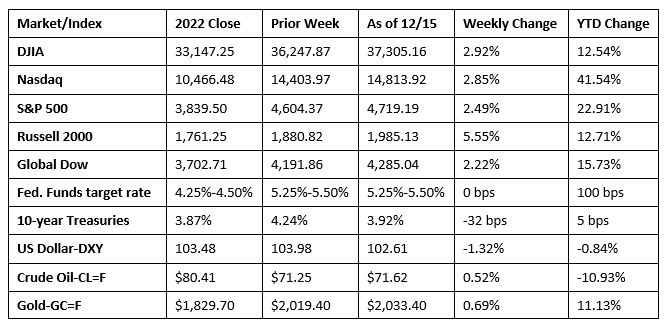

Last week saw stocks rally after the Federal Reserve policy statement released last Wednesday suggested no more interest rate hikes, while predicting rate cuts in 2024 (see below). Despite losing momentum at the end of the week, stocks enjoyed their seventh consecutive week of gains, with the S&P 500 marking its longest winning streak since 2017 and the Dow’s longest since 2018. Each of the market sectors ended the week higher, led by real estate, consumer discretionary, materials, and financials. Bond yields continued to be volatile, dropping 32.0 basis points as investors tried to determine the direction interest rates will take. Crude oil prices ended a stretch of six weeks of losses. The dollar registered its largest weekly drop in a month against a basket of currencies.

Wall Street began last week on a positive note as investors awaited the upcoming release of the latest inflation data and the Federal Reserve meeting. Each of the benchmark indexes listed here closed higher last Monday, led by the Dow, the S&P 500, and the Global Dow, which each rose 0.4%. The Russell 2000 and the Nasdaq inched up 0.2%. Ten-year Treasury yields slipped minimally to 4.23%. Crude oil prices rose 0.3% to $71.45 per barrel. The dollar ticked higher, while gold prices fell nearly 1.0%.

Markets closed generally higher last Tuesday. The Consumer Price Index (see below) showed inflation held steady with the Federal Reserve’s final meeting of 2023 on tap for Wednesday. The Dow and the S&P 500 gained 0.5%, while the Nasdaq added 0.7%, with all three indexes closing at their highest levels since January 2022. The Global Dow ticked up 0.2%, while the Russell 2000 dipped 0.1%. Crude oil prices gave back recent gains, falling 3.6% to $68.73 per barrel. Yields on 10-year Treasuries fell 3.3% to 4.20%. The dollar fell 0.3%, while gold prices rose less than 0.1%.

Wall Street reacted favorably to the outcome of the Federal Reserve’s meeting last Wednesday (see below) as stocks climbed to record highs. Each of the benchmark indexes listed here posted solid gains led by the Russell 2000, which climbed 3.5%. The Dow, the Nasdaq, and the S&P 500 each rose 1.4%, while the Global Dow added 1.1%. Ten-year Treasury yields fell to 4.03%, the lowest rate since August, while two-year yields tumbled 30.0 basis points to 4.43%, all in response to the Fed’s statement. Crude oil prices swung higher, closing at $69.74 per barrel after gaining 1.65%. The dollar fell 0.9%, while gold prices rose 2.3%.

Stocks continued to climb higher last Thursday as investors rode momentum from the Fed’s aforementioned policy statement. The Dow jumped 0.4% to hit another record high, while the S&P 500 (0.3%) and the Nasdaq (0.2%) notched gains. But the interest-sensitive small caps of the Russell 2000 posted notable gains after advancing 2.7%, while the Global Dow rose 1.3%. Ten-year Treasuries dipped to 3.93%, falling below 4.0% for the first time since August. Crude oil prices rose 3.2% to $71.70 per barrel. The dollar declined 0.9%, while gold prices climbed 2.7%.

Stocks cooled to end last week. Of the benchmark indexes listed here, only the Nasdaq (0.4%) and the Dow (0.2%) advanced. The Russell 2000 lost 0.7%, the Global Dow fell 0.2%, while the S&P 500 was flat. Crude oil prices rose for the fourth day out of five, gaining 0.7%. The dollar ended a three-day losing streak after gaining 0.6%. Gold prices dipped 0.6%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The Federal Reserve decided to maintain the target range for the federal funds rate at 5.25%-5.50% for the third straight meeting. Based on Fed projections for interest rates by the end of next year, it appears the Fed anticipates making three rate cuts of 0.25% each over the course of 2024.

