When the Federal Estate Tax exemption amount rose above the old $600,000 per person level (the 2017 exemption amount will be $5.49 million per person), many individuals erroneously decided revocable trusts were no longer necessary in their estate plans. There are many reasons not related to estate taxes for considering a revocable living trust in your plan. For a useful review of some of these issues please review the article, Are You A Living Trust Candidate?. If you have questions after reviewing these common, non-estate tax considerations contact your TCK officer to discuss your personal situation and the goals you want to achieve with your estate plan.

What We Are Watching So You Don’t Have To

On The One Hand

- The Conference Board’s Consumer Confidence Index surprised by increasing to 113.7 from an upwardly revised 109.4 in November. The reading was significantly higher than the consensus expectation of 109.8. The index currently sits at its highest reading since August 2001.

- Initial unemployment claims for the week ending December 24 declined 10,000 to 265,000. Continuing claims for the week ending December 17 increased 62,000 to 2.102 million. Initial claims have now remained below 300,000 for 95 consecutive weeks, a span not seen since 1970.

On The Other Hand

The Chicago PMI slipped to 54.6 in December from 57.6 in November.

All Else Being Equal

The last week of 2016 was light on economic news and market volume. There were no great surprises. The economy remains in a growth mode with no signs of a slowdown.

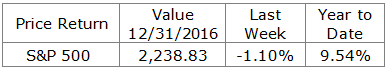

Last Week’s Market

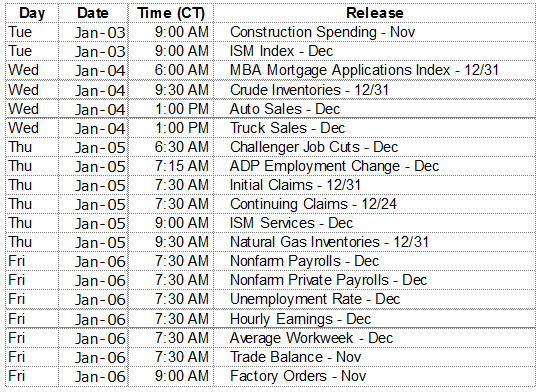

The Week Ahead