Stocks were putting together a lackluster week until Friday morning when the first Q1 earnings announcements began with a couple of the big banks who reported better than expected results. The positive results suggested to some that the consensus expectation for a year over year earnings contraction of 4%, may be the floor for this earnings cycle’s potentially bad news. In the long-term, a modest earnings contraction in the quarter is not significant but without continuing positive surprises and/or optimistic guidance for the balance of the year, we will suffer negative headlines and the harmful emotions they produce. Stay focused on your long-term goals. Work your plan. Do not allow your emotions to cause you to move off course.

On the One Hand

- The Consumer Price Index (CPI) rose 0.4% in March, in line with consensus expectations. The CPI was up 1.9% over the year ended in March, slightly below the Fed’s target for current consumer price increases.

- The Producer Price Index (PPI) for final demand rose 0.6 percent in March. Prices for goods advanced 1.0 percent and the index for the price of services rose 0.3 percent. The PPI increased 2.2 percent for the 12 months ended in March.

- The Producer Price Index (PPI) for final demand rose 0.6 percent in March. Prices for goods advanced 1.0 percent and the index for the price of services rose 0.3 percent. The PPI increased 2.2 percent for the 12 months ended in March.

On the Other Hand

- Factory orders were 0.5% lower in February after a downwardly revised 0.0% reading (from +0.1%) in January. This marked the fourth decline in the last five months for new orders for manufactured goods.

- Import and export prices rose at a greater pace than expected. Import prices were up 0.6% in March following a revised 1.0% increase in February. Export prices rose 0.7% in March, matching the February increase.

- The April, preliminary University of Michigan Index of Consumer Sentiment was 96.9, lower than expectations and down from the final reading of 98.4 for March.

All Else Being Equal

The Atlanta Fed staff continues to nudge its GDPNow estimate for Q1 real growth higher. The expectation now stands at 2.3%.

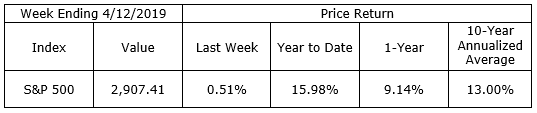

Last Week’s Market

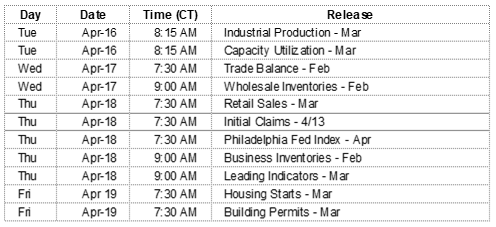

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.