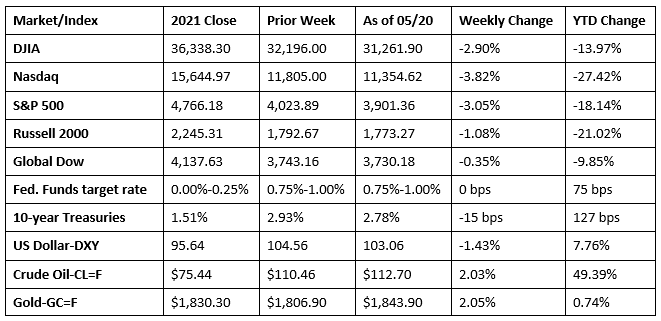

In another volatile week of trading, stocks fell for the seventh consecutive week. A late-day surge last Friday kept the S&P 500 out of bear territory, but not enough to keep it out of the red for the week. Disappointing earnings and declining profits from some major retailers apparently caused concern that retailers will pass on higher input costs to customers. Federal Reserve Chair Jerome Powell added to the angst when he said that “some pain” may be involved in the fight to tame inflation. This was enough to prompt investors to pull away from stocks. By the end of last week, the Nasdaq, the Dow, and the S&P 500 all fell by 2.9% or more. Crude oil prices climbed higher, while the dollar slid lower. Ten-year Treasury yields fell 15 basis points as bond prices increased. Gold prices rose by nearly $37.00.

Wall Street got off to a rough start last week after downbeat Chinese economic data increased worries of a global economic slowdown. Among the benchmark indexes listed here, only the Dow (0.1%) and the Global Dow (0.4%) eked out gains. The Nasdaq (-1.2%), the Russell 2000 (-0.5%), and the S&P 500 (-0.4%) dipped lower. Bond prices rose pulling yields down. Ten-year Treasury yields fell 5.8 basis points to close the day at 2.87%. Crude oil prices climbed $3.60 to $114.04 per barrel. The dollar slid lower, while gold prices advanced.

Stocks rallied last Tuesday, with all 11 major industry sectors advancing to drive the S&P 500 up over 2.0%. The Nasdaq jumped 2.8% as several major tech companies bounced back from Monday’s sell-off. The Russell 2000 increased 3.2%, the Global Dow rose 2.0%, and the Dow added 1.3%. Ten-year Treasury yields climbed 9.1 basis points to reach 2.96%. Crude oil prices, the dollar, and gold prices declined.

Last Tuesday’s rally was short-lived as stocks plunged lower last Wednesday, posting the largest one-day drop in nearly two years. The S&P 500 and the Nasdaq fell more than 4.0%, the Dow and the Russell 2000 slid 3.6%. The Global Dow dipped 2.2%. Ten-year Treasury yields lost more than 8.0 basis points, closing at 2.88%. Crude oil prices declined over $3.00 to $109.23 per barrel. The dollar advanced, while gold prices decreased. Consumer shares, particularly those of major retailers, tumbled as investors tried to weigh the impact of higher prices and monetary policy tightening on corporate earnings and economic growth.

Equities continued to spiral lower last Thursday, with only the Russell 2000 able to close barely in the black. The Dow (-0.8%), the S&P 500 (-0.6%), and the Nasdaq (-0.3%) declined on a volatile day of trading. Crude oil prices climbed $1.70 to $111.30 per barrel. The dollar sank lower, while gold prices advanced. Ten-year Treasury yields slipped to 2.85%.

Stocks closed last Friday with mixed returns, with the Dow and the S&P 500 barely eking out a gain, while the Nasdaq and the Russell 2000 slid lower. Ten-year Treasury yields fell for the third consecutive session, closing the day down 6.8 basis points. Crude oil prices rose for the second day in a row. The dollar and gold prices also advanced on the day.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Retail sales in April rose 0.9% after increasing 1.4% in March. Retail sales advanced 8.2% since April 2021. Retail trade sales in April were up 0.7% from March and increased 6.7% over last year. Gasoline station sales dropped 2.7% last month but were up 36.9% from April 2021, while sales at food services and drinking places climbed 2.0% in April and were up 19.8% from last year.

