Earnings season is in full swing and reports to date confirm full year earnings for the S&P 500 will be nearly $160 which places the PE for the index at 17.5. This week will be the heaviest in the earnings reporting season. Traders will be looking at management guidance which has so far been reassuring.

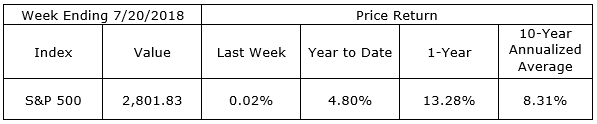

Favorable corporate reports have counterbalanced concerns about the possibility of escalating trade disputes, potential Fed policy mistakes, and mid-term election controversies. Stocks held steady last week with the S&P finishing up a scant 0.02% and the 10-year Treasury yield remained under 3.00%.

On The One Hand

- Retail sales rose 0.5% in June. If revisions to prior months were added to the June number, sales were up 1.0%. Retail sales are up 6.6% versus a year ago.

- Total business inventories increased 0.4% in May, following the 0.3% increase in April. Total business sales increased 1.4% after increasing an upwardly revised 0.6% (from 0.4%) in April.

- Industrial production rose 0.6% in June. Manufacturing rose 0.8%, mining output increased 1.2% and utilities fell 1.5%. Capacity utilization rose to 78.0% in June from 77.7% in May. Manufacturing capacity utilization increased to 75.5% in June from 75.0% in May.

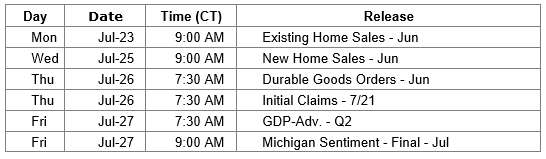

- Initial unemployment claims dropped by 8,000 to 207,000. The four-week moving average for initial claims decreased by 2,750 to 220,500. Continuing claims increased by only 8,000 to 1.751 million.

- The Philly Fed Index for July moved up to 25.7 from 19.9 in June. A reading above 0 is indicative of expansion.

- The Leading Economic Index rose by 0.5% in June. May’s reading was revised downward to unchanged from the originally reported +0.2%. Support for the expansionary signal came from increases in both the Coincident Economic Index, which increased 0.3%, and the Lagging Economic Index, which rose 0.3% in June.

On The Other Hand

Housing starts declined a whopping 12.3% in June to a 1.173 million annual rate, well below the consensus expected 1.320 million. Starts are down 4.2% versus a year ago. Building permits also declined in June, down 2.2% to a 1.273 million annual rate. Compared to a year ago, permits for single-family units are up 4.6% while permits for multifamily homes are down 15.2%.

All Else Being Equal

The GDPNow estimate for real Q2 GDP from the Atlanta Fed continues to be a strong 4.5% and the New York Fed’s Nowcast is holding at 2.7%. On Friday, the Department of Commerce will deliver the first official figures for the second quarter. We will be focusing on the Fed’s favorite inflation indicator, the PCE index, in that report.

Last Week’s Market

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.