Short-term Treasury yields moved higher last week as the 2-year rose 4 basis points to 2.58%. The 10-year rose early but was off late in the week to finish flat 2.83%. Although the 2 year/10-year spread narrowed to 25 basis points, a level not seen since August 2007, renewed concerns about inversion, a signal of recession, were absent. The reason for this might be that today’s real rates (adjusted for inflation) are roughly zero while past economic cycles did not slow until real rates reached 2%. With today’s nominal rates well under the 4.5% to 5.0% range, Fed policy is not likely to be the reason for an end to the expansion in the near term.

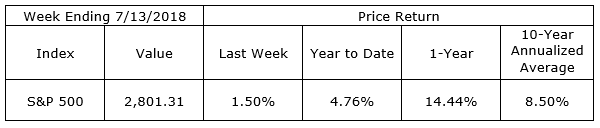

For the second week in a row, the S&P 500 Index finished the week higher by 1.50%, leaving the index just 2.49% below its all time high of 2,872.87 set on January 26 and up 4.87% year-to-date. While large cap stocks are finally challenging their highs, small cap stocks have been making new historic highs since mid-May. The Russell 2000 Index at 1,687.08 is up 4.74% from its January high of 1,610.71 and is up 9.87% year-to-date. This type of market action is typical in an aging recovery. While the expansion is aging, it is nowhere near overheating and corporate earnings which have started rolling out should continue to improve. With this backdrop, never forget that stocks, with little notice and for no apparent reason, will decline 5% or more at the rate of 3 times per year. Stay diversified.

Many became excited about Bitcoin in the final months of 2017 as it rocketed to a price over $19,000. Those who continued to watch, hopefully, you were just watching, got a crash course of sorts in cryptocurrency trading as you saw Bitcoin decline to under $6,000. At its current price of $6,600, we continue to advise watching from the sidelines if that. This is not the time to diversify into cryptocurrencies.

On The One Hand

Initial jobless claims declined 18,000 to 214,000. The four-week moving average for initial claims decreased by 1,750 to 223,000. Continuing claims declined 3,000 to 1.74 million.

On The Other Hand

- The Producer Price Index (PPI) increased 0.3% in June. The PPI is up 3.4% versus a year ago and at this pace, producer prices are well above the Fed’s 2% inflation target.

- The Consumer Price Index (CPI) rose 0.1% in June. While below consensus expectations for the month, the CPI is up 2.9% from a year ago.

- The University of Michigan’s preliminary Consumer Sentiment Survey Index for July declined to 97.1 from June’s 98.2.

All Else Being Equal

After years of worry about deflation, inflation in the U.S. is firmly back up to the Fed’s target range. The Fed has played catch-up as the economic expansion has slowly taken hold.

Last Week’s Market

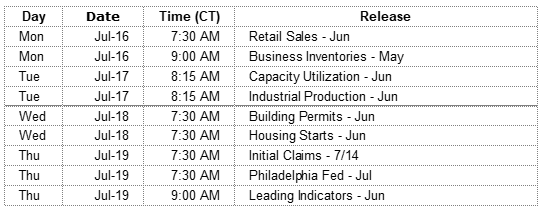

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.