U.S. stocks were flat to slightly higher in anemic trading in the short week ending Thursday. With roughly 15% of companies reporting, the consensus estimate for composite earnings has improved to a decline of 3.8%. Activity will pick up this week as a much heavier flow of Q1 earnings reports begins.

Our advice remains unchanged. Remain focused on years rather than weeks or even quarters.

On the One Hand

- Total U.S. international trade increased to $468.8 billion, up 0.63% in February and 0.78% from a year ago. Exports rose $2.3 billion to a total of $209.7 billion and imports were $586 million higher to a total of $259.1 billion. The U.S. trade deficit in goods and services shrunk to $49.4 billion.

- Retail sales in March rose by 1.6% following February’s 0.2% decline.

- Initial unemployment claims dropped 5,000 to 192,000. The four-week average for initial claims declined 6,000 to 201,250 and total continuing claims declined 63,000 to 1.653 million.

- Business inventories increased 0.3% in February after January’s 0.9% increase. Business sales were 0.1% higher following the 0.3% increase in January.

- The Leading Economic Index increased 0.4% in March following the 0.1% increase in February. The Coincident Index was up 0.1% and the Lagging Index rose 0.1%.

On the Other Hand

- Industrial Production was down 0.1% in March following an unrevised 0.1% increase in February. Capacity utilization dipped to 78.8% from an upwardly revised 79.0% (from 78.2%) in February.

- The Philadelphia Fed Index dropped to 8.5 in April from 13.7 in March. On the bright side, the new orders segment of the index rose to 15.7 from 1.9.

- Housing starts fell 0.3% to a seasonally adjusted annual rate of 1.139 million units last month, the lowest level since May 2017. In addition, data for February was revised downward by 20,000 units. Building permits also fell and were 1.7% lower to a rate of 1.269 million units in March. This was the third straight monthly decline in permits and the lowest in five months. Activity in the Midwest was sharply lower due to flooding.

All Else Being Equal

We will get our first look at where the U.S. economy stands on Friday with the release of the advance estimate of first quarter GDP. The Atlanta Fed staff provides a clue with its latest GDPNow estimate for real growth of 2.8%.

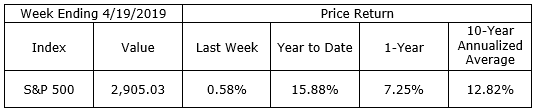

Last Week’s Market

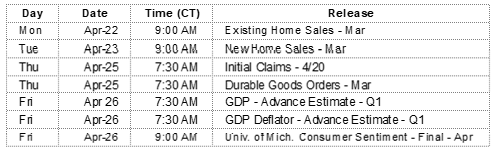

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.