If you made a Qualified Charitable Distribution (QCD) from your IRA to a charity be sure to let your tax preparer know about it. The IRS Form 1099-R you receive from your IRA trustee or custodian reports the full amount of any IRA distributions made as normal distributions. The form does not specify amounts distributed to charitable organizations as QCDs. In order to receive the income tax benefit from your charitable gift, you will need to provide your preparer with the amount so it can be deducted from the taxable amount of your distribution.

What We Are Watching So You Don’t Have To

On The One Hand

- Factory orders increased 1.2% in January after a 1.3% increase in December.

- Outstanding consumer credit increased by a less than expected $8.8 billion in January following a December increase of $14.8 billion.

- Weekly initial claims for the week increased 20,000 to 243,000. Continuing claims decreased 6,000 to 2.058 million. Although higher, initial unemployment claims below 300,000 is positive.

- February nonfarm payrolls surprised on the upside by increasing 235,000. The unemployment rate declined to 4.7% and the labor force participation rate increased to 63% from 62.9%.

- Average hourly earnings increased 0.2%, in line with expectations. Year over year average hourly earnings have risen 2.8%. The average work week was unchanged from the previous month at 34.4 hours.

On The Other Hand

Fourth quarter productivity was unrevised at 1.3%. Unit labor costs were also unrevised at 1.7%. U.S. productivity remains stuck below the long-term (1947-2016) rate of 2.1%.

All Else Being Equal

It was a net positive week for economic reports. Market interest rates have been steady or rising slightly. The 10-Year Treasury note yield finished the week at 2.58%. We expect the Fed to follow with another rate increase in the near future.

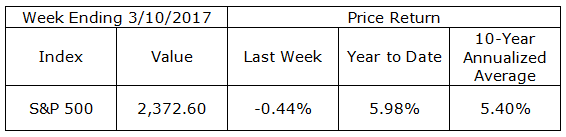

Last Week’s Market

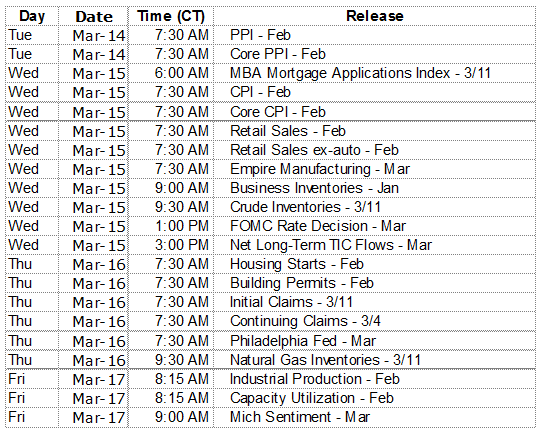

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.