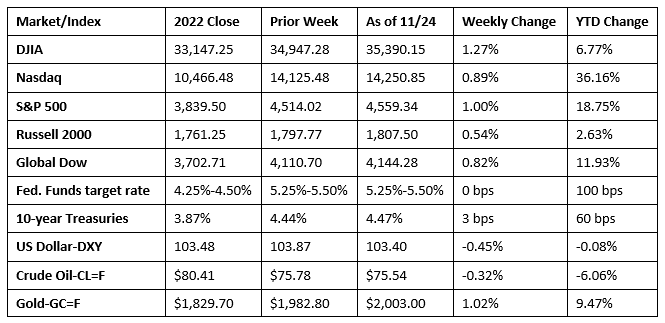

Market activity was subdued during Thanksgiving week, which saw stocks close higher. Each of the benchmark indexes listed here gained ground, led by the large caps of the Dow and the S&P 500. Each of the 11 market sectors ended the week higher, with health care, energy, and communication services leading the way. Treasury yields rose marginally higher, while crude oil prices slipped for the fifth straight week. The dollar declined, while gold prices advanced for the second consecutive week.

Thanksgiving week for Wall Street got off to a rousing start. Investors dove into the market last Monday, driving each of the benchmark indexes listed here higher. The Nasdaq gained 1.1%, the S&P 500 rose 0.7%, the Dow and the Global Dow added 0.6%, and the Russell 2000 climbed 0.5%. Communications and information technology were sectors driven higher by rising mega-cap tech companies. Ten-year Treasury yields moved very little, settling at 4.42%. Crude oil prices rose 2.1% to $77.50 per barrel. The dollar and gold prices dipped 0.4% and 0.3%, respectively.

A solid run for stocks ended last Tuesday as minutes from the last Federal Reserve meeting reminded investors that officials were willing to raise interest rates if economic data warranted it. Each of the benchmark indexes listed here lost value, with the Russell 2000 falling the furthest after dropping 1.3%. The Nasdaq declined 0.6%, while the Dow, the Global Dow, and the S&P 500 dipped about 0.1%. Ten-year Treasury yields slid to 4.41%. Crude oil prices changed little, closing at about $77.81 per barrel. The dollar ticked higher, while gold prices slipped minimally.

Stocks rebounded the day before Thanksgiving as markets were relatively quiet on one of the busiest travel days in the United States. The Russell 2000 recouped some of its losses from the prior session, gaining 0.7%. The Dow and the Nasdaq added 0.5%, the S&P 500 rose 0.4%, and the Global Dow ticked up less than 0.1%. Ten-year Treasury yields remained at 4.41%, while crude oil prices ended a mini rally, falling 1.34% to $76.73 per barrel. The dollar climbed 0.3%, while gold prices fell 0.5%.

The New York Stock Exchange closed last Thursday for Thanksgiving and shut down early on Friday. Investors may have been more interested in the start of the seasonal shopping season last Friday, as they paid little attention to the market. The Nasdaq ticked down 0.1%, while the remaining benchmark indexes listed here posted gains, led by the Russell 2000 (0.7%), followed by the Dow and the Global Dow (0.3%), while the S&P 500 edged up 0.1%. Yields on 10-year Treasuries climbed 5.3 basis points to 4.46%. The dollar slid 0.4%, while gold prices climbed 0.5%. Crude oil prices fell 2.0%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Sales of existing homes fell 4.1% in October and 14.6% since October 2022. Existing home sales have declined for five consecutive months. Inventory of available homes for sale ticked up to a 3.6-month supply in October, marginally higher than the 3.4-month supply in September. The median price for existing homes in October was $391,800, down from $392,800 in September, but 3.4% above the October 2022 price of $378,800. According to the National Association of Realtors®, a persistent lack of inventory and the highest mortgage rates in a generation have contributed to the decrease in home sales. However, while the existing home market remained tight, home sellers have seen prices continue to rise year-over-year, including a new all-time high for the month of October. Single-family home sales declined 4.2% last month and 14.6% from the previous year. The median existing single-family home price was $396,100 in October, down from September’s price of $397,400, but up 3.0% from the October 2022 price of $384,600.

- New orders for manufactured durable goods, down three of the last four months, decreased 5.4% in October. Transportation equipment, also down three of the last four months, drove the decrease, falling 14.8%. Excluding transportation, new orders were virtually unchanged. Shipments of manufactured durable goods, down three of the last four months, decreased 0.9% in October. New orders for nondefense capital goods decreased 15.6% in October. New orders for defense capital goods increased 24.5% in October.

- The national average retail price for regular gasoline was $3.289 per gallon on November 20, $0.060 per gallon lower than the prior week’s price and $0.359 less than a year ago. Also, as of November 20, the East Coast price decreased $0.046 to $3.166 per gallon; the Midwest price fell $0.061 to $3.124 per gallon; the Gulf Coast price declined $0.023 to $2.786 per gallon; the Rocky Mountain price dropped $0.141 to $3.197 per gallon; and the West Coast price decreased $0.103 to $4.417 per gallon. According to the U.S. Energy Information Administration, after adjusting for inflation, retail gasoline prices this Thanksgiving weekend are 13.0% lower than last year. Lower-than-usual gasoline demand this fall combined with the seasonal switch to winter-grade gasoline, which allows refiners to use less expensive components to produce gasoline, have helped reduce gasoline prices by $0.55/gal over the last two months. Recent declines in crude oil prices and low refining margins for producing gasoline suggest gasoline prices could remain relatively low through the end of the year.

- For the week ended November 18, there were 209,000 new claims for unemployment insurance, a decrease of 24,000 from the previous week’s level, which was revised up by 2,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended November 11 was 1.2%, unchanged from the previous week’s rate, which was revised down by 0.1%. The advance number of those receiving unemployment insurance benefits during the week ended November 11 was 1,840,000, a decrease of 22,000 from the previous week’s level, which was revised down by 3,000. States and territories with the highest insured unemployment rates for the week ended November 4 were California (2.0%), New Jersey (2.0%), Puerto Rico (1.9%), Alaska (1.8%), Hawaii (1.8%), New York (1.6%), Massachusetts (1.5%), Oregon (1.5%), Rhode Island (1.5%), and Washington (1.5%). The largest increases in initial claims for unemployment insurance for the week ended November 11 were in Massachusetts (+3,019), New York (+2,574), Texas (+1,347), New Jersey (+1,058), and Minnesota (+1,014), while the largest decreases were in Oregon (-1,363), Georgia (-1,018), Pennsylvania (-716), Illinois (-685), and Iowa (-497).

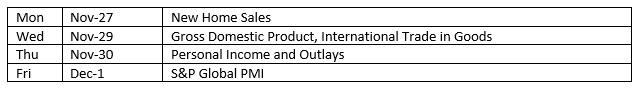

Eye on the Week Ahead

The last week of November brings with it the release of some important economic data: the latest report on gross domestic product and the report on personal income and outlays. GDP advanced 4.9% in the third quarter, according to the initial estimate, well above the second quarter advance of 2.1%. The report on personal income and outlays includes the personal consumption expenditures price index, the preferred inflation indicator of the Federal Reserve. Prices advanced 3.4% for the year ended in September, while core prices rose 3.7%.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.