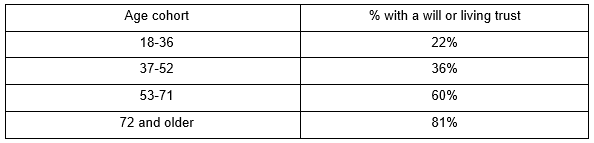

As important as estate planning is, it often gets neglected. A 2017 survey by Caring.com revealed that only 42% of U.S. adults have a will or a living trust in place. In part, it is an age thing, as the table here shows.

Source: www.caring.com/articles/wills-survey-2017

When asked why they have not completed their estate planning, 47% of survey respondents said they “just hadn’t gotten around to it.” Some 29% felt “they didn’t have enough assets to leave to anyone to warrant estate planning.”

Interestingly, more people have attended to their end-of-life medical issues than to creating a plan for their property, as evidenced by the fact that 53% of respondents reported having a health care power of attorney in place.

The hot buttons

As difficult as motivating people to take care of planning for their estate after they pass away has been in the past, it may become even trickier in the future. The temporary doubling of the amount exempt from the federal estate and gift tax ($10 million for singles and $20 million for married couples plus inflation adjustments) means the vast majority of Americans no longer need to plan to achieve tax savings until this provision in tax law expires. There are exceptions in states which continue to levy their own death taxes (estate tax, inheritance tax, or both), because states typically have much lower thresholds for taxation. Still, only a minority of states have held on to their death taxes.

In the last century, trust companies could help their clients establish marital deduction trusts for very major tax savings. No longer. The advent of the portable federal exemption means the basic tax benefit of such a trust may be had simply by filing an estate tax return and electing the Deceased Spousal Unused Exemption Amount (DSUEA). The election is permitted whether the decedent had an estate plan in place or not.

With the elimination of tax savings as an estate planning goal, the benefit which has been most important all along comes to the front: disposing of property in an orderly way, according to your wishes. Failure to have an estate plan means the state’s intestacy statute takes over. Intestacy rules are the government’s best guess of what someone would have chosen had they taken the time to plan. Even so, settling an estate via intestacy can be costly and time-consuming.

Will registration

When someone appears to have died without a will, there are questions, especially if substantial assets are involved. Was a will executed but then lost? Where should one look for a will? If someone has executed a will, how can he or she be confident the heirs will find the will?

Stacey Jerome-Miller is the President of The U.S. Will Registry, an organization that provides a secure and comprehensive database for the locations of wills that have been registered with it. There is no charge for the service. Ms. Jerome-Miller lays out the details of the operations of her organization in “Where’s There’s a Will, There’s a Way,” Probate & Property Magazine Vol. 32, No. 4 (July/August 2018).

The registry does not hold any of the estate planning documents, only the information on the draftsman and the document location. It provides an avenue of inquiry when there is a question about whether someone really died intestate.

We specialize in estate planning and settlement and are advocates for trust-based wealth management services. If you have questions about how wills and trusts work or where to begin, ask us. The officers at The Trust Company of Kansas are always willing to discuss your financial goals with you and help you to create a plan which is well-aligned with your wishes.