Last week was a tough one for the markets. Each of the benchmark indexes listed here fell, with the Nasdaq notching its largest weekly decline since March. Many of the market sectors decreased, with only information technology and energy posting modest gains. The yield on 10-year Treasuries, an important indicator of the economy, climbed 11.0 basis points, reaching a 16-year high earlier in the week. The Federal Reserve projected that interest rates would remain higher for longer than expected, which might lead to a slowing of the economy. Crude oil prices ended last week slipping marginally. The dollar and gold prices eked out gains.

Stocks opened last week relatively flat as investors awaited the Federal Open Market Committee’s upcoming interest-rate policy meeting and Fed Chair Jerome Powell’s subsequent press conference. The Dow, the S&P 500, and the Nasdaq gained less than 0.1%, while the Russell 2000 (-0.7%) and the Global Dow (-0.4%) declined. Yields on 10-year Treasuries dipped 0.3 basis points to end last Monday’s session at 4.31%. Crude oil prices rose 1.3%, settling at $91.95 per barrel. The dollar slid 0.2%, while gold prices rose 0.4%.

The markets ended lower last Tuesday on rising crude oil prices and higher bond yields. Declining growth stocks led the downturn, while the majority of the market sectors fell, with only health care, information technology, and communication services gaining. Each of the benchmark indexes listed here lost value with the exception of the Global Dow, which ended flat. The Russell 2000 (-0.4%) and the Dow (-0.3%) fell the furthest, followed by the S&P 500 and the Nasdaq, which slid 0.2%. Ten-year Treasury yields added 4.6 basis points to close at 4.36%. Crude oil prices increased 0.4%, reaching $91.59 per barrel. The dollar and gold prices dipped less than 0.1%.

Last Wednesday saw stocks lose value, despite the Federal Reserve opting to maintain interest rates at their current level (see below). However, Fed projections indicated that interest rates would remain higher for longer, which may have chilled investors. The Nasdaq fell 1.5%, followed by the S&P 500 (-0.9%), the Russell 2000 (-0.8%), the Global Dow (-0.4%), and the Dow (-0.2%). Yields on 10-year Treasuries dipped 1.6 basis points to 4.34%. Crude oil prices settled at $90.27, a decline of 1.0%. The dollar and gold prices advanced.

Stocks continued to tumble last Thursday, while the dollar hit its highest rate since March. Ten-year Treasury yields rose 13.1 basis points to 4.48%, the highest value since the 2008 global financial crisis. Wednesday’s comments by Fed Chair Jerome Powell (see below) likely carried over into Thursday’s trading. Each of the benchmark indexes listed here fell more than 1.0%, led by the Nasdaq (-1.8%), followed by the S&P 500 and the Russell 2000 (-1.6%), the Global Dow (-1.5%), and the Dow (-1.1%). The dollar rose 0.3%, settling at $105.41 against a basket of world currencies. Gold prices declined 1.4%. Crude oil prices fell for the second straight day after slipping 0.1% to $89.58 per barrel.

Last Friday saw Wall Street teeter between gains and losses, ultimately closing lower for the fourth straight session. The Global Dow slipped 0.4%, the Russell 2000 and the Dow fell 0.3%, the S&P 500 dipped 0.2%, and the Nasdaq lost 0.1%. Ten-year Treasury yields declined 4.2 basis points to 4.43%. Crude oil prices rebounded from earlier losses after gaining 0.8%. The dollar and gold prices advanced.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The Federal Open Market Committee decided to maintain the current target range for the federal funds rate at 5.25%-5.50%. Striving to achieve maximum employment and inflation at the rate of 2.0%, the Committee suggested that it would continue to assess additional information and its implications for monetary policy. In determining the extent of additional policy firming that may be appropriate to return inflation to 2.0% over time, the Committee said it would take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. Nevertheless, the Committee projected interest rates would end the year at 5.50%-5.75%, implying another rate hike before the end of 2023. However, the FOMC stated that it would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. At Fed Chair Jerome Powell’s press conference following the meeting, he indicated inflation had moderated somewhat since last year but had a long way to go before reaching the 2.0% target.

- August saw a spike in the number of issued residential building permits, after climbing 6.9% above the July estimate. However, compared to August 2022, building permits were down 2.7%. The number of single-family building permits issued in August was 2.0% above the previous month’s total. Housing starts declined 11.3% in August and 14.8% below the August 2022 rate. The decline in housing starts may have been attributable to the increase in housing completions, which rose 5.3% in August from July, and 3.8% above the August 2022 rate. However, single-family completions were down 6.6% last month.

- Sales of existing homes declined for the third consecutive month after retreating 0.7% in August. Existing home sales were down 15.3% from August 2022. The median existing home sales price was $407,100, up from July’s price of $405,700 and well above the August 2022 price of $391,700. The August median sales price has surpassed $400,000 for the third straight month. The number of existing homes for sale in August sat at a 3.3-month supply at the current sales pace, unchanged from the July estimate. Sales of existing single-family homes decreased in August, down 1.4% from July and 15.3% from August 2022. The median existing single-family home price in August was $413,500, up from the July price of $411,200 and higher than the August 2022 price of $398,800.

- The national average retail price for regular gasoline was $3.878 per gallon on September 18, $0.056 per gallon higher than the prior week’s price and $0.224 more than a year ago. Also, as of September 18, the East Coast price increased $0.021 to $3.654 per gallon; the Midwest price rose $0.027 to $3.710 per gallon; the Gulf Coast price climbed $0.065 to $3.431 per gallon; the Rocky Mountain price increased $0.058 to $4.071 per gallon; and the West Coast price advanced $0.194 to $5.163 per gallon.

- For the week ended September 16, there were 201,000 new claims for unemployment insurance, a decrease of 20,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended September 9 was 1.1%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended September 9 was 1,662,000, a decrease of 21,000 from the previous week’s level, which was revised down by 5,000. States and territories with the highest insured unemployment rates for the week ended September 2 were in New Jersey (2.5%), Hawaii (2.3%), California (2.0%), New York (1.9%), Puerto Rico (1.9%), Rhode Island (1.8%), Massachusetts (1.7%), Oregon (1.6%), and Pennsylvania (1.5%). The largest increases in initial claims for unemployment insurance for the week ended September 9 were in Indiana (+2,627), Florida (+783), Kentucky (+308), Nebraska (+273), and Iowa (+162), while the largest decreases were in Ohio (-3,425), Missouri (-3,196), New York (-3,051), California (-1,880), and Texas (-1,393).

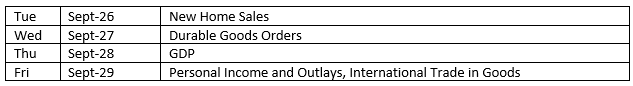

Eye on the Week Ahead

This is a very busy week for the release of some important economic data. The final estimate of second-quarter gross domestic product is available. The prior estimate showed the economy accelerated at an annualized rate of 2.1%. Also out this week is the August release of the report on personal income, consumer spending, and consumer prices. The previous month saw income creep up 0.2%, while consumer spending rose 0.8%. The personal consumption expenditures (PCE) price index, an indicator of inflation preferred by the Federal Reserve, revealed prices rose 0.2% in July and 3.3% over the past 12 months. As with the Consumer Price Index, rising energy prices, particularly oil and gasoline, are expected to impact the overall PCE price index.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.