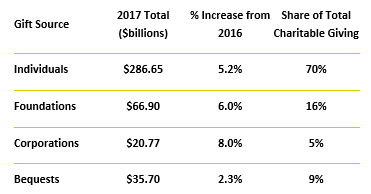

The nonprofit sector did very well in 2017, according to the June 2018 report issued by Giving USA. Total gifts to charity exceeded $400 billion for the first time ever, totaling $410.02 billion in 2017. Gifts from individuals are the largest component, and were $14 billion ahead of the 2016 pace. All giving sectors grew, as shown in the table below:

Source: Giving USA 2018

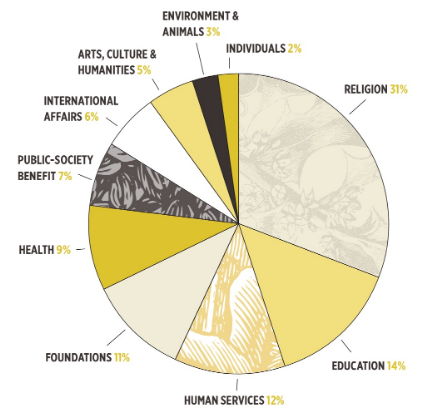

Share of Total Charitable Gifts

Some charities are concerned that 2018 may not see similar growth in giving, because tax incentives for charitable giving have been reduced. The doubling of the standard deduction means that far fewer taxpayers will be itemizing and non-itemizers see no tax benefit from their gifts to charity. The doubling of the amount exempt from the federal estate tax might mean that fewer Americans employ charitable trusts to control their estate tax exposure in the future as well. However, it will be years before such behavioral changes can be identified with confidence.

Nearly a third of charitable gifts go to religious organizations, and educational institutions come in second at 14%. The pie chart above breaks down the categories.

Split-interest Charitable Trusts

There are trust-based strategies that allow an individual to create public and private beneficiaries and reap attractive tax benefits. These include:

Charitable remainder annuity trust- A private beneficiary (or multiple beneficiaries) receives a specific dollar amount from a trust for life or a set number of years. When the trust terminates, a charity receives the remaining trust assets. Income, gift, and estate tax deductions are available to the trust creator.

Charitable remainder unitrust- Similar to the annuity trust, the income distribution for private beneficiaries is calculated as a percentage of the trust assets each year, rather than as a set dollar figure. This allows beneficiaries to share in the appreciation in the value of trust assets, while preserving all the rest of the tax benefits.

Charitable lead trust- This trust approach involves a role reversal, in that the charity receives the trust income distributions and the assets remain in private hands at the end of the trust term.

Are you interested in philanthropic giving? Helping you define and safeguard your legacy is one of our key services, and we would be pleased to answer any questions that you may have. Please contact us at (800) 530-5254 or visit tckansas.com/contactus, and one of our Certified Trust and Financial Advisors will be happy to assist you.