Treasury prices declined modestly last week leaving the 10-Year Treasury yield just shy of 3.00%. Economic data announcements continued to support the Fed’s anticipated quarter percent increase in its fed funds rate next week. The 10-year yield is likely heading into a 3.00% to 3.10% range in coming weeks.

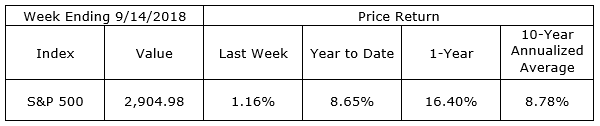

Equities got their feet back under them last week and pushed the S&P 500 to a weekly gain of more than 1%. Investors spoke optimistically about the progress of trade/tariff talks, although nothing concrete came from the talks. Belief is widespread that the tariffs are short-term negotiating tactics which will not lead to long-term hurdles for growth.

As always, do not let the markets and marketers run your financial plan. Invest to get the returns you need, while understanding the risks attached. Don’t be discouraged when your portfolio is not up as much as the stock indexes. The example in last week’s Weekly Update, which showed 8% average annual gains in a portfolio consisting of nothing but stocks, came with a 45% decline during the holding period. Portfolio gains matching this year’s 16% rise in the S&P 500 come with the possibility of declines of as much as 50%. Declines like that are a feature, not a bug of being fully invested in stocks. You cannot have one without the other. Work your plan. Don’t let the positive emotions surrounding a bull market or the urgings of investment product salespeople push you into a strategy not centered on your goals and ability to withstand intermediate-term losses.

On The One Hand

- The Producer Price Index (PPI) declined 0.1% in August, below the consensus expected rise of 0.2%. Producer prices are up 2.8% versus a year ago.

- The Consumer Price Index (CPI) rose 0.2% in August, below the consensus expected increase of 0.3%. The CPI is up 2.7% from a year ago.

- Initial jobless claims decreased by 1,000 to 204,000. The four-week moving average for initial claims decreased by 2,000 to 208,000. Continuing claims decreased by 15,000 to 1.696 million.

- Retail sales rose 0.1% in August and sales were up 0.3% including revisions to prior months. Retail sales are up 6.6% versus a year ago.

- Import prices declined 0.6% in August, while export prices declined 0.1%. The trend in prices still remains upward. Import prices are up 3.7% in the past year, versus a 2.0% gain the year ending August 2017; export prices are up 3.6% in the past year versus a 2.3% increase in the year ending August 2017.

- Industrial production rose 0.4% in August, but the report was tempered by a -0.2% revision to prior months. Overall capacity utilization rose to 78.1% in August from 77.9% in July. Manufacturing capacity utilization increased to 75.8% in August from 75.7% in July.

On The Other Hand

Although the latest PPI and CPI figures were below consensus easing concerns of accelerating inflation in the short-term, longer-term apprehension continues. The current rate is firmly above the Fed’s target rate of 2.0% but has not recently shown signs of imminent acceleration. Wages are finally showing signs of improvement and there is little indication at present they will begin to push the general rate of inflation into unhealthy higher rates. While not yet troublesome, the months ahead could flip the inflation data from the healthy, one hand, to the not so positive other hand.

All Else Being Equal

After slipping to 3.8% on Tuesday, the Atlanta Fed staff’s GDPNow forecast for Q3 real GDP growth finished the week back at 4.4% where is stood the prior week. The New York Fed’s Nowcast held steady at the much lower rate of 2.2%. Estimates of economic activity continue to be volatile and divergent yet continued growth in the U.S economy is not currently in question.

Long absent in the current expansion, wage growth is beginning to accelerate. Brian Wesbury, Chief Economist and Robert Stein, Deputy Chief Economist at First Trust commented on the latest earnings data and its implication for continued growth:

Average hourly earnings grew 0.4% in August, which meant they were up 2.9% from a year ago, the largest 12-month increase since the economic recovery started in mid-2009. By contrast, these wages were up 2.6% in the 12-months ending in August 2017. Moreover, this measure of wages doesn’t include extra earnings from irregular bonuses and commissions, like those paid out since the tax cut was passed late last year.

Total wages, which factors in both average hourly earnings as well as the total number of hours worked, are up 5.1% in the past year, meaning consumers have plenty of earnings to keep increasing spending.

Last Week’s Market

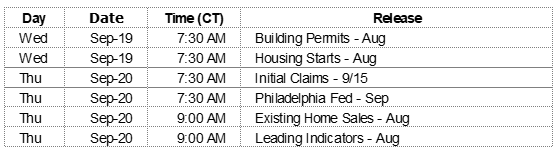

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.