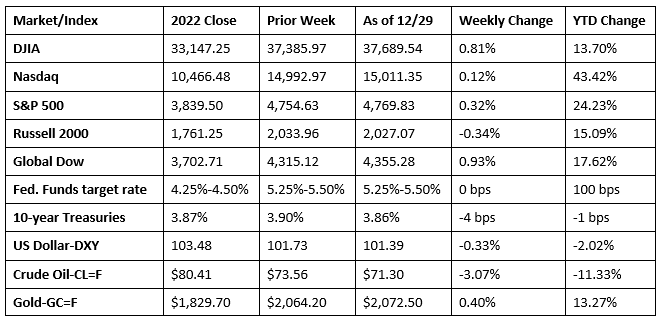

The markets closed out last week and the year with gains, despite losing steam at the end of the week. Each of the benchmark indexes listed here ended last week higher, with the exception of the Russell 2000, which dipped 0.3%. The Dow and the S&P 500 logged their ninth straight week of gains, with the S&P 500 enjoying its longest weekly winning streak since 2004. Health care and utilities led the market sectors, along with industrials, financials, and real estate. Energy and communication services ended the week in the red. Bond values advanced, pulling yields lower. Crude oil prices closed the week and the year lower. The dollar edged down, while gold prices eked out a gain.

Wall Street closed higher to begin the last week of 2023. Each of the benchmark indexes listed here closed higher, with the S&P 500 reaching a new 52-week high (but short of an all-time high). The Russell 2000 continued to vault higher as the year drew to a close, gaining 1.2% to lead the benchmark indexes listed here. The Nasdaq gained 0.5%, while the Dow, the Global Dow, and the S&P 500 each added 0.4%. Bond prices rose, pulling yields lower, with 10-year Treasury yields dipping 1.5 basis points to close at 3.88%. Crude oil prices rose 2.3% to $75.23 per barrel, likely influenced by risks of further shipping disruptions in the Red Sea. The dollar dipped 0.2%, while gold prices rose 0.5% as they neared $2,100.00 per ounce.

The S&P 500 moved closer to reaching an all-time high after eking out a 0.1% gain as stocks continued to push higher last Wednesday. The Global Dow gained 0.7% to lead the benchmark indexes listed here, followed by the Russell 2000 and the Dow, which both added 0.3%. The Nasdaq rose 0.2%. Yields on 10-year Treasuries fell 9.7 basis points to close at 3.78%. Crude oil prices lost 2.2%, slipping to $73.91 per barrel. The dollar lost 0.5% against a basket of currencies, while gold prices gained 1.0%.

Stocks were fairly muted last Thursday, although the Dow (0.1%) gained enough to hit a new record high, while the S&P 500 ended the day flat, percentage points off from closing the year with a new record high. The Nasdaq and the Global Dow ended the session where they began, while the Russell 2000 slipped 0.4%. Bond prices retreated, sending yields on 10-year Treasuries up 6.1 basis points to 3.85%. Crude oil prices dropped for the second straight session, closing at about $71.91 per barrel after falling 3.0%. The dollar gained 0.2%, while gold prices fell 0.8%.

Wall Street couldn’t maintain its momentum at the close of last week. Stocks ticked lower last Friday, with each of the benchmark indexes listed here ending the session in the red. The Russell 2000 dropped 1.5%, followed by the Nasdaq, which lost 0.6%. The S&P 500, which had been trending toward an all-time high, never quite reached that mark after slipping 0.3%. The Global Dow and the Dow dipped 0.2% and 0.1%, respectively. Ten-year Treasury yields were flat, closing at 3.86%. Crude oil prices fell 0.6% ending at $71.38 per barrel. The dollar ticked up 0.1%, while gold prices fell 0.5%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The advance report on international trade in goods revealed the deficit was $90.3 billion in November, 0.8% higher than the October deficit. Exports of goods for November were $165.1 billion, 3.6% less than October exports. Imports of goods for November were $255.4 billion, 2.1% less than October imports.

- The national average retail price for regular gasoline was $3.116 per gallon on December 25, $0.063 per gallon higher than the prior week’s price and $0.025 more than a year ago. Also, as of December 25, the East Coast price increased $0.067 to $3.117 per gallon; the Midwest price rose $0.060 to $2.858 per gallon; the Gulf Coast price increased $0.137 to $2.684 per gallon; the Rocky Mountain price climbed $0.053 to $2.861 per gallon; and the West Coast price decreased $0.004 to $4.051 per gallon.

- For the week ended December 23, there were 218,000 new claims for unemployment insurance, an increase of 12,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended December 16 was 1.3%, an increase of 0.1 percentage point from the previous week’s rate, which was revised down by 0.1%. The advance number of those receiving unemployment insurance benefits during the week ended December 16 was 1,875,000, an increase of 14,000 from the previous week’s level, which was revised down by 4,000. States and territories with the highest insured unemployment rates for the week ended December 9 were New Jersey (2.3%), Alaska (2.2%), California (2.2%), Minnesota (2.0%), Montana (2.0%), Massachusetts (1.9%), Puerto Rico (1.9%), Washington (1.9%), Illinois (1.8%), New York (1.8%), and Rhode Island (1.8%). The largest increases in initial claims for unemployment insurance for the week ended December 16 were in Ohio (+1,304), Oklahoma (+1,029), Michigan (+580), Connecticut (+472), and Massachusetts (+432), while the largest decreases were in California (-3,834), Georgia (-1,684), Pennsylvania (-588), Arkansas (-541), and Minnesota (-500).

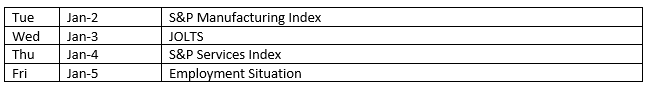

Eye on the Week Ahead

The first week of the new year focuses on employment and industrial production. Purchasing managers surveys for manufacturing and services for December are out this week. November saw an uptick in the services sector, while manufacturing waned, according to survey respondents. As to employment, two important indicators are out this week with the release of the Job Openings and Labor Turnover Survey for November and the Employment Situation for December. The previous JOLTS report showed job openings decreased, while hires and separations changed little. On the other hand, there were 199,000 new jobs added in December, slightly above the consensus, but below the 240,000 monthly average for 2023.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.