The best way to prepare for retirement is to save, early and often. Generally, one should set aside 10% to 15% of one’s income each year. If the habit takes hold early in one’s career, a very meaningful nest egg should be the result.

Saving is easier when there is a tax deduction for it, which helps explain the popularity of the traditional IRA. However, the tax law includes a stipulation that those who have developed the savings habit will find disconcerting. Once one reaches age 70½, a program of required annual minimum IRA distributions must commence. Each year the owner must withdraw an amount geared to his or her life expectancy. The reason for the requirement is to make certain that the money saved for retirement gets used for retirement—or, at least, becomes subject to income taxes during retirement. Failure to withdraw at least that required minimum distribution annually causes the owner to be subject to a 50% penalty, but the total required minimum distribution is still fully taxable. Ouch!

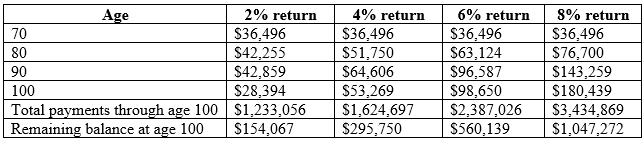

How large are the payouts?

Required minimum distributions from an IRA won’t exhaust the account before the owner lives beyond age 100, even if the account has poor investment return. Accounts that enjoy even modest returns will keep getting larger in the early years of minimum distributions. This table shows the projected size of a required minimum distribution from a $1 million IRA at various ages, for various rates of return. It also shows total distributions and the balance remaining at age 100, if only required minimum distributions are taken each year. If a 6% annual rate of return can be achieved, the account balance won’t dip below $1 million until age 92. Please note that rates of return are for illustration only and do not represent any particular investment.

Source: M.A. Co.

If you are a client of The Trust Company of Kansas, now is a good time to reach out to your account officer about taking your 2018 required minimum distribution. If you aren’t a client of ours yet, but are nearing age 70½, reach out to us today and we’ll be glad to help you.

At The Trust Company of Kansas, we help people. We promise to minimize the burden of wealth management, and bestow the freedom to enjoy everything else. The officers at The Trust Company of Kansas are always willing to discuss your financial goals with you and help you to create a plan that is well-aligned with your wishes. If you have a specific question about wealth management, please contact us at (800) 530-5254 or visit tckansas.com/contactus, and one of our Certified Trust and Financial Advisors will be happy to assist you.