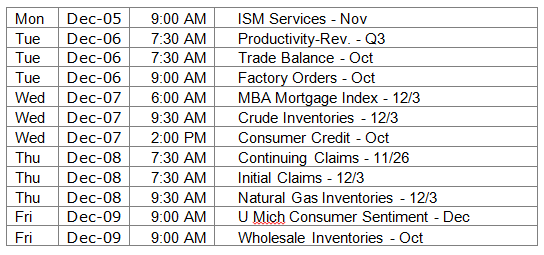

The economy continues its slow-growth trend and nothing in the data is signaling much change in the coming weeks. This will be a light week for economic data. The key reports will be the ISM non-manufacturing index and the October trade deficit.

Last Week’s Market

The Week Ahead