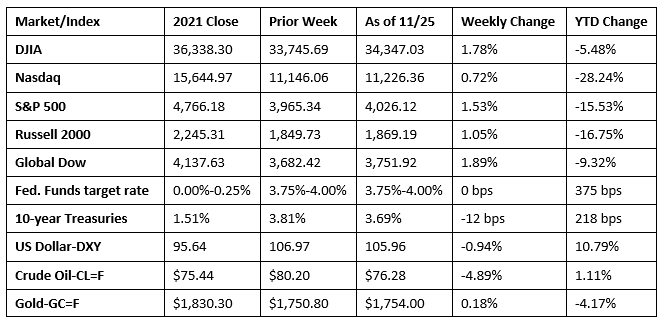

Wall Street ended the Thanksgiving week ahead of where it began, as each of the benchmark indexes listed here posted solid gains during a week of light trading. The Global Dow led the indexes, followed by the Dow, the S&P 500, the Russell 2000, and the Nasdaq. Stocks have been rallying since October and the holiday season tends to be strong for equities heading into the final month of the year. Crude oil prices fell for the third straight week, firmly settling below $80.00 per barrel. A cap on Russian oil prices, coupled with China’s surging COVID cases, has kept oil prices muted.

Last Monday saw stocks slide lower to begin the holiday-shortened week, with the Nasdaq (-1.1%) tumbling the furthest among the benchmark indexes listed here. The Global Dow lost 0.8% after a rise in COVID-19 cases in China prompted a lockdown in parts of that country. The Russell 2000 dropped 0.6%, the S&P 500 declined 0.4%, and the Dow slipped 0.1%. Crude oil prices continued to drop, falling to $79.74 per barrel. Ten-year Treasury yields were flat, ending the session at 3.82%. The dollar gained against a basket of currencies. Gold prices fell for the third consecutive session.

Stocks rose last Tuesday in what may have been an early holiday-shopping day for dip buyers. The S&P 500 closed above 4,000 for the first time since September, while the Dow reached its highest level in three months. The tech-heavy Nasdaq and the S&P 500 gained 1.4%, followed by the Global Dow (1.3%), while the Dow and the Russell 2000 advanced 1.2%. Ten-year Treasury yields shed 6.7 basis points, closing the session at 3.75%. Crude oil prices reversed a downward trend, climbing $1.12 to $81.16 per barrel. The dollar slipped lower, while gold prices eked out a gain.

Equities continued to ascend last Wednesday as minutes from the last Federal Reserve meeting reinforced expectations that interest-rate hikes may be scaled back beginning in December. Each of the benchmark indexes listed here advanced, led by the Nasdaq (1.0%) and the Global Dow (0.8%). The S&P 500 rose 0.6%, the Dow added 0.3%, and the Russell 2000 eked out a 0.1% gain. Ten-year Treasury yields gave back 5.2 basis points to close the session at 3.70%. The price of crude oil slid to $77.39 per barrel as prices approached the 2021 closing value of $75.44 per barrel. The dollar declined, while gold prices rose nearly $11.00 to $1,750.90 per ounce.

Stocks ended mixed last Friday in a shortened trading session. The New York Stock Exchange closed early the day after Thanksgiving, and trading was relatively light. The Dow (0.5%) and the Russell 2000 (0.3%) ended higher, while the Nasdaq (-0.5%) finished lower. The S&P 500 and the Global Dow ended the day flat. Ten-year Treasury yields ended marginally lower, closing at 3.69%. Crude oil prices lost $1.66 to end the day at $76.28 per barrel. The dollar advanced against a basket of currencies. Gold prices increased for the third straight session.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- New orders for durable goods rose 1.0% in October, the seventh increase in the last eight months. Excluding transportation, new orders increased 0.5%. Excluding defense, new orders increased 0.8%. Transportation equipment, up six of the last seven months, led the increase, climbing 2.1%. New orders for nondefense capital goods in October increased 1.9%. Unfilled orders for durable goods increased for the 26th consecutive month, while inventories advanced for the 21st month in a row.

- Sales of new single-family homes increased 7.5% in October but were 5.8% below the October 2021 rate. The median sales price for new single-family homes in October was $493,000 ($455,700 in September), while the average sales price was $544,000 ($516,400 in September). At the current sales pace, the available inventory of new single-family homes for sale in October sat at 9.7 months, down slightly from the September rate of 9.9 months.

- According to the U.S. Energy Administration, the national average retail price for regular gasoline was $3.648 per gallon on November 21, $0.114 per gallon below the prior week’s price but $0.253 higher than a year ago. Also as of November 21, the East Coast price decreased $0.073 to $3.538 per gallon; the Gulf Coast price fell $0.116 to $3.021 per gallon; the Midwest price declined $0.158 to $3.519 per gallon; the West Coast price dropped $0.145 to $4.779 per gallon; and the Rocky Mountain price decreased $0.077 to $3.636 per gallon. Residential heating oil prices averaged $5.434 per gallon on November 21, $0.349 below the previous week’s price but $2.050 per gallon more than a year ago.

- Claims for unemployment insurance rose notably during the last reporting period. For the week ended November 19, there were 240,000 new claims for unemployment insurance, an increase of 17,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended November 12 increased 0.1 percentage point to 1.1%. The advance number of those receiving unemployment insurance benefits during the week ended November 12 was 1,551,000, an increase of 48,000 from the previous week’s level, which was revised down by 4,000. States and territories with the highest insured unemployment rates for the week ended November 5 were Rhode Island (2.1%), Alaska (1.9%), Puerto Rico (1.8%), New Jersey (1.7%), California (1.6%), New York (1.4%), Massachusetts (1.3%), Nevada (1.1%), Washington (1.1%), and Oregon (1.1%). The largest increases in initial claims for unemployment insurance for the week ended November 12 were in Minnesota (+1,971), North Carolina (+1,141), New Jersey (+1,020), Montana (+918), and Pennsylvania (+607), while the largest decreases were in Kentucky (-3,330), Georgia (-1,726), Florida (-1,302), Indiana (-1,136), and Texas (-1,091).

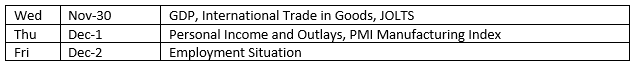

Eye on the Week Ahead

The last week of November brings with it plenty of important, market-moving economic data. The second estimate of third-quarter gross domestic product is available this week. The initial estimate showed the economy advanced 2.6% in the third quarter after decelerating in each of the year’s first two quarters. Another important report that’s out this week includes the latest data on personal income and outlays, which includes the personal consumption expenditures price index, a measure of inflation preferred by the Federal Reserve. The latest information on the labor sector is out at the end of this week with the release of the employment situation report. Job growth has been steady through October, while average hourly earnings have increased 4.7% over the past 12 months.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.