- Industrial production increased for the fourth consecutive month following a 1.1% advance in April. Manufacturing output rose 0.8%, utilities moved up 2.4%, and mining gained 1.6%. Total industrial production in April was 6.4% above its year-earlier level.

- The housing market is showing definite signs of slowing. In April, building permits (-3.2%), housing starts (-0.2%), and housing completions (-5.1%) decreased from their respective March totals. In particular, single-family new home construction is beginning to wane. The number of single-family building permits issued in April was 4.6% below the March figure, while single-family housing starts (-7.3%), and housing completions (-4.9%) also declined.

- Sales of existing homes fell for the third consecutive month after declining 2.4% in April. Existing-home sales are down 5.9% since April 2021. According to the National Association of Realtors®, higher home prices and rising mortgage rates have limited buyer activity. The median existing-home price in April was $391,200, up from the March price of $374,800 and well ahead of the April 2021 price of $340,700. Unsold inventory sits at a 2.2 month supply at the current sales pace, slightly ahead of the March rate of 1.9 months. Sales of existing single-family homes also declined in April after dropping 2.5% from March. Single-family existing home sales are off 4.8% from a year ago. The median existing single-family home price was $397,600 in April, higher than the $381,300 March price.

- The national average retail price for regular gasoline was $4.491 per gallon on May 16, $0.163 per gallon above the prior week’s price and $1.463 higher than a year ago. Also as of May 16, the East Coast price increased $0.20 to $4.43 per gallon; the Gulf Coast price rose $0.14 to $4.16 per gallon; the Midwest price climbed $0.15 to $4.30 per gallon; the West Coast price increased $0.14 to $5.36 per gallon; and the Rocky Mountain price increased $0.05 to $4.28 per gallon. Residential heating oil prices averaged $3.92 per gallon on May 13, about $0.03 per gallon less than the prior week’s price. U.S. crude oil refinery inputs averaged 15.9 million barrels per day during the week ended May 13, which was 239,000 barrels per day more than the previous week’s average. During the week ended May 13, refineries operated at 91.8% of their operable capacity, while gasoline production decreased, averaging 9.6 million barrels per day.

- For the week ended May 14, there were 218,000 new claims for unemployment insurance, an increase of 21,000 from the previous week’s level, which was revised down by 6,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended May 7 was 0.9%, a decrease of 0.1 percentage point from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended May 7 was 1,317,000, a decrease of 25,000 from the previous week’s level, which was revised down by 1,000. This is the lowest level for insured unemployment since December 27, 1969, when it was 1,304,000. States and territories with the highest insured unemployment rates for the week ended April 30 were California (2.1%), New Jersey (2.0%), Alaska (1.8%), New York (1.5%), Puerto Rico (1.4%), Rhode Island (1.4%), Massachusetts (1.3%), Minnesota (1.3%), and Illinois (1.2%). The largest increases in initial claims for the week ended May 7 were in California (+3,046), Ohio (+772), Texas (+452), Arkansas (+393), and Iowa (+337), while the largest decreases were in New York (-9,899), Kentucky (-1,479), Indiana (-1,341), Florida (-746), and Massachusetts (-615).

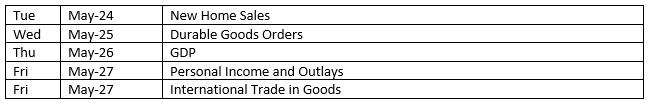

Eye on the Week Ahead

Two important reports are available this week: one related to the economy and the other targeting inflation. The second estimate of the first-quarter gross domestic product is out this week. The economy decelerated at an annualized rate of 1.4%, according to the initial estimate. The April report on personal income and outlays is also available this week. The Personal Consumption Expenditures Price Index, a measure of inflationary trends favored by the Federal Reserve, shows prices have risen 6.6% since April 2021 — well above the 2.0% rate targeted by the Fed.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.