The Federal Reserve raised the target rate for Federal Funds from a range of 0.50-0.75% to 0.75-1.00% at its March 15 FOMC meeting. Market interest rates as measured by U.S. Treasuries were mixed. During the quarter, the yield on the 13-Week T-Bill rose from 0.48% to 0.74% but the yields on the 10-Year Treasury and 30-Year Treasury declined slightly from 2.45% to 2.40% and from 3.06% to 3.02%, respectively.

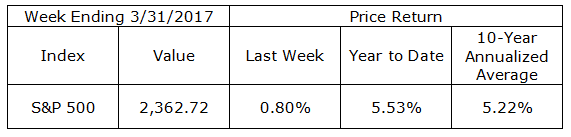

The Dow Jones Industrial Average rose to new highs finishing the quarter at 20,663.22, up 4.56%. The S&P 500 rose 5.53% to finish the quarter at 2,362.72. Foreign stocks also rose as demonstrated by the EAFE which increased 7.25% in the quarter. The three best performing sectors in the quarter were Information Technology +12.16%, Consumer Discretionary +8.09% and Health Care +7.89%, while the three worst performing sectors were Energy -7.30%, Telecommunication Services -5.06% and Financials +2.08%.

What We Are Watching So You Don’t Have To

On The One Hand

- The Consumer Confidence Index rose sharply to 125.6 from an upwardly revised February reading of 116.1.

- The third estimate for fourth quarter 2016 GDP was reported at 2.1%, up from the previous estimate of 1.9%. The GDP Deflator remained unchanged at 2.0%.

- Initial unemployment claims declined 3,000 to 258,000. Continuing claims increased 65,000 to 2.052 million.

- February Personal Income grew 0.4%, in line with expectations. Year-over-year personal income is up 4.6%.

- The Chicago Purchasing Managers Index increased to 57.7 in March from 57.4 in February.

On The Other Hand

- Personal Spending came up short increasing just 0.1% for the month of February.

- The Personal Consumption Expenditure (PCE) deflator was up 2.1% from year ago levels putting it one-tenth of a percent above the Fed’s target for its preferred inflation measure.

- The final University of Michigan Consumer Sentiment reading for March was revised slightly lower from the preliminary reading of 97.6.

All Else Being Equal

The Fed will be satisfied with its early March 1/4% increase in its target rate that was warranted given this week’s reported PCE deflator coming in over its 2% target rate. Expect additional increases in the Federal Funds rate at future FOMC meetings.

Consumer sentiment is positive but actions remain cautious as demonstrated by the moderate spending figures and the increased savings rate. These are positive indications that growth can be sustained.

Scott Grannis noted, “U.S. households’ financial burdens (payments for mortgage and consumer debt, auto leases, rents, homeowner’s insurance, and property tax, all as a percent of disposable income, are at historically low levels and have not budged for over five years. Moreover, the overall leverage (total liabilities as a percent of total assets) of the household sector is at 30-year lows.”

http://scottgrannis.blogspot.com/2017/03/household-finances-are-on-solid-ground.html

Last Week’s Market

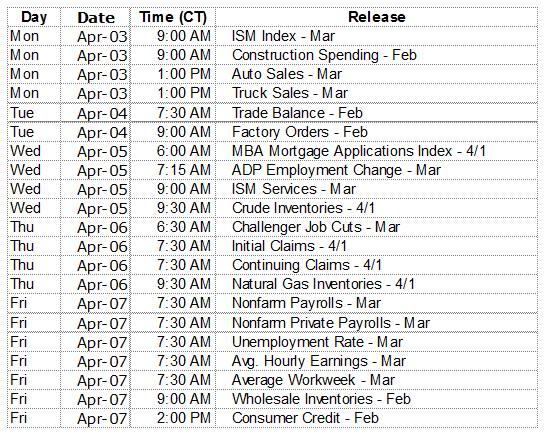

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.