Diversification has been viewed as a necessary process for reducing risk. A recent study provides proof which shows diversification is also responsible for increasing returns. Morningstar’s John Rekenthaler, vice president of research, explored a recently published study by Arizona State University’s Hendrik Bessembinder titled “Do Stocks Outperform Treasury Bills?” The finding: “Most common stocks do not outperform Treasury bills.”

How can this be? Rekenthaler explained:

“That finding directly contradicts what I have often written, which is that stocks rise more often than they fall. …my statement remains correct, as long as it’s understood that “stocks” is shorthand for “the stock market overall,” or at least “a large pool of securities.” The statement is false if applied to a single holding.”

The study went on to explain “half of U.S. stock market wealth creation has come from just 0.33% of listed companies”. This finding leaves no doubt broad diversification is critical for both reducing volatility and increasing return.

What We Are Watching So You Don’t Have To

On The One Hand

- The ISM Manufacturing Index maintained its recent strength with a 57.2 reading for March. Each of the 18 industries included in the report booked growth in new orders for the month.

- Construction spending increased 0.8% in February. Both private and public construction spending registered increases of 0.8% and 0.6%, respectively, in the month.

- Factory orders increased 1.0% in February on top of an upwardly revised 1.5% increase in January. Excluding transportation, orders increased 0.4%. On the other hand, business orders (nondefense capital goods orders, excluding aircraft) were down 0.1% in February.

- Initial unemployment claims decreased by 25,000 to 234,000 for the week. Continuing claims decreased by 24,000 to 2.028 million.

- Wages per hour are up 2.7% in the past year while total hours worked are up 1.4%. As a result, total wages are up 4.1% from a year ago.

On The Other Hand

- Year over year, U.S. light vehicle sales were down 0.3% in March. Domestic auto sales were 10.7% below the year-ago period. Domestic truck sales rate was 5.5% above the year-ago period.

- Some will celebrate the February Trade Balance report which showed the deficit narrowing to $43.6 billion. Exports were $0.4 billion more than the previous month while imports were $4.3 billion less. We consider the report a negative because the total volume of trade, exports plus imports, declined which is an indication U.S. consumer demand is softening.

- The ISM Non-Manufacturing Index for March declined to 55.2 from February’s reading of 57.6.

- Nonfarm payrolls increased 98,000 in March, about half the consensus expectation. Including revisions to the January/February reports, nonfarm payrolls were up 60,000. The soft March reading comes after two relatively strong months. For the three months combined, average payrolls grew 178,000 in the first quarter, slightly below the average monthly payrolls growth of 182,000 in 2016. The average workweek in March was 34.3 hours and tied the revised February figure.

All Else Being Equal

In last week’s notes, we mentioned the need for the hard data reports to confirm the positive results we have seen in recent consumer and business sentiment surveys. This confirmation was generally lacking in this week’s economic releases. A fraction of one month’s data is not sufficient to make a call one way or the other. Remember, also, data released this week will be revised in coming months. The slow growth trend is intact but the anticipated acceleration is not yet showing up in the data.

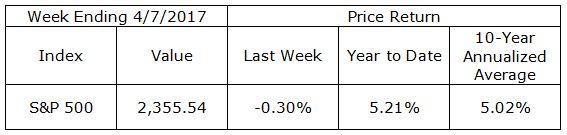

Last Week’s Market

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.