- The Consumer Price Index increased 0.1% in November, after being unchanged in October. The index less food and energy rose 0.3% in November, after rising 0.2% in October. Prices for shelter continued to rise in November, offsetting a decline in gasoline prices. Prices for energy fell 2.3%, while prices for food increased 0.2%. The CPI rose 3.1% for the 12 months ended in November, a smaller increase than the 3.2% advance for the 12 months ended in October. Prices less food and energy rose 4.0% for the year ended in November, the same increase as for the 12 months ended in October. Energy prices decreased 5.4% for the 12 months ended in November, while food prices increased 2.9% over the last year.

- The Producer Price Index, which measures prices producers receive for goods and services, was unchanged in November after declining 0.4% in October. Last month, prices for both goods and services were unchanged. For the year ended in November, the PPI increased 0.9%. Producer prices less foods, energy, and trade services edged up 0.1% in November, the sixth consecutive monthly advance. For the 12 months ended in November, prices less foods, energy, and trade services rose 2.5%.

- The Producer Price Index, which measures prices producers receive for goods and services, was unchanged in November after declining 0.4% in October. Last month, prices for both goods and services were unchanged. For the year ended in November, the PPI increased 0.9%. Producer prices less foods, energy, and trade services edged up 0.1% in November, the sixth consecutive monthly advance. For the 12 months ended in November, prices less foods, energy, and trade services rose 2.5%.

- Retail sales rose by 0.3% in November and were up 4.1% from November 2022. Retail trade sales rose 0.1% last month and 3.1% from November 2022.

- Prices for imports decreased 0.4% in November following a 0.6% decline the previous month. The November decline was the first one-month declines since June 2023. Lower fuel prices in November more than offset an increase in nonfuel prices. Prices for imports fell 1.4% for the year ended in November. Export prices fell 0.9% for the second consecutive month in November. Lower prices for nonagricultural exports in November more than offset higher agricultural prices. The price index for exports also declined over the past 12 months, decreasing 5.2% from November 2022.

- Industrial production increased 0.2% in November. Manufacturing output jumped 0.3%, largely due to a 7.1% increase in motor vehicles and parts production following the resolution of strikes at several major automakers. Excluding motor vehicles and parts, manufacturing fell 0.2%. The output of utilities moved down 0.4%, and the output of mines moved up 0.3%. Total industrial production in November was 0.4% below its year-earlier level.

- The November deficit for the federal government was $314.0 billion, $247.5 billion above the October deficit and $65.5 billion higher than the November 2022 deficit. Total government receipts in November were $274.8 billion and government outlays totaled $588.8 billion. Through the first two months of fiscal year 2024, the government budget deficit sat at $380.6 billion compared to $336.4 billion over the same period last fiscal year.

- The national average retail price for regular gasoline was $3.126 per gallon on December 11, $0.095 per gallon lower than the prior week’s price and $0.103 less than a year ago. Also, as of December 11, the East Coast price decreased $0.083 to $3.123 per gallon; the Midwest price fell $0.090 to $2.901 per gallon; the Gulf Coast price declined $0.116 to $2.622 per gallon; the Rocky Mountain price dropped $0.116 to $2.899 per gallon; and the West Coast price decreased $0.111 to $4.141 per gallon.

- For the week ended December 9, there were 202,000 new claims for unemployment insurance, a decrease of 19,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended December 2 was 1.3%, an increase of 0.1 percentage point from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended December 2 was 1,876,000, an increase of 20,000 from the previous week’s level, which was revised down by 5,000. States and territories with the highest insured unemployment rates for the week ended November 25 were New Jersey (2.4%), California (2.3%), Alaska (2.2%), Puerto Rico (1.9%), Washington (1.9%), Hawaii (1.8%), Massachusetts (1.8%), Minnesota (1.8%), New York (1.8%), and Oregon (1.8%). The largest increases in initial claims for unemployment insurance for the week ended December 2 were in California (+13,478), New York (+9,073), Texas (+8,321), Georgia (+6,728), and Oregon (+5,406), while the largest decreases were in Kansas (-893), Vermont (-14), and Delaware (-14).

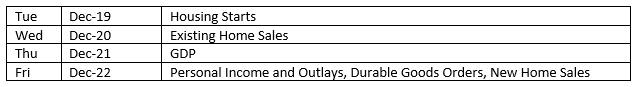

Eye on the Week Ahead

The final estimate of third-quarter gross domestic product is available this week. The second estimate had the economy accelerating at an annualized rate of 5.2%. The November data on personal income and outlays is also out this week. Consumer spending rose 0.2% in October, while the personal consumption expenditures price index, a measure of inflation, was flat. Consumer prices continue to inch lower, although they remain above the Federal Reserve’s target of 2.0%.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.