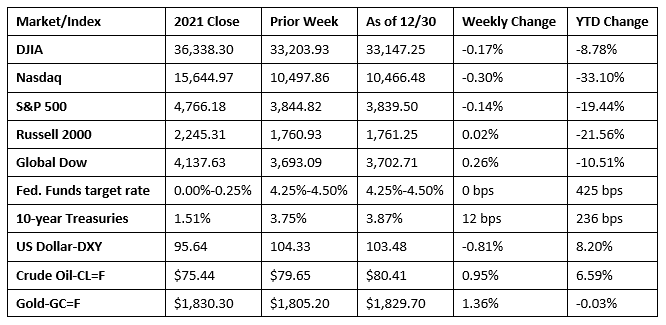

A late-week surge in dip buying wasn’t enough to save stocks from closing the last week of 2022 in the red. Only the Russell 2000 and the Global Dow managed to eke out minimal gains. The Nasdaq, S&P 500, and the Dow all ended the week lower. Treasury yields rose, as bond prices fell. The dollar slid lower, but ended the year up over 8.0%. Crude oil prices ended the week up by nearly 1.0%, closing above $80.00 per barrel.

Stocks began the holiday-shortened week mostly lower, with only the Dow and the Global Dow ticking up 0.1%. The tech-heavy Nasdaq fell 1.4%, while the Russell 2000 (-0.7%) and the S&P 500 (-0.4%) edged lower. Ten-year Treasury yields added 10.9 basis points to close at 3.86%. Crude oil prices were flat, hovering around $79.72 per barrel. The dollar dipped lower, while gold prices rose nearly 1.0%, jumping to their highest level in six months. The Friday before Christmas marked the start of the so-called Santa Clause rally period, which includes the last five trading days of the outgoing year and the first two trading days of the new year. On average, this period has historically produced positive results for stocks. However, poor returns are often seen as a negative indicator.

Equities continued their tailspin last Wednesday, dampening hopes for a year-end rally. The S&P 500 fell to its lowest level since November as fears of rising COVID cases followed the end of China’s lockdown. Several countries, including the United States, will require COVID testing for all air passengers originating from China. The Russell 2000 (-1.6%) and the Nasdaq (-1.4%) led the declining indexes, followed by the S&P 500 (-1.2%), the Dow (-1.1%), and the Global Dow (-0.8%). Bond prices slipped lower, driving yields higher with 10-year Treasury yields climbing to 3.88%. Crude oil prices fell by nearly $1.00, reaching $78.64 per barrel. The dollar advanced, while gold prices declined.

Wall Street closed 2022 on a downbeat, closing out the worst year in more than a decade. Each of the benchmark indexes listed here ended last Friday in the red, led by the Russell 2000 and the S&P 500, which fell 0.3%. The Dow and the Global Dow dipped 0.2%, while the Nasdaq slipped 0.1%. Ten-year Treasury yields added 4.4 basis points to close the week at 3.87%. Crude oil prices advanced 2.5% to reach $80.41 per barrel. The dollar declined, while gold prices advanced.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The international trade in goods deficit shrunk $15.5 billion, or 15.6% in November. Exports of goods fell 3.1% and imports of goods declined 7.6%.

- Retail prices for regular gasoline continued to slide last week. According to the U.S. Energy Administration, the national average retail price for regular gasoline was $3.091 per gallon on December 26, $0.029 per gallon below the prior week’s price and $0.184 lower than a year ago. Also, as of December 26, the East Coast price decreased $0.047 to $3.071 per gallon; the Gulf Coast price rose $0.043 to $2.684 per gallon; the Midwest price declined $0.012 to $2.899 per gallon; the West Coast price dropped $0.073 to $3.910 per gallon; and the Rocky Mountain price decreased $0.084 to $3.002 per gallon. Residential heating oil prices averaged $4.639 per gallon on December 26, $0.042 above the previous week’s price and $1.273 per gallon more than a year ago.

- For the week ended December 24, there were 225,000 new claims for unemployment insurance, an increase of 9,000 from the previous week’s level. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended December 17 was 1.2%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended December 17 was 1,710,000, an increase of 41,000 from the previous week’s level, which was revised down by 3,000. States and territories with the highest insured unemployment rates for the week ended December 10 were Alaska (2.3%), California (2.1%), New Jersey (2.1%), Puerto Rico (2.0%), Montana (1.8%), Minnesota (1.8%), Rhode Island (1.7%), New York (1.6%), Massachusetts (1.6%), and Washington (1.6%). The largest increases in initial claims for unemployment insurance for the week ended December 17 were in Massachusetts (+1,505), New Jersey (+1,258), Missouri (+1,040), Rhode Island (+522), and Pennsylvania (+460), while the largest decreases were in California (-2,268), Ohio (-1,806), Texas (-941), Georgia (-760), and Washington (-704).

Eye on the Week Ahead

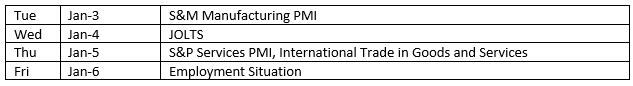

The first week of 2023 includes some important economic data for the last month of 2022. The purchasing managers’ indexes for manufacturing and services are available this week. November saw the PMIs for both manufacturing and services contract. The employment figures for December are available at the end of the week. The employment sector remained strong in November, with over 260,000 new jobs added and hourly earnings increasing 0.6% from the previous month.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.